Big data is transforming the world in ways that humans never believed was possible, with the latest breakthroughs aimed at saving billions of dollars and thousands lives. It’s the difference between knowing or not knowing when a portion of 2.6 million miles of pipeline might burst, one or more of 15,500 high-risk dams might fail, a refinery might explode, or which portion of 7.2 million miles of electric power lines might black out.

Protecting the critical infrastructure of the United States is set to be a $153 billion market by 2022, and the remote sensor industry that will make this protection possible is expected to more than double from $10.68 billion this year to $21.62 billion in just three years’ time.

The pipeline protection industry alone is set to see its value double from US$4.13 billion in 2015 to US$8.72 billion in 2026. And this is just one market segment that this breakthrough tech is set to address.

The infrastructure monitoring industry is at a major turning point, and with Trump set to spend $1 trillion on infrastructure in the coming years, smart investors are turning their heads.

Here are 5 companies that should be on your big data radar as critical infrastructure becomes a matter of life and death:

#1 Honeywell International Inc. (NYSE: HON)

Honeywell is a major player in critical infrastructure monitoring. It’s also got its hands in critical infrastructure security and cyber security, recently acquiring cyber security company Nextnine Ltd.

Honeywell, a Fortune 100 software-industrial set-up, positioned itself solidly in this market—and early on—gaining prowess as a key warrior against cyber threats to critical infrastructure.

The company says the cyber security market in the Middle East alone is expected to double from $11.38 billion in 2017 to $22.14 billion by 2022.

Honeywell announced last week that it was idling its Metropolis plat in Illinois—a plant that manufactures uranium hexafluoride (UF6)—the building block of enriched uranium for use in nuclear reactors. The shutdown was announced on November 20, citing “significant challenges facing the nuclear industry,” which amounts to decreased demand after the notorious Fukushima disaster.

Despite the closure, Honeywell has other fish to fry, and is a key player in the pipeline monitoring business. It reported impressive Q3 financials that outperformed the broader market, with Q3 revenue of $10.1 billion, exceeding analyst expectations and securing revenues of $9.8 billion in Q3 2016. But it’s not just revenues that Honeywell boasted in its Q3 report—it was good across the board, with earnings per share at $1.75 vs $1.60 a year ago, and free cash flow up 18 percent year-to-date. As for the segments performing the best, that’s Aerospace, Home and Building Technologies, and Safety and Productivity Solutions—the latter growing 21 percent year over year.

The stock is up almost 33 percent in the last 52 weeks, jumping from $112.15 per share in November 2016 to $149.35 on November 21, 2016.

Past sales growth has sauntered slowly behind its peers in recent years, and Honeywell has in the past failed to return profits to its shareholders at a level that would cause excitement. But the tide is turning, and with Honeywell’s new CEO, Darius Adamczyk, manning the ship, Honeywell may soon outshine its larger peers. Adamczyk has a plan to spin off two business units by the end of 2018—part of HON’s aggressive plan to increase sales. The units Honeywell is dumping—its turbocharger business and the unit that manufactures air purifiers and smoke alarms—may cut into sales, but it also means Honeywell will be leaner and meaner, left with its divisions that are growing sales at a faster pace.

“All the remaining businesses offer options for investment and growth,’’ Adamczyk said on a conference call with analysts, according to Bloomberg Markets. “The punch line for me is, we’re going to be very active in the M&A arena.’’

Honeywell is expected to release its 2018 outlook on December 13 before the market opens.

#2 Carl Data Solutions (CSE:CRL; OTC:CDTAF)

This is where Small-Cap plus Big Data can be a smart play for early-in investors.

Carl Data’s tech is designed to monitor, predict and therefore allow operators to save us from any type of infrastructure failure - oil spills and dam failures, toxic explosions and mine collapses - and it takes advantage of the massive data from a remote monitoring market that will be worth over $27 billion by 2023.

While everyone’s been focusing on the billions of sensors that collect data remotely, Carl Data has been focusing on the data itself. Industries from critical infrastructure to manufacturing and everything in between are receiving way too much data that disappears into a black hole. Carl Data intercepts it and makes it actionable—and profitable.

It could be one of the most disruptive tech systems we’ve seen for the infrastructure industry.

From Toronto and Dallas to LA, major cities are lining up for Carl Data solutions to protect budgets and populations from the devastating disasters caused by aging infrastructure. The mining vertical is already being successfully tapped, and Carl Data anticipates other major verticals to follow suit.

There are few systems out there that can handle the type or sheer volume of data swarming in the cloud.

Carl Data’s AI system can be programmed to predict events that may lead to critical infrastructure failures up to seven days into the future.

- It can use AI to forecast whether a future storm might cause a major incident at one of America’s many aging and high-hazard potential dams—before they fail.

