The world has a pot problem.

Quite simply: there isn’t enough of it, legal and accessible, to meet the tidal wave of demand that is about to sweep across North America.

After the campaign promises of Prime Minister Justin Trudeau, the Canadian government is poised to fully legalize and regulate cannabis next year, permitting adult recreational use. California, the largest pot market in the United States, is expected to follow suit.

Countries throughout the world are embracing cannabis as a legal form of recreation, similar to alcohol and tobacco. The global pot market could be as big as $31.4 billion by 2021, with the United States’s market share shrinking from 90 percent to only 57 percent.

Investors looking for a cannabis score could soon need to look outside the United States. Plus, they need to be conscious of how supply limitations and a rapid increase in demand in Canada next year could create opportunities.

Right now licensed producers in Canada only provide about five percent of the potential recreational demand, serving a medical marijuana patient base of 200,000 people. But with legalization next year, Canada is expected to add to that base millions of recreational consumers. In addition, the number of medical marijuana patients has already tripled in the last year and continues to grow seven percent month over month.

With full legalization in place, Deloitte estimates the total economic impact could be $22.6 billion annually, more than the combined sales of beer, wine and spirits. And Canadians will be able to order pot to their very door, allowing for easy consumption on a scale never before imagined.

One company that is well positioned to take advantage of those opportunities is Cannabis Wheaton Income Corp. (TSX-V:CBW; OTC: CBWTF) the world’s first “streaming cannabis company.”

Cannabis Wheaton is teaming up with producers and distributors, and is even getting in on the action itself by acquiring its own licensed producer.

The company is prepared to do it all, providing capital to licensed producers of cannabis for their facility buildouts and facility expansions in exchange for a royalty stream of cannabis production and a minority equity interest.

Canada may be on the cusp of a cannabis revolution. Here are five reasons why investors should be watching Cannabis Wheaton (TSX-V:CBW; OTC: CBWTF) very closely.

#1 Unique Streaming Approach

Cannabis Wheaton is driven by a unique business model: taking a leaf out of Netflix’s book, it is the first company to propose “cannabis streaming”, bank-rolling the growth plans of licensed producers, a business model commonly found in the mining sector.

Cannabis Wheaton actually took its name from Silver Wheaton, a large and well-known mining firm.

Here’s how it works. Cannabis Wheaton partners with licensed producers looking to scale up quickly to meet increased demand. In exchange for its services, Cannabis Wheaton receives a small portion of equity in the producer and royalties as a percentage of product produced, to distribute or sell to other partners or through its own distribution channels.

The company already has partnerships with 39 clinics, with access to over 30,000 registered medical marijuana patients. Partnership agreements have been signed with 17 facilities across six Canadian provinces for cannabis production, with a combined 1.4 million effective square feet of growing space.

Its flexibility should allow it to partner quickly with new firms looking to get in on the action and access both the expertise of Cannabis Wheaton’s management team as well as non-dilutive accretive capital. And Cannabis Wheaton’s royalty-based business model is designed to allow it to earn immediately from profitable relationships.

Cannabis Wheaton’s diversified position, with interests in numerous operations, means it hasn’t placed all its eggs in one basket: if one crop fails, Cannabis Wheaton can turn to another producer without breaking a sweat.

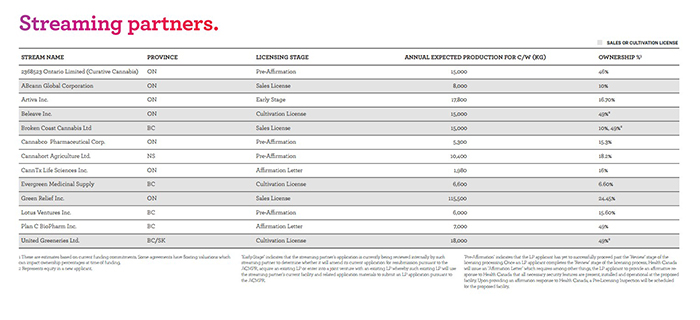

Cannabis Wheaton is building a pan-Canadian network of streaming partners, forming connections between producers and distributors and bringing the young industry together, just as it prepares for a potential revolutionary expansion. Check out its streaming partners below:

With legalization on the horizon, lots of new companies are eager to take advantage of this potential $8 billion market. Cannabis Wheaton is a step ahead, launching its “Wheaton Licensing Program,” which assists applicants wishing to become Licensed Producers with knowledge of the market.

