In the twentieth century, fossil fuels powered the industrialization, urbanization and modernization of the global economy. Societies transformed. The world was connected. Wealth increased tenfold.

Now, in the twenty-first century, as revolutionary technologies disrupt moribund industries at lightning speed, knowledge is the new source of power.

Proprietary technology can translate into massive success for companies positioned to meet demand. In the energy sector, companies like Halliburton, Schlumberger and Baker Hughes reap huge profits from licensing their technologies and IP to other firms. In the case of Halliburton, deft use of proprietary tech has yielded yearly earnings of $5.4 billion.

New technologies have enabled drillers in the Permian Basin to pump more for less, while technicians in Houston can monitor rigs hundreds of miles away with just the click of a mouse.

Just like Google revolutionized the internet, the world of oil production could be about to be transformed by a small company with a revolutionary technology. Armed with blockchain-based tech, led by a team of qualified energy professionals, and poised to take advantage of a sea of oil locked away in Utah, Wyoming and Colorado, Petroteq Energy (TSX:PQE.V; OTCQX:PQEFF) shows strong potential to disrupt energy in a big way.

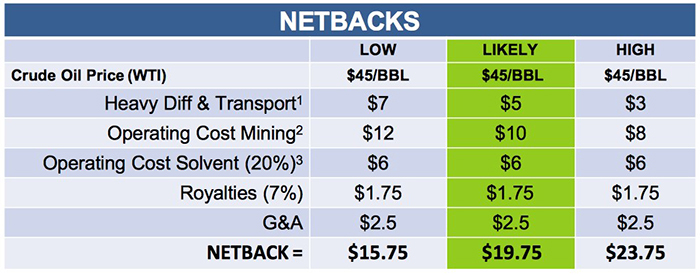

Petroteq’s proprietary technology can turn capex-heavy oil sands profitable at around $20 per barrel, and its use of blockchain tech and emphasis on third-party licensing should bode well for profits amidst rising global demand.

Many investors who bought into U.S. energy after the price crash of 2014 realized huge gains, as the shale revolution transformed the United States into the world’s foremost energy producer. So if 2017 was the year of the Permian Basin—a bonanza for U.S. shale producers—the next few years could see a revolution in energy production in “dry sands” oil fields in Utah, Wyoming and Colorado, and companies that know how to tap into these new resources will dominate.

As North America prepares to control global energy production, and with demand for heavy crude oil set to skyrocket amid the rejuvenation of American infrastructure, investors seeking prime energy stocks might want to spend a few moments looking at Petroteq.

Here are five things you need to know about this hot new energy influencer:

#1: Licensing Fees for Big Earnings

Unique tech demands a premium from whoever wants to use it. When demand spikes, Petroteq’s unrivaled tech will be superbly positioned to license its methods to third parties.

Petroteq’s (TSX:PQE.V; OTCQX:PQEFF) focus: oil sands. Normally, drillers use water to crack open oil sands deposits, leaving toxic pollutants behind and often failing to make sufficient discoveries. Because of all the equipment involved and the high environmental cost, oil sands is one of the dirtiest and most expensive fossil fuel sources. The “wet sands” of Canada, the largest oil sands deposit in the world, is dirty and non-competitive at today’s prices, forcing Shell and other majors to divest from the tar sands altogether.

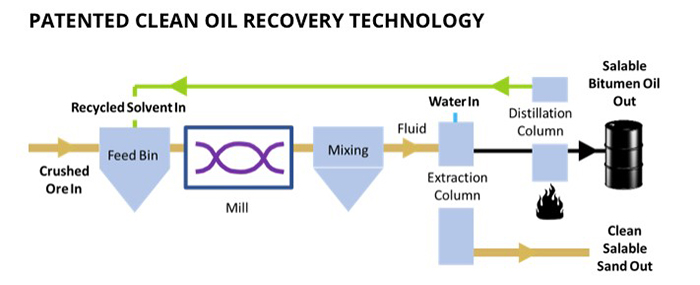

Here’s where Petroteq steps in, with a brand-new method for extracting oil sands, leaving little to no ecological impact and generating zero greenhouse gases. Rather than wet sands, Petroteq goes after “dry sands” deposits that can be reached quickly, reducing the risk of a dry well.

