Hindsight is 20/20. Investors always lament missing the boat on the next big craze that mints a long line of millionaires.

If an investor could jump into a time machine and travel back in time, perhaps 20 years or so, one of the surest and fastest ways to make it rich would be to bet on wireless technology. Few people had cell phones at the time – now everybody does. Some visionary people made a fortune through wireless technology, but the cellular market in the U.S. is now saturated; that ship has sailed.

But that isn’t true everywhere. Only a fraction of the world has access to the global communications network in this way. In South America, the wireless market is just getting going, and there are still millions to be made.

One small-cap company is making moves that should raise some eyebrows, and has potential to do very well.

Tower One (CNX: TO; OTC: TOWTF) just announced that it has signed a Letter of Intent to acquire a Mexican private Tower Company, which owns, builds and leases cellular towers to the telecom industry in Mexico. The company also happens to have a Master Lease Agreement (MLA) with AT&T, allowing it to be granted direct Build-To-Suit opportunities.

Cellular towers might not seem like the sexiest growth market, but the profit potential is massive. In Latin America, where cell phone use is low by U.S. standards but is experiencing rapid growth, cell tower operators are at the forefront of a gold rush. They build the towers and lease the coverage to cell phone companies. With demand rising quickly, it is almost a matter of “if you build it, they will come.”

Alex Ochoa, CEO of Tower One, spoke of the significance of the Mexican acquisition. “This acquisition is a great addition to Tower One’s multi-regional strategy. It gives us the opportunity to add additional infrastructure to our existing portfolio in Argentina and Colombia. Since going public by reverse merger in Q1 2017, the company has now initiated our expansion program into these three countries.”

The news might seem innocuous at first, but it is a sign that the company is positioning itself for major inroads into the Mexican market. And the opportunity is huge. AT&T has already announced plans to invest as much as $3 billion in upgrading the Mexican network, opening up coverage to 100 million people by next year, double the current reach at just 51 million users. Tower One is positioning itself to profit from this explosive growth.

But that is only the latest news from this small company. Looking deeper, there are several reasons why investors need to pay attention to Tower One.

#1 Hot growth market

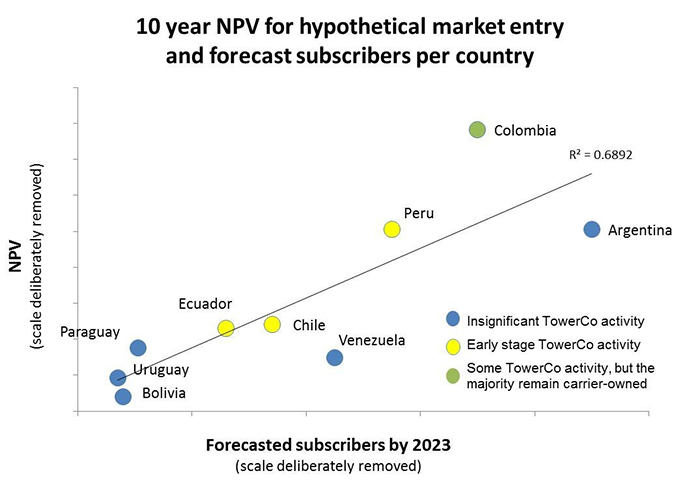

According to a Mott MacDonald study on South America's Cell Tower Investment Opportunity, growth in wireless tech is set to surge, meaning there is massive demand for cell towers. By 2020, South America will need 520,000 cell towers to meet the needs of the market, but there are only 100,000 right now.

Tower One (CNX: TO; OTC: TOWTF) estimates that it could earn $180,000 from each tower. Because the industry could build more than 400,000 towers by 2020, a back of the envelop calculation suggests that the market for cell towers in South America could be worth $75 billion. In other words, the market is set to quintuple in just a few years, which could lead to windfall profits for the few companies that control the towers.

In a lot of ways, it is like a landlord in a white-hot real estate market. If everyone wants to live in a desired area that has a shortage of living space, there is a high premium on any house or apartment, lining the pockets of the landlord. In the cell tower business, the tower owner leases out space, and each tower can service up to four telecom companies. And because wireless usage is growing so quickly in South America, companies like Tower One are scrambling to build as many towers as possible to cash in.

Figure 1 Source: Mott MacDonald

#2 Huge profit opportunity

The profit opportunity is very straightforward. Each tower can generate between $12,000 and $15,000 per year per operator, after the initial $50,000 to $100,000 investment to build the infrastructure. As such, the tower just about pays for itself after a few years, and thereafter the margins should be huge.