- Think major pipeline operators like Enbridge, Kinder Morgan, Husky, TransCanada and all their oil and gas stream crossings: Carl Data can alert engineers via cell phone immediately if thresholds are threatening breach.

- For companies like Teck, Gold Corp., Imperial Metals and BC Hydro and thousands of hydro-electric dams and toxic tailing ponds around the world, Carl Data could be the difference between safety and a billion-dollar clean-up. It’s already working with Teck Resources and has developed and deployed an application for monitoring tailing ponds. The tech system will help Teck manage risk and is expected to result in significant operational savings.

- When snow melts in the streams feeding into a toxic tailing pond, sensor data from points where the streams enter the ponds, combined with AI, can predict the likelihood of an incident.

This is a massive data platform that can service absolutely any and every industry vertical. And it’s already earning revenues, so it’s not your typical small-cap.

Clients pay a fee based on the number of data sources coming into their account, along with set-up fees and customization services, which include new algorithms and unique reporting.

And the entire system just got a lot easier and even more cost-effective with Carl Data’s AB Embedded Systems Ltd acquisition. Now, new solutions are in place to set up networked data-loggers to get all the data into the system automatically.

For investors looking for a backdoor into one of the biggest data coups since the Internet itself, this might just be it.

#3 NVIDIA (NYSE:NVDA)

Nvidia keeps popping up in nearly every vertical that has even the slightest thing to do with technology. That’s because it makes some of the most popular semi-conductor chips on the market, and the market absolutely loves this stock.

For every remote monitoring device, there is a chip. So, it’s not a stretch for a chipmaker to make it in the top five. While Nvidia’s GPU first revolutionized PC gaming, Nvidia’s hotter than hot chips are primed and ready to benefit from the explosion that is big data. Nvidia’s chips are the fastest on the market today, topping charts in the fields of artificial intelligence, self-driving vehicles and even Amazon’s Echo.

And if their chips are hot enough for you, we suspect their stock is, more than doubling since May.

There are so many tech verticals that will benefit Nvidia that it’s hard to keep track of them all, but critical infrastructure monitoring is definitely one of them.

#4 Verint Systems (NASDAQ: VRNT)

Verint Systems is another major player in the big data as a service arena, poised and ready to benefit from a market that is rife with security concerns. What Verint Systems offers is the ability to capture large amounts and types of data from numerous sources, analyzing that data through analytics, and then using those insights to help optimize customer engagement.

Its most recent addition to its cyber security solution lineup is machine learning.

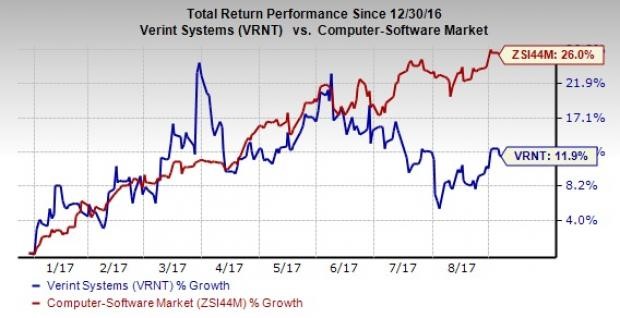

On the financial side, Verint has jumped up from just over $38 a year ago to over $43 today—an increase of 13 percent. Its fiscal Q2 2018 non-GAAP earnings beat estimates of 47 cents per share, coming in at 61 cents per share. Non-GAAP revenues of $278.2 million for that quarter were 5.3 percent up year on year.

And as of September, Verint was significantly overperforming its sector—the computer software market.

Its cyber intelligence segment generated non-GAAP revenues of $95 million in fiscal Q2 2018.

#5 International Business Machines Corp. (NYSE:IBM)

One might argue that the cloud itself is part of our critical infrastructure, and IBM is a key player in protecting this ethereal space.

Not only is IBM a cloud-computing behemoth, but it’s also got some other interesting catalysts and it’s moving aggressively. Most notably, it’s been promoting Blockchain hard and fast recently, releasing IBM Blockchain in the spring as the first enterprise-ready Blockchain service. It’s hoping the Canadians will adopt it for selling recreational marijuana once it becomes legalized next summer. In doing so, it’s all about protecting ‘critical infrastructure’ and securing transactions from fraud.

The stock has dipped 8 percent this year, but next year is looking good and we don’t see a lot of downside here. The declining revenue that’s been going on for 22 quarters may be over, so this could be a good time to get in on a giant in this space. And we would look to Blockchain efforts to get it back on track. In the meantime, it’s a cheap stock to buy.

Honorable Mentions:

Pure Technologies LTD (TSE:PUR): Pure technologies is all about critical infrastructure including water and wastewater pipelines, oil and gas pipelines, and bridges and structures. One of Pure Tech’s biggest achievements in this space is its SoundPrint acoustic monitoring technology, which is set to revolutionize the industry.