With legalization on the horizon, lots of new companies are eager to take advantage of this potential $8 billion market. Cannabis Wheaton is a step ahead, launching its “Wheaton Licensing Program,” which assists applicants wishing to become Licensed Producers with knowledge of the market.

Think of it as an “incubator” or “accelerator” for potential cannabis producers and distributors, a program that will help Cannabis Wheaton grow its profile and curate future streaming partners.

So, as the industry grows, Cannabis Wheaton aims to be at the center of it all, connecting distributors to producers, supplying capital where it’s most needed, and nurturing new firms through its incubator.

#2 Rapid Scaling Upwards

The rapidly improving environment for cannabis companies in Canada, along with the fact that no other major industrial nation has come so far in legalizing and regulating cannabis, means that Canadian companies like Cannabis Wheaton are poised to become the new cannabis “multi-nationals.”

Investment from the United States, where cannabis remains federally illegal, may soon pour in to meet the growing demand from Canada’s 36 million people. If markets open up in other industrialized countries, the global cannabis market could expand exponentially.

Only a few companies have access to enough funding to meet such demand.

Cannabis Wheaton (TSX-V:CBW; OTC: CBWTF), thanks to its innovative streaming structure, can raise the capital and, via its streaming partners, produce the product necessary to meet surging demand, in Canada and elsewhere. It’s already begun to rapidly expand its profile, in anticipation of Canada’s expected nation-wide legalization and regulation of cannabis.

What Netflix is to movies and TV series, Cannabis Wheaton could be to pot.

Last month, the company completed a private placement of convertible debenture units for $35 million, additional capital that it can pump into existing and new streaming agreements.

Cannabis Wheaton recently announced a $10 million debt financing deal with Beleave Inc., the parent company of a licensed producer, built around a novel debt instrument dubbed the Debt Obligation repayable in Product Equivalent, or “DOPE Note”.

The DOPE Note model allows Cannabis Wheaton to loan Beleave up to $10 million and receive repayment in cannabis, which can be sold by Beleave to its patients and/or customers or the company can sell on to other distributors. The first $5 million has already been advanced.

Along with its existing partnerships, Cannabis Wheaton has entered into a distribution alliance with a national independent pharmacy chain. The agreement is the first of its kind in Canada and will give Wheaton a 10-year exclusive relationship with several nation-wide pharmacies for medical cannabis distribution.

The company also has a deal, subject the changing regulations, with a convenience store chain that has over 350 stores, giving it a 10-year exclusive right to supply cannabis.

Finally, on November 1, Cannabis Wheaton secured a landmark acquisition: a licensed producer, RockGarden. The acquisition gave Cannabis Wheaton the ability to legally possess cannabis obtained from its streaming partners and sell it directly through its own distribution channels.

Cannabis Wheaton wants to be on the forefront of the next phase in cannabis distribution: online orders that are shipped directly to consumers, cutting out dispensaries. Once online ordering is streamlined, it could generate even more demand from consumers looking for convenience.

Cannabis Wheaton is expanding its profile rapidly. And with over $35 million in the bank, its resources and attractive streaming model should allow it to continue that expansion.

#3 Management Expertise

Cannabis Wheaton (TSX-V:CBW; OTC: CBWTF) has a strong team at the helm, an experienced group of cannabis experts with enough market savvy to take full advantage of Canada’s changing regulations.

CEO Chuck Rifici is a well-known figure in the cannabis industry, the co-founder of Canada’s largest government-sanctioned marijuana producer, Canopy Growth Corp., and the man who took it public in April 2014. Canopy has a $3.7 billion market cap and is the largest public cannabis company in the world.

A pioneer of the legal pot trade, Rifici has also sat on the board of a number of industry standouts, including Supreme Pharmaceuticals Inc. (FIRE), CannaRoyalty Corp. (CRZ) and Aurora Cannabis Inc. (ACB).

Rifici has the political connections to make it in the world of pot, still an industry in need of strong government support. He is the former chief financial officer of the Liberal party, and the company’s strategic advisor Rick Dykstra is a former Conservative Member of Parliament and current party president.

Cannabis Wheaton is well positioned to navigate the regulatory environment. Rifici and Dykstra can count on legal support from industry expert Hugo Alves, a former partner at Bennett Jones LLP, founder of the firm’s Cannabis Group and another industry pioneer and now President and Director of Cannabis Wheaton.

