The gaming industry is a raging bull, because it’s nothing like it used to be. Games are no longer just physical products - they’re digital, and they can be updated, streamed, and improved on the fly. Game developers aren’t solely focused on selling discs and cartridges anymore – they’re building immersive worlds and casual mobile games that players can engage with over and over again. Games are a service built on mobility, connectivity and engagement.

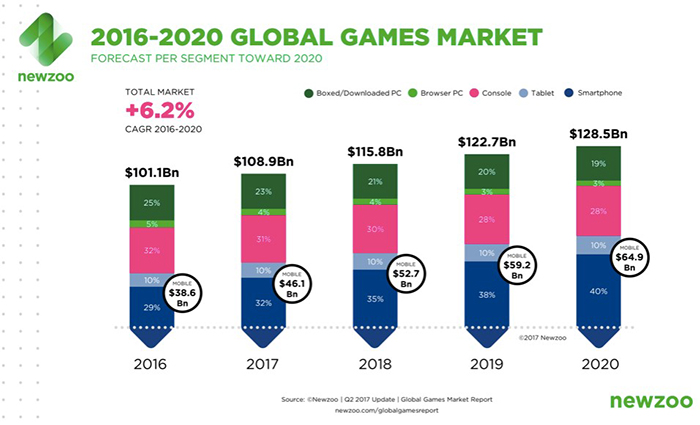

The video-gaming industry is set to reach $108.9 billion in worldwide revenues this year. It’s already surpassed the $100-billion mark in 2016.

Video games on PC and mobile will grow to $132 billion in total revenues by 2021, according to Juniper Research.

Developers/ publishers have adjusted quickly to this digital world. This has provided an opportunity for investors to participate in this new interactive media paradigm.

It’s been a stellar first half of 2017, and the second half may be even better as companies take advantage of the seasonal upswing around the Christmas holidays.

In this space, we’re looking at our top 5 picks that cover the gaming companies, the super tech behind them and a unique answer to the evolution of in-game advertising.

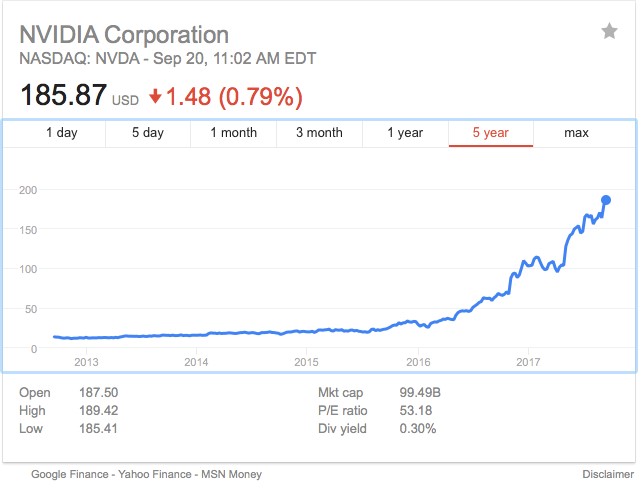

#1 Nvidia (NYSE:NVDA)

Nvidia is one of hottest stocks on the market right now, and it has the potential to push it even further. It’s a top performer in the entire S&P 500. There are a lot of naysayers because this stock is already up to over $180 a share, but there were skeptics when it was much lower and it just keeps climbing. The last 12 months have seen this stock gain close to 190 percent.

This isn’t a gaming stock, per se, but Nvidia is expected to report strong gaming segment sales thanks to demand for Nintendo Switch. Nvidia’s chips are central to the gaming industry. But they’re also central to some of the other large market segments. Nvidia’s chips are at the top of the list for artificial intelligence (AI), and they’re used in self-driving vehicle projects and Amazon’s Echo speaker—among many other things.

Nvidia’s chips are the best out there—or at least the fastest. Take Two Interactive is a huge fan, so is Nintendo Switch. Amazon’s Twitch.tv also used Nvidia chips to help it stream game-play live.

So if you’re looking for broad exposure to the gaming industry, this is it.

This company’s future pipeline is also something to get excited about. In the third quarter, Nvidia is expected to start shipping its next-gen Volta GPU architecture for artificial intelligence. This could extend Nvidia’s lead over others in this hot subspace.