Cell towers offer 80 percent EBITDA margins. There are few industries with such high margins and investors would be hard pressed to find that elsewhere.

Tower One believes it will need to raise $5 to $10 million to finance the construction of the next 200 towers. But after that, the company will be generating enough cash to self-finance its ambitious growth plans.

#3 Early cash

Not only does Tower One (CNX: TO; OTC: TOWTF) expect to generate enormous returns for years to come, but investors won’t have to wait decades to see returns. The tower business generates a wave of cash in short order.

A tower can be built in just one month, and a cell operator can be brought online two weeks later. Better yet, customers ink deals for 10 or 20 years, locking in rock-solid revenue streams for decades. In other words, 45 days after you break ground, you are generating cash…for the next two decades.

The company currently has 15 towers, with 20 more on the way. But because Tower One is moving quickly, sensing that time is of the essence, it has ambitious growth plans. By the first quarter of 2018, Tower One is planning to have 100 towers in operation. A year later, that figure is planned to triple to 300 towers.

Tower One could theoretically earn $180,000 on each tower it builds over a three-year period.

Put that altogether, and it should add up to a valuation that is much larger than its current market cap of just $19 million!

#4 A small-cap in a market with few pure-play competitors

For investors looking for an entry point, there are only four publicly-traded cell tower companies in the world. Three of them, however, are large and mature, offering little more than stability for investors trying to get in on the action.

But the fourth is Tower One (CNX: TO; OTC: TOWTF), a small-cap company established in this business in 2017 and currently valued at just $19 million. It is the only small-cap cell tower company that can offer investors a way in.

Tower One’s older and larger competitors built hundreds of thousands of cell towers, minting millionaires along the way. SBA Communications (NASDAQ: SBAC), for example, handed shareholders a nearly 45,000 percent return over ten years. The three cell giants have a combined market cap of $100 billion.

Tower One is hoping to repeat this success story in South America. Better yet…and this is important…while Tower One’s larger competitors control the North American market, they do not yet have a head-start in South America. They are all pretty much starting from scratch, which means the small-cap Tower One could see large growth, even if only captures a fraction of the market.

#5 Executive team stacked with heavy hitters

Tower One (CNX: TO; OTC: TOWTF) is headed up by Alex Ochoa, who has a long track record of success and has created billions in shareholder value. He recently left Mackie Research Capital, one of the top institutional brokerage firms in Canada.

Also on the team is Rolland Bopp, who should be recognizable to those familiar with the telecom industry. He is the former CEO of Deutsche Telekom USA, a company now known as T-Mobile.

But the exciting thing about Tower One right now is that 60 percent of the company’s shares are held by the company’s management, which means they will laser focus on shareholder value. Investors who get in early can be assured that management is just as motivated as they are for success.

In short, massive growth in the cell tower business is what everyone is predicting for South America, potentially offering returns to shareholders that are as predictable as they are substantial, and Tower One is the only small-cap company that offers an entry point for investors.

Other companies to watch in the space:

Cogeco Communications Inc. (TSX:CCA): Cogeco Communications Inc., formerly Cogeco Cable Inc., is a Canada communications company with a $2.62-billion market cap. Right now, it’s got negative earnings, but over the longer term, this company is looking good.

The company has rallied significantly since the beginning of the year and trades for C$92 now as a result of stronger earnings. Canada’s 4th largest cable company could rally even higher as the company could prove to be a prime takeover target for its larger peers Rogers or Bell.

Redline Communications Group Inc. (TSX:RDL): Redline is not a giant, but it does operate in more of a niche environment—in hard-to-access places, providing wireless for critical industries, including oil and gas, and anywhere from the rainforests of South America to the slopes of Alaska and the deserts of the Middle East.

While the company didn’t manage to squeeze a profit in Q2 2017, we expect the company to improve its operations results as it did in the previous quarter. The company’s main challenge remains to expand and attract new customers for its new LTE product.

BCE Inc. (NYSE:BCE; TSX: BCE) is a Canadian telco giant. Founded in 1980, the company, formally The Bell Telephone Company of Canada is composed of three primary subsidiaries. Bell Wireless, Bell Wireline and Bell Media, however throughout its push into the position of one of Canada’s top telco groups, it has bought and sold a number of different firms.