The company’s proprietary method can produce a barrel of oil from dry sands for $22, a far cry from the high breakeven costs of the Canadian tar sands.

Plus, blockchain technology developed in-house allows the entire process to be monitored step-by-step, reducing costs and boosting efficiency.

Make no mistake—these technologies will be critical for the next phase of the North American energy revolution. The oil sands of Utah hold 32 billion barrels of oil equivalent, in 8 major deposits. So far, few companies have successfully marketed Utah oil sands, as production and transportation costs have been too steep.

But Petroteq’s proprietary methods should make breaking into the Utah fields far easier, while the low production costs should translate into high profitability.

The company has already proven it can produce Utah oil effectively. It took over the Asphalt Ridge plant for $10 million and produced 10,000 barrels in 2015. Next year, Petroteq plans to tap into the field’s 30,000 bopd of proven reserves, producing at only $23 per barrel. It’s sitting on top of a field holding 87 million barrels of oil equivalent.

But Petroteq won’t do the drilling when the dry oil sands gold rush begins. Instead, the company could be about to make a killing from licensing its tech to other producers. As demand for heavy oil increases, drillers will begin exploiting the immense reserves of accessible oil sands throughout the world.

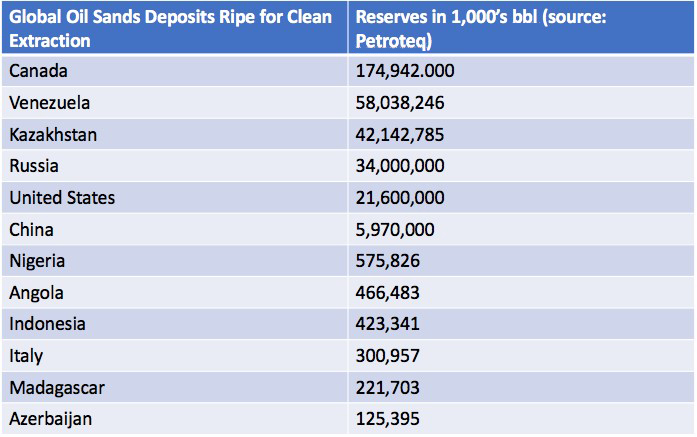

How big could these licensing fees be? Consider the size of the market: 174 billion barrels in Canada, 21 billion in the United States, some 500 billion barrels worldwide.

And we are not aware of anyone who can access these reserves at $20/barrel without Petroteq’s proprietary tech.

With WTI hovering near $60, and with $70 not too far away, the potential for Petroteq to earn billions per year in licensing fees is very real.

#2: Blockchain Technology

The building block of the cryptocurrency economy, Blockchain technology has the capacity to make energy trading and energy production faster, more efficient and easier to trace.

It’s already attracted the attention of the majors, and Petroteq intends to make it a central component of its strategy.

It basically functions as a way of ensuring secure transactions between partners without the need for a verifying third party overseeing the transaction. It’s used in the bitcoin world to act in place of banks or other third parties.

Major companies like BP, Shell and Statoil hope to set up a secure real-time blockchain digital platform that could allow for quicker and easier energy trades without any troublesome, inefficient middlemen.

Petroteq (TSX:PQE.V; OTCQX:PQEFF) has signed an agreement with First Bitcoin Capital, a blockchain development and crypto-currency firm, and has also been working with IBM to bring its oil field operations in line with big data.

While the majors dabble in setting up a Blockchain exchange, Petroteq wants to be on the forefront, becoming the first company to build a data platform containing energy-specific information, which it can then license to other companies along with its proprietary production technology.

Partnership with First Bitcoin Capital, gives Petroteq the credibility it needs to realize its ambitions. With Bitcoin trading for more than $11,000 per coin, up from just a few hundred a few years ago, the capacity for realizing huge gains is pretty extraordinary.

