FinTech is changing the world we live in, one app at a time.

As smartphone tech and software continues to disrupt traditional business models, transforming standard methods of customer/service interaction, commercial exchange and communication, FinTech (short for “Finance Technology”) is disrupting the fields of personal finance, banking and e-commerce.

The expansion of FinTech start-ups has been impressive and spontaneous. Investment soared in 2015, expanding from $3 billion to $19.5 billion in the space of two years. In 2016, global investment in FinTech grew by 11 percent, reaching $17.4 billion, with spending in China out-pacing that of the United States. Yet the American sector has seen far more activity, with some 650 deals compared to only 28 in China.

In the second quarter of 2017, FinTech companies backed by venture capitalist (VC) firms raised $5.2 billion, roughly doubling the amount raised in Q1, hitting the highest level yet reached in the FinTech sector.

Twenty-six of the largest FinTech start-ups are valued at $83.8 billion. Adyen, a Dutch start-up that manages transactions by major tech companies, has doubled its revenue in a single year, from $365 million to $700 million.

Given the potential for disruption in the field of personal finance and banking and the relatively sluggish response of many large banking houses to changes in technology, the chances for start-ups to reach ‘unicorn’ status quickly are pretty high, though some of the super-stars have yet to schedule IPOs.

Beyond the big names (PayPal, Square, etc) that already dominate the field, here are five stocks investors anxious to join the FinTech revolution can start with:

1) TD Ameritrade (NASDAQ: AMTD)

An early pioneer of online trading, TD Ameritrade is trying to further disrupt electronic investing through a new product, Essential Portfolios. The program provides automatic portfolio management, utilizing Morningstar Investment Management to select ETFs based on estimates like risk tolerance and specific investor goals.

Essentially a “robo-advisor,” the EP program has been met with some skepticism from industry hands wary of automation.

On the back of new innovations like EP, TD Ameritrade saw a marked increase in trades per day in Q4 of 2016 and net income rose to $216 million while new client assets were $19 billion. The share price has taken a few licks in the last month, but AMTD (the holding company) shares have risen in the last six months from $40.97 to $43.05.

The company is trying to bust out some new disruption through its innovation center, launched in 2014 as an incubator, which currently staffs more than 140 engineers. The center is focused on maintaining TD Ameritrade’s focus on constant innovation, re-capturing the company’s reputation for being a disruptor and an e-commerce developer before it became cool.

2) Glance Technologies, Inc. (CSE:GET; OTC:GLNNF)

Glance Technologies has clinched the top spot as the no. 1 mobile full service restaurant payment app in Canada, and is poised to surge ahead of its competition as it leaves its humble origins behind.

In August, Glance Tech. signed a new deal with a Canadian restaurant chain with 90 locations. GlancePay is accepted by hundreds of merchants in Canada and has grown rapidly in the last year.

The company is also making advances into the billion-dollar cannabis industry, securing a $1 million license from Cannapay Financial Inc. in May 2017.

The report from Q2 gives fresh cause for optimism. Glance increased revenue by an astonishing 664 percent from Q1, while costs fell appreciably as the company streamlined. Management expects revenue in Q3 to exceed those in Q2.

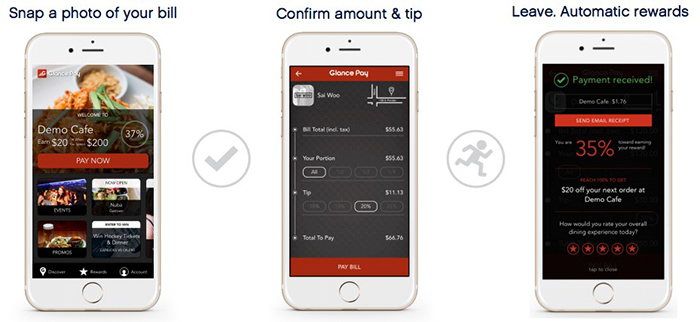

GlancePay, the company’s premier app, was launched in September 2016 and has already registered over 200 merchants. Q2 revenue from the app has increased 64 percent from Q1, as the app takes off in Canada. GlancePay is designed to streamline customer interaction with merchants, allowing users to order (coming soon), pay, and earn rewards from a single platform.

The app uses GPS tech to pinpoint personal location and provides a host of perks, including in-store rewards, in-app marketing and tab-splitting features to set it apart from ApplePay and Square, another FinTech pioneer which has grown in the U.S. market.

Along with allowing quick and easy payment, GlancePay allows customers to check out nearby restaurants and pre-order for delivery or pick-up (coming soon). The app combines nearly all features of the restaurant experience in one convenient package.

It’s as easy as point, shoot, pay.

The tech behind GlancePay is meant to take advantage of Bitcoin and other crypto-currencies, allowing even more flexibility. The app allows customers to choose restaurants, order food (coming soon) and pay without any recourse to traditional payment methods, and no tiresome scrolling through Yelp reviews.

The opportunity for investors is clear, as other bill-paying apps take-off. ApplePay is already used in millions of transactions, while Alipay, a competitor launched by China-based Alibaba Group, conducts $1.7 trillion in annual business in China, where e-payments are already widespread.

Tech like GlancePay is poised to meet demand in the North American market. While the stock price has stayed low ahead of anticipated growth, the company seems to be in a good position when most FinTech start-ups have declined to make IPOs.

3) Citigroup Inc. (NYSE:C)

The banking and finance giant Citigroup Inc. has embraced the FinTech revolution. A few years ago, Citigroup’s consumer banking chief traveled to Silicon Valley to meet with VCs and tech head-honchos, in order to find ways for the finance giant to meet the challenges of disruption. The meetings led to the creation of ‘Citi FinTech’, a unit of the massive company’s mobile banking services and a means of switching to a “smartphone-centric business model.”

