- Comparison to solar installers/similar business indicates possible fair value for SBRT at 2-3x current market price as company undergoes discovery.

- Tailwinds are there for solar and energy efficiency businesses with smart networking products, like VLSR and SBRT.

The most influential micro-cap acquisition of 2017 has gone completely unnoticed by the public markets, but that's about to change as financials emerge in 2018. With the summer acquisition of SolBright Energy, and their subsequent name change to match, little Solbright Group (OTCMKTS:SBRT) (formerly Arkados Group), is significantly undervalued compared to peers, and it's likely just a matter of time before investors realize that this solar/SAAS business could be worth 2-3x where the stock trades today. With some 2018 price discovery, SBRT could be due for a rapid rally higher in 2018.

Money-Saving Industrial Energy IoT Installs Are Taking Off

Solbright's is revenue-generating company, and with the addition of its new solar installation business this summer, the company could be about to springboard into a new period of growth.

This summer, the company acquired a sizable Atlantic coast photovoltaic engineering and installation firm, a logical addition to their existing business. Solbright's existing energy conservation services subsidiary, SES, is potentially on the edge of some serious growth as the solar installation business brings in dozens of new customers. The original SolBright Renewable Energy (not to be confused with the emerging SBRT) brought with it a pipeline of $40 mln in potential revenue, as the company was already doing significant sales - in the second quarter of 2017, SBRT reported a massive $5.278 mln in sales, lead by their new solar unit. That's a tremendous increase of over 1100% compared the second quarter of 2016 (the company's second fiscal quarter 2017).

SES provides energy conservation services and solutions to business and buildings throughout the eastern United States including energy consumption assessments and recommendations, as well as acting as the general contractor for conservation retrofits, oil-to-natural gas boiler conversions and other smart industrial metering systems. Through their proprietary software package and installation of a sensor network, SES helps businesses and facilities streamline their efficiency, saving as much as 25% or more on their energy usage. It's quintessential Industrial Internet of Things applications.

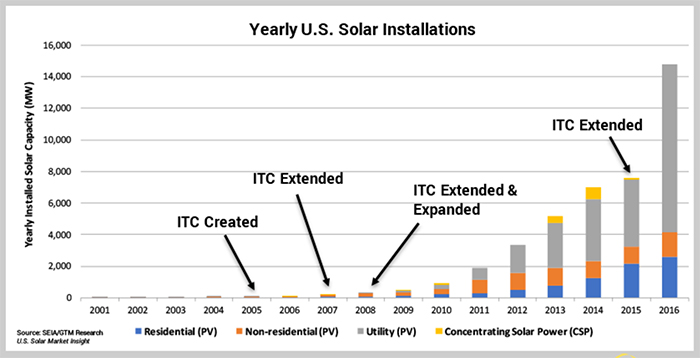

The demographic tailwinds are all there too... solar installations are on the rise in the United States with second quarter installations up 8% over the same period last year. In fact, installations are beginning to hockey-stick...

Secondly, more and more products are emerging for smart, industrial IoT settings, like those that Solbright tackles, and energy conservation measures - not to mention cost-savings - are going mainstream. With these tailwinds and the addition of a huge revenue backlog, SBRT could be on the verge of tremendous growth. Convincing new solar customers to take on their SES IIOT services as well is almost a no-brainer for the customer, and the residual income from SBRT's software package is a high-margin opportunity.

If the company can maintain a similar quarterly revenue rate as in their fiscal first quarter of 2018, they could be on track for a $20 mln year... 800% growth from 2017.

Even Current Revenue To Justify 2-3X of Upside

Valuing this business isn't easy because there are so few companies doing what Solbright is doing: solar photovoltaic installs and smart networks to enhance a facility's efficiency with a proprietary software (SAAS) platform. But there exist some topically comparable companies out there, like Vivint Solar (NYSE: VSLR), which trades on the New York Stock Exchange and installs/maintains residential and commercial photovoltaic projects.

At a $380 million market capitalization, the market has applied a 1.6X Price/Sales multiple to the stock based on $243 million in sales over the trailing twelve months (TTM). In 2016, the company did sales of $135 million, for a Price/Sales multiple of 2.8.

The same metrics applied to SBRT demonstrate just how undervalued - and undiscovered - this company is... Solbright is on track to have sales of around $20 million in their fiscal 2018, based on extrapolating from their $5.3 million in the first quarter.

A 1.5 to 2.5x Price/Sales multiple could mean a fair value market capitalization based on this 2018 estimate of $30 to $50 million! The stock today is valued at just $16 million, implying the stock has 2-3x of upside as investors understand the company's latest solar acquisition! And, this Sales multiples may be conservative based on the company's SAAS business model, which should blossom in conjunction with new photovoltaic installations.

When looking for trade-worthy stocks, investors should be looking for companies with unappreciated business facets, like SBRT's new revenue stream and pipeline of possible deals. A good recent example can be seen with Neuralstem (NASDAQ:CUR), which this week revealed that their NSI-189 drug candidate improved the symptoms of major depression. The news was unexpected because NSI-189 was unsuccesful in a trial in July - CUR ripped 100% as a result. China-based Xunlei Limited (NASDAQ:XNET) unexpectedly announced a pivot to focus on cryptocurrency and blockchain technology applications, despite that the company's history is in streaming membership services. With the unexpected news, XNET has nearly quadrupled since the beginninf of October. For SBRT, the realization by investors that significant revenue expansion is emerging in 2018 could be a rapid catalyst for another "unexpected" move.

About One Equity Stocks

One Equity Stocks is a leading provider of research on publicly traded emerging growth companies. Our team is comprised of sophisticated financial professionals that strive to find the companies and management teams that will outperform the market and deliver investment returns to our subscribers. We are not a licensed broker-dealer and do not publish investment advice and remind readers that investing involves considerable risk. One Equity Stocks encourages all readers to carefully review the SEC filings of any issuers we cover and consult with an investment professional before making any investment decisions. One Equity Stocks is a for-profit business and is usually compensated for coverage of issuers. In the case of AKDS, we are reimbursed for actual costs of this distribution and have received 250,000 shares of restricted stock for Business Development, Capital Markets and Research Services from SBRT. Readers should always assume that we will sell some or all of our position on the 180 day anniversary of the stock's issuance date. Please contact us at [email protected] for additional information or to subscribe to our intelligence service.