But again, the real prize here is information: Petroteq will become the proprietor of an industry-specific, tailored blockchain overseen by the tech specialists at IBM that will bring every facet of upstream and downstream energy production under the umbrella of big data analytics.

When the product is finished in about six months, Petroteq will sit on an asset that could be worth billions when licensed to other energy firms. Using blockchain for energy transactions will remove the need for expensing trading houses and middlemen, and Petroteq can offer its services at a fraction of the cost charged by financiers.

Bottom line: Licensing this technology could make Petroteq the biggest name in upstream and downstream operations.

#3: Demand Going Sky High

Oil from dry sands is heavy, as opposed to the light crude that comes from the shale fields of the Permian.

But with the United States poised to launch a major infrastructure development plan next year, demand for heavier crudes is set to skyrocket. The Trump administration wants to spend $1 trillion revamping American roads, bridges and freeways, and it will need millions of barrels of heavy crude—crucial in the production of asphalt and other building materials—to do it.

Heavy oil refineries are poised to take in more crude, and discounts for heavy blends are disappearing as the market tightens.

Petroteq (TSX:PQE.V; OTCQX:PQEFF) should be well situated to feed this demand growth. By licensing its technology to third parties, it could realize revenues and quick growth with little or no capital expenditure, fostering big profitability and strong investor return.

Then there’s the price of oil, which has been slowly ticking up in recent months, thanks in part to spikes in geopolitical risk. Disturbing trends in Saudi Arabia, such as the mass arrest of dozens of Saudi princes and businessmen, indicate that all is not well in the world’s number-one oil exporter.

Violence broke out in Iraq in October as Iraqi troops seized the oil-town of Kirkuk from Kurdish forces. There’s a good chance tensions could escalate further, putting pressure on prices.

Then there’s Venezuela, where chaos could trigger a supply cut-off, sending prices skyrocketing.

Current prices, hovering between $55 and $60, could jump as high as $80 next year. Supply shocks in Latin America or the Middle East could send prices even higher.

Meanwhile, North America continues its march towards global energy dominance. American energy production will reach a milestone in 2018, with 10 million barrels of oil equivalent per day attained for the first time since the 1970s.

And investors who want to take full advantage of this energy revolution—the most dramatic shift in global energy since the discovery of the Middle East oil fields in the 1940s—are licking their chops.

#4: Dream Team

As Petroteq (TSX:PQE.V; OTCQX:PQEFF) positions itself as the Google of energy, it’s snapping up the best talent and focusing on applying its technology through aggressive, active leadership. CEO and chairman Aleksandr Blyumkin is so confident in the company that he’s pumped millions of his own money to expand its presence, including providing an interest-free loan to grow production from Petroteq’s facility at Temple Mountain, Utah.

The Petroteq ethos of innovation and daring is personified by CTO Dr. Vladimir Podlipskiy, a pioneer of oil sands extraction technology with a ton of patents to his name. No one alive knows more than Podlipskiy about how to extract oil from oil sands, a tricky and potentially expensive process that he has mastered.

#5: A Licensing and Technology-Driven Juggernaut

Petroteq’s (TSX:PQE.V; OTCQX:PQEFF) products and technologies firmly place it at the forefront of some of the hottest trends in the market. It can unlock billions of barrels of previously-untapped heavy oil at a fraction of the cost of other firms, just as demand is set to spike with American infrastructure projects and tightening global supply of heavy crude.

But what truly sets this company apart is its mastery of information.

Poised as a licensing fee juggernaut, every upstream developer hungry for Utah oil sands will turn to Petroteq’s proprietary tech to unlock reserves. Other companies eager to cut costs and streamline operations will use the company’s blockchain data service to cut out the middlemen.

In 2018 we could see this small-cap energy company emerge as a major player in the American energy revolution.

