Most American investors missed the first boat on the wildly profitable cryptocurrency market, which hit $158 billion in August and is set to hit nearly $3 trillion by 2023. Now, another boat is setting sail, and this time there’s an easy way to get onboard.

Bitcoin—soaring to $5,000 per coin-- is now worth four times as much as an ounce of gold. A simple $100 investment a few years ago would have amassed multiple millions in profit.

Profits like this have been hard to come by for the majority of investors because this is a complicated playing field, and Wall Street has been dragging its heels. But for the first time in history, we can add a basket of cryptocurrencies and blockchain startups to any brokerage account, IRA or 401k.

That’s because Canada is hot on the cryptocurrency trail, and Global Blockchain Technologies (TSX: BLOC.V; OTC: BLKCF) just announced trading of the first-ever investment company which plans to hold a blockchain-based company and currency basket on the TSX Venture Exchange.

So investors can get in on it, too—before the next wave of money comes into a market heading into the trillions.

Here are 5 reasons to keep a close eye on Global Blockchain (TSX: BLOC.V; OTC: BLKCF), an investment company poised to become the first-ever vertically integrated originator and manager of startup blockchain and digital currency companies, balanced by investments in well- established cryptocurrencies.

#1 This is the Next Wave of Cryptocurrency Investing

Blockchain technology is automation and collaboration on steroids. It could become the biggest market disrupter we’ve ever seen because it cuts across every industry imaginable—from banking and healthcare, to shipping, real estate and even government and crowdfunding. It could be as disruptive as the Internet of Things (IoT), and right now, it’s the backbone of the multi-billion dollar cryptocurrency market.

By the end of August, the total market cap of cryptocurrencies had risen 800% this year, and analysts expect total cryptocurrency market caps to exceed $200 billion by the end of this year. That’s an amazing feat for a market that didn’t even exist ten years ago.

The crypto millionaires were created with Bitcoin mining. That created a flurry of crypto crowd sales and new investment vehicles like Ethereum and Litecoin—and then another generation of millionaires. Now we’re readying for the next wave, and this time it’s about commercial use and mass adoption. That’s when Wall Street will stop dragging its feet, but by that time the boat transporting the third generation of crypto millionaires will already have set sail, along with big profits.

opportunities are mind-boggling, but so is figuring out where to put your money. Global Blockchain (TSX: BLOC.V; OTC: BLKCF) could have figured it out...

#2 Exposure to the Blockchain System

Global Blockchain (TSX: BLOC.V; OTC: BLKCF) will respond to existing investor demand with its plan to acquire a basket of holdings within the blockchain space, making it poised to become the first global investment company with exposure to a wide range of the blockchain system—and with start-up equity and token diversification.

You can buy it right now from an online broker, and even add it to your IRA or 401K.

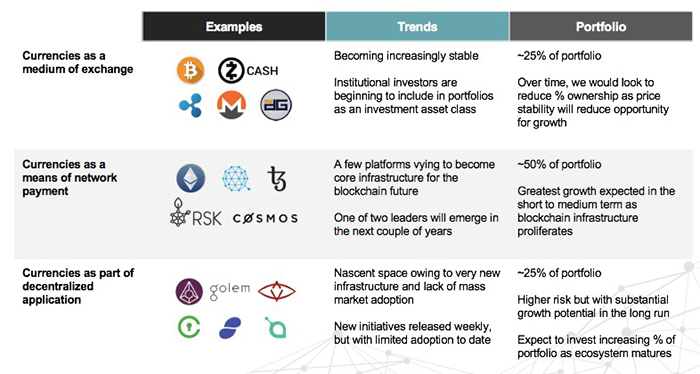

It’s plans, if successfully carried out, would diversify your exposure to minimize risk for investors, by balancing blue-chip companies with high-growth potential small-caps. It also diversifies portfolios by balancing crypto currencies by category. Here is BLOC’s planned investment strategy:

But it’s not just about a basket of currencies to speculate on. It’s much more than that: It’s set to become a technology company planning to build an investment portfolio based on the token economy. And it may be the only public company of its kind.

The opportunities here are much bigger than simply holding crypto currencies. The Global Blockchain business model is about creating protocols.