Alves has advised 12 of the leading licensed producers, as well as 50 ancillary cannabis businesses. Possibly no one in Canada knows more about the regulatory environment than him, and possibly no one could give better advice as to how to navigate the changing waters of the legal cannabis industry than him.

With this management team in place and its unique business model to back it up, Cannabis Wheaton is better positioned than any other firm to take full advantage of the coming cannabis boom.

#4 Upcoming Legislation and Looming Supply Shortages

Crucial to Cannabis Wheaton’s (TSX-V:CBW; OTC: CBWTF) rise is the changing legal environment in Canada, particularly the expected legislation that will effectively legalize recreational pot use throughout the country.

The Liberal government of Prime Minister Justin Trudeau has made legalizing pot a major part of its platform.

Trudeau said in his election campaign in 2015 that he hoped to legalize marijuana, and his government appears on track to deliver on that promise.

Announcing the legislation in March 2017, Trudeau’s government plans to pass the law by Canada Day 2018. In November, the proposed Cannabis Act was passed by the lower house of the Canadian Parliament and is now with the Senate. The Cannabis Act permits the personal use of cannabis for recreational purposes and imposes a strict regulatory regime for licensed cannabis operators.

It is expected that the law will be changed by mid-2018, opening up all of Canada to legalized cannabis. That means demand is expected to spike, big time.

And right now, cannabis producers are in a tight spot. Canada right now has 80 licensed producers with a small number being authorized to sell cannabis, who grow about 31,000 kg of pot, a mere 5 percent of potential demand once pot is legalized.

The most recent data by Marihuana Policy Group asserts that demand for recreational cannabis in Canada will be much stronger than expected and that Canadian demand could exceed 900,000 kgs next year.

Production, distribution, marketing: it’s all in need of rapid expansion.

And Cannabis Wheaton, thanks to its streaming model, access to capital and market expertise, is well positioned to exploit the need for future expansion.

According to Alves, “There is a segment of the marketplace where people are trying to get their facilities built and they don’t have access to capital at all.” Wheaton can meet that need by quickly funneling capital to firms that need it.

Plus, its partnerships with both distributors and producers make it a well-positioned middleman to connect firms, form more lucrative relationships and facilitate the growth of supply where it’s most needed.

#5 Massive Opportunity in Recreational Use

Up until now, the story in cannabis has been the medical marijuana market: with pot still criminalized in most industrial countries, players and investors have had to pick their battles, finding openings in the regulatory spider-web in order to squeeze out revenue.

That’s could be all about to change.

The expected legalization and regulations of recreational pot use in Canada is the first major step. Next year, it could become possible for licensed producers to reach millions of new customers.

When the Trudeau government first showed serious signs that it intended to pass legislation earlier this year, investment in cannabis surged. Now there’s a second surge coming, one that investors should be ready for.

Cannabis Wheaton (TSX-V:CBW; OTC: CBWTF) has taken advantage of the excitement to scale up its activities. It has partnerships with a pharmacy chain and a convenience store chain, and is preparing the way for online ordering.

The company launched a new media blitz, hosting a networking event at the Las Vegas MJBizCon 2017 Cannabis Conference.

Cannabis Wheaton won Start-Up of the Year Award at the 2017 Canadian Cannabis Awards, while CEO Chuck Rifici also won Innovator of the Year award at the same gala.

The company’s profile is rising, fast.

The possibilities are huge. The market for recreational cannabis could be $8 billion, and that’s just Canada. Cannabis Wheaton could become a future cannabis “multi-national,” serving firms throughout the world.

The state of California, one of the largest cannabis markets in the world, is expected to begin selling recreational pot next year. By some estimates, the legal cannabis market in North America could be $24.5 billion by 2021.

While federal law in the United States may take some time to change, you can be sure that Germany, Ireland, France, the United Kingdom, Brazil, and a host of other countries will take notice and may also join the cannabis craze.

Where there’s smoke, there’s fire. And Cannabis Wheaton (TSX-V:CBW; OTC: CBWTF) is a company which could become red hot in the months to come. If investors want to get in on the action, they need to move. Now.