Now, Citi FinTech operates out of Queens, employs about 130 people and is working on a host of new banking, finance and payment apps available to Citi customers.

Working within the banking sector, which has proven somewhat resistant to disruption in finance and consumer tech, the Citi FinTech team focuses on apps that allow customers easy access to money at all times.

In an industry where trust is a big factor (people feel uncomfortable about accessing money through smartphones, and worry that security for on-line banking is inadequate), the challenge for Citigroup Inc. is finding a way to encourage customers to use their products with the same confidence they have when they visit their local Citibank branch.

Finding that confidence could be tricky, but it’s absolutely necessary as FinTech continues to disrupt traditional banking.

Citigroup has had some strong quarters in recent years, and share price has climbed appreciably. It now hovers near $68, up from less than $60 in March 2017. Continued strong performance should be expected, as the company innovates to outmatch its competition.

4) Vantiv (NYSE: VNTV)

A company that operates under the radar as a credit card payment processor for major U.S. retailers, as well as thousands of others smaller companies, Vantiv is poised to make some major gains this year following its acquisition of Worldpay, another payment processing company based in the UK.

It was an all-stock deal, as Vantiv offered $10.4 billion to purchase a majority, and together the new combined firm will be valued at $28.8 billion.

The company delivered a strong performance in 2016, increasing revenue by 13 percent, with projected revenue growth of between 8-9 percent in Q1 of 2017.

Vantiv actually exceeded expectations, as share prices rose significantly in the first six months of 2017, from $60.48 to $71.60, with a major spike after the Worldpay acquisition.

Share price will likely dip in the weeks to come as the consequences of the deal come into focus, but Vantiv looks set to continue out-performing for the rest of the year. Its business may not be flashy, but it should offer ample returns for savvy investors.

5) LendingClub Corporation (NYSE: LC)

In 2016, as FinTech startups took off and the sector grew in leaps and bounds, one early pioneer was left behind. LendingClub Corporation, an early practitioner of on-line lending that went public in December 2014 at a high of $24.75, spent most of last year mired in scandal, as fallout from revelations of malpractice in May 2016 sent stocks plummeting, from $8 to $3.50 a share.

LendingClub has had a lot of catching up to since the doldrums of 2016. It posted a disappointed Q1 for 2017, showing flat performance and stalled revenue. But with some cosmetic changes to its customer interface, restructured pricing and a June securitization, the company looks set for a turnaround.

Share price has climbed back over $6 but it’s been a bumpy road. Earnings were strong in Q2 and the stock climbed on the news that revenue had grown by 35 percent over last year to reach $139.6 million for the quarter.

With its current low share price and a return to growth forecast from its latest earnings report, LendingClub could attract investors, especially when one factors in the original IPO of nearly $25. If the company continues to grow, it could meet or even exceed that price.

Should the optimism surrounding LendingClub’s second lease-on-life prove well-founded, it would show once again that an innovative company, though occasionally down, is seldom out for the count.

Honorable Mentions:

Shopify Inc (TSX:SHOP): More than 500,000 companies rely on Shopify’s real-time e-commerce, including Tesla, Budweiser and Red Bull, among many others. Shopify manages their e-commerce machines, and its stock is now up to over $105 right now, with a market cap of over $10 billion.

Canada’s fastest growing company saw its stock price increase 500% in 27 months following its IPO and analysts now expect that this company has become a takeover target for the world’s tech giants such as Google, Amazon or Facebook.

Currently, the only concern for Shopify’s investors should be whether the company can maintain its year-over-year growth rates of more than 70 percent.

Mogo Finance Technology Inc. (TSX:MOGO): This is a new spin on unsecured credit, which is a burgeoning sub-segment of FinTech. Mogo’s software analyzes borrowers instantly and greatly reduces the traditionally cumbersome underwriting process for loans. It’s online only, so there’s very low overhead and a ton of cash to spend on marketing.

Perhaps even more exciting for investors, Mogo just introduced its mobile app and newest solution—Canada's first free credit score with free monthly updates. Mogo saw its share price fall a bit in July and early August, but has seen its stock rebound in recent weeks.

EXFO Inc (TSX:EXF): EXFO isn’t new to the Canadian tech sector. The company was founded in 1985 in Quebec City, and its original products were portable testing products for optical networks. Since then, the company has acquired and build 3G, LTE, protocol, copper/xDSL, IMS, and VoIP test and service assurance products.

Recent developments from EXFO are promising for long term growth potential. The new baseband unit emulation technology which is sure to be adopted on a large scale, as the tech offers operators a reduction of costs and a faster revenue stream.

EXFO Inc is a model in the telecommunications industry. With a market cap of $273-million, EXFO is strong, but still growing.

Power Financial Corp (TSX:PWF): Montreal-based Power Financial Corp has been in the finance industry since 1984. The company operates in three segments: Lifeco, IGM and Pargesa Holding SA (Pargesa). And, with its holdings in a diversified portfolio spanning the United States and Europe, Power Financial is a leader in its field.

Focusing its investments in the emerging FinTech industry, Power Financial stands to benefit by riding this wave into the future. The company’s forward thinking attitude and liberal approach to technology is sure to leave investors satisfied.

We like PWF because it owns 60 percent of Wealthsimple, a leading robo-advisor for investing in ETF portfolios.

Legal Disclaimer/Disclosure: This piece is an advertorial and has been paid for. This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. No information in this Report should be construed as individualized investment advice. A licensed financial advisor should be consulted prior to making any investment decision. We make no guarantee, representation or warranty and accept no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Baystreet.ca only and are subject to change without notice. Baystreet.ca assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report.