Though PUR dipped to CAD$3.95 in March this year, it has climbed to CAD$4.47 since then. Investors are watching Pure Technologies closely and the company is sure to be a valuable addition to numerous portfolios going forward.

Teck Resources Ltd (TSX:TECK.B): Teck Resources may find itself on the receiving end of the boom in the critical infrastructure monitoring market. As Canada’s largest diversified resource company, Teck has invested in critical infrastructure with Carl Data Solutions for environmental monitoring of its mines. TECK.B stock fell earlier this year, but has already climbed almost 50 percent since June.

Keep in mind this, though: Teck’s Q1 earnings and revenue fell short of expectations because of weaknesses at its zinc unit, sending it shares down about 6% in late April. In particular, there’s been a 23% drop in production at its Red Dog mine due to lower grades of zinc

Avigilon (TSX:AVO): Avigilon develops, manufactures, markets and sells HD and megapixel network-based video surveillance systems, video analytics and access to control equipment. We expect strong continuous growth in the video analytics business and a company such as Avigilon is well positioned to capture market share in the Canadian markets.

As a key player in the digital security marketplace, it is clear to see why Avigilon made the list. With its technology continuing to move forward, investors can count in Avigilon to provide lasting value.

Computer Modelling Group (TSX:CMG) is a software technology company producing reservoir simulation software for oil and gas companies. Computer Modeling Group LTD. Is a tempting trade for investors as it brings together two essential industries - tech and resources- which are going anywhere any time soon. Especially as the need for security grows, a tech company involved in the oil and gas industry has an incredible opportunity to offer other services.

While Computer Modelling Group focuses on the resource industry, its technology is definitely breaking ground. Founded nearly 40 years ago by Khalid Aziz, a renowned simulation developer, the company has proven that it has staying power. As the resource industry meets technology, this will be a stock to pay attention to.

The Descartes Systems Group Inc. (TSX: DSG) (commonly referred to as Descartes) is a Canadian multinational technology company specializing in logistics software, supply chain management software, and cloud-based services for logistics businesses. The company is making waves in the tech industry with its futuristic products and visionary leadership.

As a key stock in Canada’s tech boom, Descartes Systems is a smart choice for investors. The company has a huge market cap of $2.6-billion and the stock has grown by nearly 20% YTD. As infrastructure and supply chains become more complex, new solutions are necessary, and Descartes Systems is at the forefront of addressing some of the biggest issues businesses are facing.

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Disclaimer for Forward-Looking Information

Certain statements in this press release are forward-looking statements and are prospective in nature. Forward-looking statements are not based on historical facts, but rather on current expectations and projections about future events, and are therefore subject to risks and uncertainties which could cause actual results to differ materially from the future results expressed or implied by the forward-looking statements. Forward-looking statements in this news release include statements that Carl Data’s custom closed control system can predict events that may lead to critical infrastructure failures up to seven days into the future, that Carl Data can precisely monitor and analyze the vibration of pipelines and predict maintenance of infrastructure which can save millions and prevent possible disasters; that revenues could grow substantially, that Carl Data’s technology may be able to prevent disasters resulting from infrastructure failure, and that the Company’s technology can be adopted for almost any industry.

Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. Such forward-looking statements are subject to risks and uncertainties that may cause actual results, performance or developments to differ materially from those contained in the statements including, without limitation, risks with respect to: that Carl Data’s data scientists may not be able to continue developing breakthrough machine learning abilities into their software, that machine learning and Carl Data’s technology in general may not achieve the expected results and its accomplishments may be limited, that the use of past data may not enable accurate predictions as expected, Carl Data may not establish a market for its services as expected; general economic conditions in the US, Canada and globally; the inability to secure additional financing; competition for, among other things, capital and skilled personnel; potential delays or changes in plans with respect to deployment of services or capital expenditures; possibility that government policies or laws may change; technological change; risks related to Carl Data’s competition who may offer better or cheaper alternatives; Carl Data may not adequately protecting its intellectual property; interruption or failure of information technology systems; and regulatory risks relating to Carl Data’s business, financings and strategic acquisitions. The Company disclaims any intent or obligation to update publicly any forward-looking information other than as required by applicable securities laws.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Safehaven.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) has been paid by the profiled company or a third party to disseminate this communication. In this case the Company has been paid by Carl Data one hundred and twelve thousand five hundred US dollars for this article and certain banner ads. This compensation is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. Gains mentioned in our newsletter and on our website may be based on end-of- day or intraday data. We have been compensated by Carl Data to conduct investor awareness advertising and marketing for (CSE:CRL; OTC:CDTAF). Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the company. The third party, profiled company, or their affiliates may liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our communications and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing The Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

RISK OF INVESTING. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

All trades, patterns, charts, systems, etc., discussed in this message and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author and do not necessarily reflect those of the publisher.