It’s all about smart asset allocation that has the potential to change this space entirely for investors.

#3 Top Crypto Pioneers Lead This Innovation

No other market requires the level of experience that Blockchain-based cryptocurrency does just to attempt to invest in something that really qualifies.

The dream team behind Global Blockchain (TSX: BLOC.V; OTC: BLKCF) qualifies investments for you, plans to buy those investments for its portfolio, and its crypto and blockchain basket is all about reducing uncertainty.

Remember the Ethereum ICO? It’s risen over 94,000 percent. Global Blockchain’s Chairman and CEO, Steve Nerayoff not only was a senior advisor to Ethereum in the time leading to its ICO, but was the architect of the Ethereum crowsdale, the way the project was funded. He also was a senior advisor to the Lisk Cryptocurrency project, which is now a $526-million market cap company. Nerayoff is an early leader of the blockchain industry, and one of its most important pioneers.

But the Global Blockchain prowess doesn’t stop with Nerayoff.

- Rik Willard, CEO, is another cryptocurrency and ICO veteran, the co-founder of the Silicon Valley Blockchain Society and advisor to Luxembourg and other countries’ blockchain initiatives.

- Shidan Gouran, President, is also a cryptocurrency and ICO expert with a long track record.

- Kyle Kemper, Chief Strategy Officer, is the executive director of the Blockchain Association of Canada.

- Jeff Pulver, Advisor, has consulted and invested in 350 startups.

- Michael Terpin, Advisor, is the co-founder of BitAngels, the world’s first angel network for digital currency startups. He’s also the managing partner of bCommerce Labs, the first Blockchain incubator fund in the world. He founded Marketwire, one of the largest company newswires, which was acquired in 2006 and sold to NASDAQ for $200 million.

And it’s not just their blockchain successes and expertise investors will be harnessing: It’s their exclusive access to assets that many investors may never be able to invest in otherwise.

#4 Smart Crypto Balancing Act

If the U.S. Securities and Exchange Commission (SEC) approves crypto ETFs, many predict it will push digital currencies even higher, with some analysts predicting that as much as $300 million could pour into a bitcoin ETF in its first week, Bloomberg reports.

Europe also has a Bitcoin exchange traded note (ETN) for investors, and analysts are widely expecting the SEC to approve a Bitcoin ETF soon.

One of the biggest hints is the tapping of the lawyer for one of the three proposed ETFs to head the SEC’s division in charge of EFTs. The same lawyer represents the Winklevoss twins’ efforts to create a Bitcoin ETF.

The SEC rejected the Winklevoss ETF in March, but now regulators have agreed to hear an appeal—and with their own lawyer at the helm, analysts are optimistic on a green light.

In the meantime, we’re looking at a total market cap of tokens at $8.79 billion, and more than $2 billion has already flowed into ICO (initial coin offering) token sales.

Global Blockchain (TSX: BLOC.V; OTC: BLKCF) comes into play right here.

This team knows blockchain and crypto currencies. Their extensive and diversified expertise will assist them in selecting ICOs with what it takes to be winners; and distinguish those likely to fail. And they plan to balance large-cap holdings with small-cap and emerging cryptocurrencies so investors can benefit from the stability of one, and the growth potential of the other at the same time.

But it’s also intending to become an incubator for new crypto technologies, which means that investors are not just investing in assets—they’re investing in innovation.

“Blockchain solutions in finance are virtually endless, and the gaming industry, too, will be massive. But the verticals here are astounding. Imagine creating a protocol for diamond trading, or renewable energy credits,” says BLOC Chairman Steve Nerayoff. “Any centralized market place that is dominated by a few middle men will likely be taken over by blockchain technology. Anything you can think of where the marketplace can become more democratic.”

#5 New Savvier Coins Offer Upside

Global Blockchain (TSX: BLOC.V; OTC: BLKCF) also plans to create additional value by developing its own tokens. That’s because it sees a major gap in the token world: new ICOs have teams that are only one-dimensional—they’re developing but not following through in the market. Global Blockchain is planning to pick up the slack here...

They don’t plan to just build, they’ll help brand and distribute.

