LEDE

The market, recently, is sticking pretty tightly to its patterns -- that is, stock-by-stock the high probability back-tests are winning and that means back-testing has been exceptionally good. In that vein, we turn to yet another trade that has won far more often than it has lost and the winning trades are also much larger in return than the losing trades. We can mark this one down for next quarter -- it will be here before we know it.

PREFACE -- THE TRADE

We are adding yet another trade type to our arsenal, making now over a dozen trades that we scan for, and that will soon be available in our scanner for Pro members.

This is a slightly advanced option trade that bets on volatility for a period that starts one-day after Alphabet Inc (NASDAQ:GOOGL) earnings and lasts for the 6 calendar days to follow, that has been a winner for the last 3 years. We note the use of strict risk controls in this analysis.

With the possibility of market volatility through late summer and picking up into September, we look at trade that takes no stock direction risk but does take a long position on volatility.

Alphabet Inc (NASDAQ:GOOGL) Earnings

In Alphabet Inc, irrespective of whether the earnings move was large or small, if we waited one-day after earnings and then bought an one-week straddle (using weekly options), the results were quite strong. This trade opens one-day after earnings were announced to try to find a stock that moves a lot after the earnings announcement.

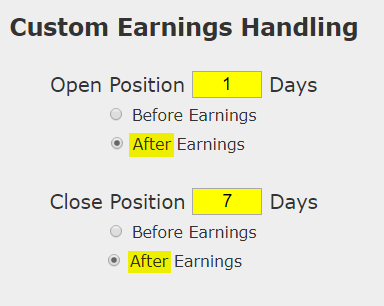

Simply owning options after earnings, blindly, is likely not a good trade, but hand-picking the times and the stocks to do it in can be useful. We can test this approach without bias with a custom option back-test. Here is the timing set-up around earnings:

Rules

* Open the long straddle one-calendar day after earnings.

* Close the straddle 7 calendar days after earnings.

* Use the options closest to 7 days from expiration (but at least 7-days).

This is a straight down the middle volatility bet -- this trade wins if the stock is volatile the week following earnings and it will stand to lose if the stock is not volatile. This is not a silver bullet -- it's a trade that needs to be carefully examined.

But, this is a stock direction neutral strategy, which is to say, it wins if the stock moves up or down -- it just has to move.

RISK CONTROL

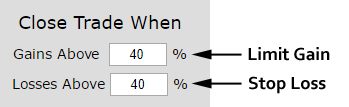

Since blindly owning volatility can be a quick way to lose in the option market, we will apply a tight risk control to this analysis as well. We will add a 40% stop loss and a 40% limit gain.

In English, at the close of every trading day, if the straddle is up 40% from the price at the start of the trade, it gets sold for a profit. If it is down 40%, it gets sold for a loss. This also has the benefit of taking profits if there is volatility early in the week rather than waiting to close 7-days later.

RESULTS

If we bought the straddle in Alphabet Inc (NASDAQ:GOOGL) over the last three-years but only held it after earnings we see a 668% return, testing this over the last 12 earnings dates in Alphabet Inc. That's a total of just 72 days (6 days for each earnings date, over 12 earnings dates).

Looking at Averages

The overall return was 582.3%; but the trade statistics tell us more with average trade results:

- The average return per trade was 57.8% over 6-days.

- The average return per winning trade was 77.2% over 6-days.

- The average return per losing trade was -38.9% over 6-days.

We note here the goal: While this trade simply will not win every time, it has the two distinct characteristics we seek:

(1) It has won far more often than it has lost.

(2) The average return percent for the winning trades (77%) is much larger than the average return percent for the losing trades (-39%).

It's these two phenomena taken together that we're after with a portfolio of these trades. It is also these two phenomena that have created the large back-test returns.

Looking at the Last Year

While we just looked at a multi-year back-test, we can also hone in on the most recent year with the same test:

Now we see a 264% return over the last year and a 100 win-rate.

- The average return for the last year per trade was 71.9% over 6-days.

An Alternative

For the the more advanced option trader, a similar approach to this strategy would be to sell a strangle around this straddle turning it into an iron butterfly. You can test this approach in the CML Trade Machine (option back-tester).

WHAT HAPPENED

This is it -- this is how people profit from the option market -- finding trading opportunities that avoid earnings risk and work equally well during a bull or bear market.

To see how to do this for any stock we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.