BCE Inc has resisted takeover attempts and shown significant resilience throughout the years. The company has been so successful, that it is now a household name.

It’s paying a quarterly dividend of $0.72 per share right now. It’s had some great results, even if net income has declined a bit in the most recent quarter. It’s still blowing other telcos out of the water.

Peeks Social (TSXV:PEEK) is a Canadian company which is primarily focused on the development of social media and social commerce products. The Peeks Social app has reached over 30 million people and is growing quickly. As one of the 15th highest grossing social apps on Google platform, Peeks is adding value for both its customer and its investors.

Through strong leadership and a forward-thinking management team, the company has made waves in Canada’s mobile world. The company’s CEO, Mark Itwaru, worked with AT&T Canada for years as an engineer and designer before beginning his work with Peeks.

Peeks Social is set to continue its rise in Canada’s mobile application world, and as it continues to grow, investors are sure to profit.

Shaw Communications Inc (TSE:SJR.B): Shaw Communications, a giant in the Canadian telecoms sector, saw a drop in its share price following its disappointing forecasted earnings growth in 2017. In a sector that is set to see growth, undervalued and experienced companies such as this can make for a great hold play.

With a market cap of $13.73 billion, Shaw Communications is going to be a big player in the sector for quite some time to come, and as it nears its 52-week low this could be a great time to pick up a telecoms giant.

Forward-Looking Information

This news release contains "forward-looking information" within the meaning of applicable securities laws. Generally, any statements that are not historical facts may contain forward-looking information, and forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" "intends" or variations of such words or indicates that certain actions, events or results "may", "could", "would", "might" or "will be" taken, "occur" or "be achieved". Forward-looking information includes, but is not limited to the closing of an letter of intent to purchase a Mexico company with a master license from AT&T; that the margins on cell tower operations are huge, generally around 80%; that Tower One will need to raise $5 to $10 million to finance the construction of the next 200 towers but after that it will be generating enough cash to self-finance its growth plans;

that a cell tower can be built in just one month, and a cell operator can be brought online two weeks later; that cell operators sign deals for 10 or 20 years; that 45 days after construction on a tower starts, it can generate cash; that by the first quarter of 2018, Tower One could have 100 towers in operation and year later, that figure could triple to 300 towers; and that Tower One could theoretically earn $180,000 on each tower it builds over a three-year period. These forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Tower One to be materially different from those expressed or implied by such forward-looking information, including but not limited to: risks related to not coming to a final agreement to close the Mexico acquisition; not being able to agree with AT&T on important aspects of its license; the estimation of personnel and operating costs; that the cell market in South America will not grow as expected; that Tower One may not receive required regulatory approvals; construction of cell tower risks, including cost overruns, labor issues, technology that doesn’t work as well as expected; delays or problems in construction; the availability of necessary financing; cell operators may not come to quick or long term agreements as expected; competitors may offer cheaper, faster or better services, reducing expected revenues; general global markets and economic conditions; risks associated with currency fluctuations; competition faced in securing experienced personnel with appropriate industry experience and expertise; the reliance on key personnel; financing, capitalization and liquidity risks including the risk that the financing necessary to fund continued development of Tower One's business plan may not be available on satisfactory terms, or at all; the risk of potential dilution through the issuance of additional common shares of Tower One; the risk of litigation; and the risk that cybercrime, climate change including unusual weather, or changing technology may severely damage Tower One’s business. There may be many other factors that cause results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. We undertake no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as required by law. Investors are cautioned against attributing undue certainty to forward-looking statements.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Safehaven.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) has been paid by the profiled company or a third party to disseminate this communication. In this case the Company has been paid by Tower One twenty thousand US dollars for this article and certain banner ads. This compensation is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. Gains mentioned in our newsletter and on our website may be based on end-of- day or intraday data. If we own any shares we will list the information relevant to the stock and number of shares here. We have been compensated by Tower One to conduct investor awareness advertising and marketing for CNX: TO; OTC: TOWTF. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the company. The third party, profiled company, or their affiliates may liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non- compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor awareness efforts. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price is likely to occur.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our communications and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, it is certainly possible for errors or omissions to take place regarding the profiled company, in communications, writing and/or editing.

DISCLOSURE. The Company does not make any guarantee or warranty about what is advertised above. This article and the information herein are provided without warranty or liability.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing The Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

RISK OF INVESTING. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR- OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

All trades, patterns, charts, systems, etc., discussed in this message and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author and do not necessarily reflect those of the publisher.