This is the next phase of maturity in an industry that is starving for a development lab that is run by a team with real world experience, and backed by some of the top blockchain programmers in the world.

This team isn’t just a group of techies: They’re crypto pros across the spectrum, and they are planning on harnessing every vertical connected to the industry.

Bottom line?

Crypto investing is high-speed, and when the next wave comes, it won’t wait for investors to figure out how to get on the boat of third-generation millionaires. The speed of growth here could outpace anything that’s ever come before it, but this complicated playing field has kept many investors from joining in. Until now.

Now, with Global Blockchain, if their plans prove successful, we have a unique opportunity to wade through the endless ICOs for a diversified basket of cryptocurrencies. And we have the opportunity to do it before Wall Street hedge funds jump in.

As investors scramble for a way to profit from the blockchain massive market disrupter, Global Blockchain plans to offer the first real solution: a basket of holdings within the blockchain and crypto-currency space that:

- Answers growing demand from investors

- Is currently a unique opportunity to find and navigate exposure to this extremely complicated space

- Is a publicly listed security accessible in the U.S., Canada and Europe that can be bought through an online broker, with Asia and Australia to follow

- Its business plan is designed to give the average investor access to ICOs that they may never be able to access on their own

- Is led by major crypto pioneers who just took the cryptic out of the crypto world

The age of prosperity is starting in the blockchain, and Blockchain Global could be the back door to a dramatically changing world.

Honorable Mentions:

Kinaxis Inc (TSX:KXS) is a provider of cloud-based subscription software for supply chain operations. The Company offers RapidResponse as a collection of cloud-based configurable applications. The Company's RapidResponse product provides supply chain planning and analytics capabilities that create the foundation for managing multiple, interconnected supply chain management processes, including demand planning, supply planning, inventory management, order fulfillment and capacity planning.

Kinaxis is a growing company, but the company has already carved out a significant piece of the pie. As a leader in its field, Kinaxis is a force which investors are keeping an eye on.

Computer Modelling Group (TSX:CMG) is a software technology company producing reservoir simulation software for oil and gas companies. Computer Modeling Group LTD. Is a tempting trade for investors as it brings together two essential industries - tech and resources- which are going anywhere any time soon. Especially as the need for security grows, a tech company involved in the oil and gas industry has an incredible opportunity to offer other services.

While Computer Modelling Group focuses on the resource industry, its technology is definitely breaking ground. Founded nearly 40 years ago by Khalid Aziz, a renowned simulation developer, the company has proven that it has staying power. As the resource industry meets technology, this will be a stock to pay attention to.

Shopify Inc (TSX:SHOP) (NYSE:SHOP) is a Canadian e-commerce company with more than 500,000 companies rely on Shopify’s real-time e-commerce, including Tesla, Budweiser and Red Bull, among many others. Shopify manages their e-commerce machines, and its stock is now up to over $106 right now, with a market cap of over $10 billion. CNET called the application “clean, simple, and easy-to-use" in a review of the Shopify platform.

The company’s online presence and sheer reach make it an ideal buy for investors. Shopify makes purchasing goods and services easy for anyone – and in a time where convenience is king, Shopify surely has staying power.

Blackberry Ltd (TSX:BB) This well-known cell-phone pioneer is engaged in the sale of smartphones and enterprise software and services. The Company's products and services include Enterprise Solutions and Services, Devices, BlackBerry Technology Solutions and Messaging.

Blackberry used to be a worldwide leader in phones, but Apple, Google and other Android manufacturers have rapidly acquired market share. Blackberry has since focused on software and is now developing systems for autonomous vehicles. Tech giants such as Apple and Google won’t be able to repeat Blackbery’s success in this sector that easily.

Celestica Inc. (TSE:CLS.TO) (NYSE:CLS) is a manufacturer of electrical devices used in IT, telecommunications, healthcare, defense and aerospace industries. The company has seen strong growth YoY which we expect to continue as the sales expectations are almost 3% better than last year’s.

While many investors thought the stock was overvalued after a stellar run in 2016, the recent correction and volatility in the stock has attracted new buyers and the stock has recovered since.