#2 Versus Systems, Inc. (CSE:VS; OTC:VRSSF)

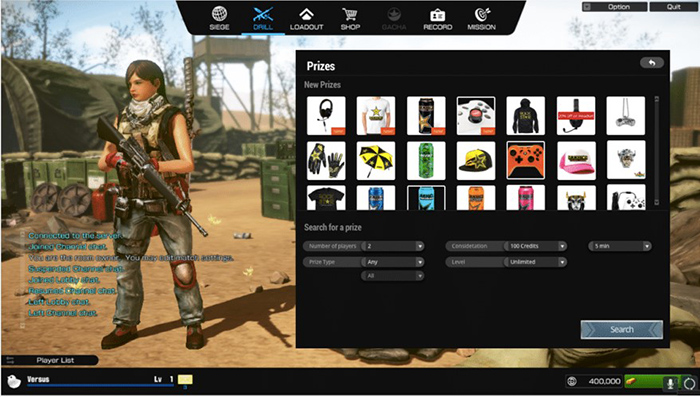

Versus Systems is debuting in a big way with the highly-anticipated releases of NASCAR Heat and NASCAR Heat Mobile. Versus isn’t a game developer--it’s a comprehensive platform that gives big-name brands and products unique access to the world’s 2.6 billion gamers.

Brands and products have a multi-billion-dollar problem: They can’t reach this massive gaming audience with their advertising effectively.

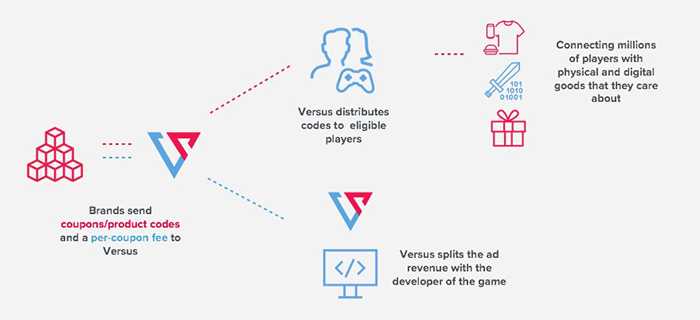

Versus is offering every brand in the world the first-ever relevant way to access this huge audience with its prizing and promotions platform. This pioneering platform allows game developers and brands to offer prize-based matches to players, all integrated directly into games. No more pop-ups, no more irrelevant advertising—this is pure, targeted advertising, matching prizes to players and is expected to make players want to play more, and buy more.

The catalysts are hard-hitting and fast-moving. Versus has already entered into a ground-breaking deal to provide in-game prizing to 704Games, which has an exclusive license to produce video games for NASCAR, the biggest spectator sport in America according to Forbes, with over 15 of the top 20 most-attended sporting events in the U.S. each year. 704Games makes NASCAR Heat games for Xbox One, PlayStation 4, and Steam; and NASCAR Heat Mobile for iOS and Android.

More Fortune 500 companies sponsor NASCAR than any other sport. That means that all those brands will have new ways to engage gamers through 704Games and its Versus prize platform.

Game developers should love it, too, because they get to split the prize profits with Versus.

With an online game advertising market projected to reach some $7 billion by 2019, (Statista.com) and over $10 billion annually within five years, Versus represents the future of the gaming industry from an advertising perspective.

Versus brings together game developers and brands in an effective way, arguably for the first time. It could be as important as Adwords are to Google and its parent, Alphabet.

#3 Take-Two Interactive Software, Inc. (NASDAQ:TTWO)

TTWO is smaller than two of the other big gainers we’re looking at—but it looks like it might have the most room to grow. It’s behind the wildly popular Grand Theft Auto (GTA) franchise. And the skeptics who thought it wouldn’t get past this were proven wrong. It’s also now got Red Dead Redemption, BioShock and Borderlands.

More specific catalysts include its recent acquisition of privately held Social Point S.L.—a free-to-play mobile game developer--for $250 million. This gives TTWO one of the top mobile game apps, NBA2K17.

NBA2K is one of TakeTwo’s most profitable franchises, with the latest edition, NBA2K18 selling very well. But there’s more: the company also partners with the NBA on an esports league that will significantly boost NBA2K’s profile going forward.

Earnings reports also reverberate positively on the stock price. Revenues were up 15 percent from the same quarter last year, and losses were down significantly (almost half) so the next year could see this company enter profitability.

This stock looks good both fundamentally and in terms of technical analysis. Fundamentally, earnings are expected to grow each quarter, and from a technical perspective, stock has been attractively active and it’s broken past its 52-week-high of $101.40.

Currently trading as a $10.84-billion market cap company, TTWO

The market is enthusiastic about this stock, and so are we.