Honorable mentions:

Pembina Pipeline Corp. (TSX:PPL-A, NYSE:PBA): The North American pipeline industry has had a tough year, but the recent approval of the Keystone XL pipeline route and the growing need for transportation capacity should act as a boon for the sector.

Pembina Pipeline Corp. has ridden the oil price crash in an impressive manner, maintaining a good stock price and increasing its dividend. This is a stock that pays you to wait, and as the sector continues to improve it is likely investors will see good gains here.

Kinaxis Inc (TSX:KXS) is a provider of cloud-based subscription software for supply chain operations. With the complexity of oil, gas and resource transport and storage, Kinaxis has the potential to offer incredible solutions for its clients.

The Company offers RapidResponse as a collection of cloud-based configurable applications. The Company's RapidResponse product provides supply chain planning and analytics capabilities that create the foundation for managing multiple, interconnected supply chain management processes, including demand planning, supply planning, inventory management, order fulfillment and capacity planning.

Kinaxis is a growing company, but the company has already carved out a significant piece of the pie. As a leader in its field, Kinaxis is a force which investors are keeping an eye on.

Franco-Nevada Corporation (TSX:FNV , NYSE:FNV) specializes in securing precious-metal streams, but the company also works in the oil and gas industry. With key assets in some of North America’s most desirable oil and gas plays, including Texas, Oklahoma and Alberta, it is clear that the company has amazing potential in the coming years.

FNV ended 2016 with a relative bang. And as oil and gas prices inch up, investors are watching this diverse company very closely.

Computer Modelling Group (TSX:CMG) is a software technology company producing reservoir simulation software for oil and gas companies. Computer Modeling Group LTD. Is a tempting trade for investors as it brings together two essential industries - tech and resources- which are going anywhere any time soon. Especially as the need for security grows, a tech company involved in the oil and gas industry has an incredible opportunity to offer other services.

While Computer Modelling Group focuses on the resource industry, its technology is definitely breaking ground. Founded nearly 40 years ago by Khalid Aziz, a renowned simulation developer, the company has proven that it has staying power. As the resource industry meets technology, this will be a stock to pay attention to.

Imperial Oil (TSX:IMO): Imperial oil could be one of the best contrarian bets in the oil markets for 2018, having missed its third quarter profit estimates and currently dealing with the resultant stock decline. It still has some of the lowest cost producing oil sands in Canada and that is going to pay off as oil prices continue to rise and new tech breakthroughs bring breakeven prices even lower.

The management is well known for being conservative, but that certainly shouldn’t put investors off in a time when recovery is the buzzword of the day and consistency is sure to be rewarded.

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This news release contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this release include that PETROTEQ will be able to produce oil as currently scheduled and at the targeted low prices from its Utah property; that oil will be as much in demand in future as currently expected; that PETROTEQ’s technology is protected by patents and that it doesn’t infringe on intellectual property rights of others; that PETROTEQ will find licensees for its technology and that it can patent its technology in many countries; that PETROTEQ’s technology will work as well as expected; that blockchain technology will help PETROTEQ achieve its goals; and that PETROTEQ will be able to carry out its business plans. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that the Company’s patents and other technology protection are not valid, patents may not be granted in countries where PETROTEQ wants to license its technology; production of oil may not be cost effective as expected, PETROTEQ may not raise sufficient funds to carry out its plans, changing costs for extraction and processing; technological results based on current data that may change with more detailed information or testing; blockchain technology may not be developed to assist PETROTEQ achieve its goals; competitors may offer better technology; and despite the current expected viability of its projects, that the oil cannot be economically produced on its properties. Currently, PETROTEQ has no revenues.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Safehaven.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) has been paid by the profiled company to disseminate this communication. In this case the Company has been paid by PETROTEQ sixty five thousand US dollars for this article and certain banner ads. This compensation is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. We have been compensated by PETROTEQ to conduct investor awareness advertising and marketing for TSXV:PQE and OTCQX:PQEFF. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the company. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information in our newsletters. The information in our communications and on our website has not been independently verified and is not guaranteed to be correct.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing The Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.