While telecommunications stocks have been volatile recently, defense, IT and aerospace industries have outperformed and while many see limited upside, these industries continue to surprise both investors and analysts.

Forward-Looking Information

This news release contains "forward-looking information" within the meaning of applicable securities laws. Generally, any statements that are not historical facts may contain forward-looking information, and forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" "intends" or variations of such words or indicates that certain actions, events or results "may", "could", "would", "might" or "will be" taken, "occur" or "be achieved". Forward-looking information includes, but is not limited to the impact of the management and advisor appointments of BLOC.V; BLOC.V's projected asset allocations, business strategy and investment criteria; the size and scope of cryptocurrencies and Initial Coin Offerings ("ICO's"); the rate of cryptocurrency adoption and the resultant effect on the growth of the global cryptocurrency market capitalization; and the risk reduction strategies of BLOC.V. Readers should be aware that BLOC.V has no assets except cash from a recently completed financing and its business plan is purely conceptual in nature: there is no assurance that it will be implemented as set out herein, or at all. Forward-looking information is based on certain factors and assumptions about BLOC.V believed to be reasonable at the time such statements are made, including but not limited to: statements and expectations regarding the ability of BLOC.V to (i) successfully engage senior management with appropriate industry experience and expertise, (ii) gain access to and acquire a basket of cryptocurrency assets and pre-ICO and ICO financings on favorable terms or at all, (iii) successfully create or incubate its own tokens and ICO's, and (iv) execute on future investment and M&A opportunities in the cryptocurrency space; and such other assumptions and factors as set out herein. These forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of BLOC.V to be materially different from those expressed or implied by such forward-looking information, including but not limited to: risks related to changes in cryptocurrency prices; the estimation of personnel and operating costs; that it will receive required regulatory approvals; the availability of necessary financing; permitting of businesses that it intends to invest in; general global markets and economic conditions; risks associated with uninsurable risks; risks associated with currency fluctuations; competition faced in securing experienced personnel with appropriate industry experience and expertise; risks associated with changes in the financial auditing and corporate governance standards applicable to cryptocurrencies and ICO's; risks related to potential conflicts of interest; the reliance on key personnel; financing, capitalization and liquidity risks including the risk that the financing necessary to fund continued development of BLOC.V's business plan may not be available on satisfactory terms, or at all; the risk of potential dilution through the issuance of additional common shares of BLOC.V; the risk of litigation; and the risk that cybercrime may severely damage the value of any or all of BLOC.V’s investments. There may be many other factors that cause results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. We undertake no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as required by law. Investors are cautioned against attributing undue certainty to forward-looking statements.

BLOC.V has no assets except cash from a recently closed financing and this article is based on the business plan of BLOC.V which at this point is purely conceptual in nature. There is no assurance that the business plan will be implemented as set out herein, or at all.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Safehaven.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) has been paid by the profiled company or a third party to disseminate this communication. In this case the Company has been paid by BLOC.V ninety-four thousand two hundred fifty US dollars for this article and certain banner ads. This compensation is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. Gains mentioned in our newsletter and on our website may be based on end-of- day or intraday data. If we own any shares we will list the information relevant to the stock and number of shares here. We have been compensated by BLOC.V to conduct investor awareness advertising and marketing for CSE:BLOC.V and OTC:BLKCF. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the company. The third party, profiled company, or their affiliates may liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non- compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor awareness efforts. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price is likely to occur.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our communications and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, it is certainly possible for errors or omissions to take place regarding the profiled company, in communications, writing and/or editing.

DISCLOSURE. The Company does not make any guarantee or warranty about what is advertised above. The opinions expressed in this article are exclusively those of the author and have in no way been approved or endorsed by BLOC.V. This article and the information herein are provided without warranty or liability.

SHARE OWNERSHIP. The owner of Safehaven.com owns shares of this featured company and therefore has an additional incentive to see the featured company’s stock perform well. The owner of Safehaven.com will not notify the market when it decides to buy more or sell shares of this issuer in the market, but will not trade on material information that has not been disclosed to the public. The owner of Oilpatch.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing The Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

RISK OF INVESTING. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

All trades, patterns, charts, systems, etc., discussed in this message and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author and do not necessarily reflect those of the publisher.