#4 Activision Blizzard, Inc. (NASDAQ:ATVI)

Behind World of Warcraft, StarCraft, Diablo, Hearthstone, Destiny, Overwatch, Call of Duty and Sylanders, ATVI is a gaming behemoth whose franchises have generated nicely compounding revenue. 2Q17 saw ATVI generate $1 billion in revenue from in-game purchases.

A big catalyst has been its King Digital acquisition, which sets it firmly in the mobile game market. That acquisition gives it Candy Crush and Bubble Witch—two of the top ten games in the U.S. for 15 quarters running.

And now some of its big 8 franchises are also set to go mobile soon.

Overwatch, one of ATVI’s best performers, will also debut in the hotter-than-hot esports spectator world with league play this year.

But for revenues, we’re watching King Digital, which was the top contributor to Activism’s bookings per paying user this quarter (and, indeed for the past 8 quarters).

The King Digital acquisition has legs, too. It’s got a publishing partnership with PlayStudios for ‘social casinos’ that are expected to be released later this year.

#5 Electronic Arts, Inc. (NASDAQ:EA)

EA is currently trading as a $37.14-billion market cap company, and it’s up 47 percent so far this year. If you’re not sure who they are, think FIFA 17—which enjoys its rank as the best-selling console game in the world.

It’s also know for Madden NFL, Battlefield 1 and Titanfall 2.

Now we’re seeing it move from yearly game releases to downloadable digital content, mobile games and esports. Again, think Plants vs. Zombies and The Sims.

A great catalyst is a recent deal sighed with ESPN to broadcast competitive gameplay of the FIFA Ultimate Team Championship.

EA’s quarterly revenue is up 17 percent over the same time last year, with revenues coming in at $1.5 billion—digital revenues accounting for $934 million of that. The company generated over $1 billion in operating cash flow in its first quarter, and sales were up 13.6 percent compared with the same period in the prior year.

Overall, one might argue that EA is potentially a better play than ATVI or TTWO because it’s more profitable and generates a higher return on investment—not to mention the bigger cash flow per share. Compared to its peers, it may be undervalued.

Other companies worth watching in the space:

Kuuhubb Inc. (TSX: KUU.V) is a company active in the development and acquisition of lifestyle and mobile video game applications. Its strategy is to create sustainable shareholder value through undervalued, but proven applications with robust long-term growth potential.

The company is headquartered in Helsinki, Finland and operates in both U.S. and Asian markets.

The company has seen its stock increase after a few recent acquisitions and currently trades at $1.60.

Mogo Finance Technology Inc. (TSX:MOGO): This is a new spin on unsecured credit, which is a burgeoning sub-segment of FinTech. Providing loan management, the ability to track spending, stress-free mortgages, and even credit score tracking, Mogo is at the forefront of an online movement to assist users with their financial needs.

Mogo’s software analyzes borrowers instantly and greatly reduces the traditionally cumbersome underwriting process for loans. It’s online only, so there’s very low overhead and a ton of cash to spend on marketing. Labeled as “the Uber of finance” by CNBC, Mogo is definitely turning heads.

With increasing membership growth and revenue lines continuing to improve, and a platform which many banks have failed to offer, Mogo could well become an acquisition target in the near future.

EXFO Inc (TSX:EXFO): EXFO isn’t new to the Canadian tech sector. The company was founded in 1985 in Quebec City, and its original products were portable testing products for optical networks. Since then, the company has acquired and build 3G, LTE, protocol, copper/xDSL, IMS, and VoIP test and service assurance products.

Recent developments from EXFO are promising for long term growth potential. The new baseband unit emulation technology which is sure to be adopted on a large scale, as the tech offers operators a reduction of costs and a faster revenue stream.

EXFO Inc is a model in the telecommunications industry. With a market cap of $273-million, EXFO is strong, but still growing.

Power Financial Corp (TSX:PWF): Montreal-based Power Financial Corp has been in the finance industry since 1984. The company operates in three segments: Lifeco, IGM and Pargesa Holding SA (Pargesa). And, with its holdings in a diversified portfolio spanning the United States and Europe, Power Financial is a leader in its field.

Focusing its investments in the emerging FinTech industry, Power Financial stands to benefit by riding this wave into the future. The company’s forward-thinking attitude and liberal approach to technology is sure to leave investors satisfied.

We like PWF because it owns 60 percent of Wealthsimple, a leading robo-advisor for investing in ETF portfolios.

Blackberry Ltd (TSE:BB) This well-known cell-phone pioneer is engaged in the sale of smartphones and enterprise software and services. The Company's products and services include Enterprise Solutions and Services, Devices, BlackBerry Technology Solutions and Messaging.

Blackberry used to be a worldwide leader in phones, but Apple, Google and other Android manufacturers have rapidly acquired market share. Blackberry has since focused on software and is now developing systems for autonomous vehicles. Tech giants such as Apple and Google won’t be able to repeat Blackberry’s success in this sector that easily.

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

FORWARD-LOOKING STATEMENTS. Statements in this communication which are not purely historical are forward-looking statements and include statements regarding beliefs, plans, intent, predictions or other statements of future tense. Forward looking statements in this article include that the gaming industry continues to grow; that Versus Systems may have a system that would be accepted by gamers; that its prizing platform will appeal to video gaming companies and will encourage gamers to play more and buy more; that Versus Systems’ patent applications will become patents and that the patents can protects its intellectual property; the size of the potential market and market demographic for gaming prizes; that a lot of brands and prizes are expected to be added to the platform; that new games will join the Versus platform; that data gathered from gamers can be used and can be a potential revenue stream for Versus; that Versus will have a major financial impact when NASCAR Heat Mobile game goes live, expected in Q1 2018; that gaming advertising revenues will grow as expected; and that Versus can partner with a number of game developers for inclusion of Versus’ platform in new games. Forward looking statements involve known and unknown risks and uncertainties which may not prove to be accurate. Actual results and outcomes may differ materially from what is expressed or forecasted in these forward-looking statements. Matters that may affect the outcome of these forward looking statements include that markets may not materialize as expected; prizes in gaming may not turn out to have as large a market as thought or be as lucrative as thought as a result of competition or other factors; Versus Systems may not be able to diversify or scale up as thought because of potential lack of capital, lack of facilities, regulatory compliance requirements or lack of suitable employees or contacts;; Versus is dependent on the success of game developers; Versus’ patents may not be granted and even if granted, may not adequately protect Versus’ intellectual property rights; Versus is a development stage company and to date has no revenues; and other risks affecting Versus in particular and the gaming industry generally. The forward-looking statements in this document are made as of the date hereof and the Company disclaims any intent or obligation to update such forward-looking statements except as required by applicable securities laws.

Risk factors for the video gaming industry in general which also affect Versus include the following: please also review the risk factors listed in the annual filings of public companies in the gaming industry:

- The business is intensely competitive and “hit” driven. Versus may not deliver “hit” products and services, or consumers may prefer competitors’ products or services.

- The business is dependent on the success and availability of products developed by third parties, as well as Versus’ ability to develop commercially successful platforms for these products.

- Technology changes rapidly in the business and if Versus fails to anticipate or successfully implement new technologies or adopt new business strategies, technologies or methods, the quality, timeliness and competitiveness of its products and services may suffer.

-Versus may experience security breaches and cyber threats.

-Versus’ business could be adversely affected if consumer protection, data privacy and security practices are not adequate, or perceived as being inadequate, to prevent data breaches, or by the application of consumer protection and data privacy laws generally.

- The products or services Versus distributes through its platform may contain defects, which could adversely affect Versus’ reputation.

-Versus’ business partners may be unable to honor their obligations or their actions may put us at risk.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Safehaven.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) has been paid by the profiled company or a third party to disseminate this communication. In this case the Company has been paid by Versus Systems one hundred and twelve thousand five hundred US dollars for this article and certain banner ads. This compensation is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. Gains mentioned in our newsletter and on our website may be based on end-of- day or intraday data. If we own any shares we will list the information relevant to the stock and number of shares here. We have been compensated by Versus Systems to conduct investor awareness advertising and marketing for [CSE:VS and OTC:VRSSF]. Safehaven.com receives financial compensation to promote public companies. This compensation is a major conflict of interest in our ability to be unbiased. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the company. The third party, profiled company, or their affiliates may liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non- compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor awareness efforts. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price is likely to occur. Our emails may contain forward looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our communications and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, The Company often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications.

DISCLOSURE. The Company does not make any guarantee or warranty about what is advertised above. The Company is not affiliated with, any specific security. While the Company will not engage in front-running or trading against its own recommendations, The Company and its managers and employees reserve the right to hold possession in certain securities featured in its communications. Such positions will be disclosed AND we will not purchase or sell the security for at least two (2) market days after publication.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing The Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

AFFILIATES. Some or all of the content provided in this communication may be provided by an affiliate of The Company. Content provided by an affiliate may not be reviewed by the editorial staff member. Our affiliates may have their own disclosure policies that may differ from The Company’s policy.

The information contained herein may change without notice.