Other companies to watch closely in the space:

Glance Technologies, Inc (CSE:GET) This company’s GlancePay is at the forefront of the mobile payment revolution, with a clear competitive advantage. It’s already the no. 1 mobile payment app in Canada, ranking in the top 92 percent of app downloads. It’s also making big waves across North America, where it ranks 37th of all mobile payment app downloads.

And this could be even bigger because GlancePay is also making inroads in the billion-dollar cannabis in a deal that gives them direct ownership in Canapay Financial Inc.

Mobile payment technology is one of the fastest-growing markets in the world, and GlancePay is hoping to be the major market disrupter—filling a gap that not even the trillion-dollar Chinese turnover is filling, or major players on the North American scene.

Aurora Cannabis Inc (TSX:ACB) which is a producer and distributer of medical marijuana across Canada. The company, formally Prescient Mining Corp, is a Vancouver-based business founded a little over one decade ago. Aurora’s main objective is to bring medicine to the people reliably and economically, which sets it aside from many of its major competitors. In the marijuana industry, patients will often have to jump through hoops to procure their medication, but with Aurora’s caring and knowledgeable staff, patients no longer have to worry.

One of the most appealing things for patients ordering medications from Aurora is the company’s delivery method. This marijuana major sells marijuana by phone and over the internet and then it is delivered straight to the patient’s door.

Aurora is a major player in Canada’s cannabis scene. With a $1-billion market cap and solid growth, savvy investors are watching this stock like hawks.

Emerald Health Therapeutics Inc (TSXV:EMH) is another producer and distributer of medical marijuana. Based in British Columbia, Emerald Health is fully licensed by Access to Cannabis for Medical Purposes Regulations (ACMPR) and provides high quality medicine of different varieties. The company’s approach to research is what really sets the company apart from the competition. With the incredible emphasis placed on isolating the most important qualities in each strain and creating new products for patients, it is no wonder their medicine is so popular.

Additionally, Emerald Health has an incredibly talented administration. With over 30 years in the life sciences field, CEO Dr. Bin Huang is leading the company to greatness.

Because the company focuses on quality, both in their leadership positions and in their products, investors can feel comfortable taking the leap into this budding enterprise.

Cronos Group Inc (TSXV:MJN) is another Toronto-based cannabis company with a lot of ambition. The company has prioritized its production acquisitions in order to provide geographically diverse products. Loaded with values, this company is comprised of passionate and focused employees.

One of the primary objectives of Cronos Group is to destigmatize the medical use of marijuana and bring medicine to those who need it. Cronos Group has made it their priority to lead as an example for the industry, and provide the best care possible to the community.

For investors, Cronos Group is especially appealing due to their core and strategic assets. Their portfolio is sure to impress, and will assuredly continue to grow in time.

Hydropothecary Corp (TSXV:THCX) is a another heavy hitter in Canada’s cannabis scene. With former BC Health Minister Dr. Terry Lake as the VP of Corporate Social Responsibility, and the well-versed Ed Chaplin, who has raised millions for his previous ventures, as the Chief Financial Officer, the company is sure to have a bright future ahead.

With 4 primary products, including Canada’s only peppermint flavored medical cannabis oil sublingual mist, Hydropothecary has chosen quality over quantity. Offering patients the ability to administer their medication in a smoke-free format provides users with an option that is not available just anywhere.

Keep an eye on this stock moving forward as it may just have what it takes to take the industry by storm come June 2018.

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

FORWARD-LOOKING STATEMENT. Statements in this communication which are not purely historical are forward-looking statements and include statements regarding beliefs, plans, intent, predictions or other statements of future tense. Forward looking statements in this article include: that the Canadian government will fully legalize and regulate cannabis next year; that the global pot market could grow to $31.4 billion by 2021; that Canada is expected to add to its medical marijuana patient base millions of recreational consumers; that the effect of full legalization could be a total economic impact of $22.6 billion annually; that Cannabis Wheaton Income Corp.’s (“Cannabis Wheaton”) flexibility should allow it to partner quickly with new firms looking to get in on the action and access the expertise of Cannabis Wheaton’s management team and non-dilutive capital; that there will likely be a supply shortage if Cannabis is legalized in Canada; that, if cannabis markets open up in other industrialized countries, the global cannabis market could expand exponentially; that producers will need to obtain additional financing from companies like Cannabis Wheaton; Canadian recreational users of cannabis will consume 900,000 kg per year, for a market of $6 billion; that Cannabis Wheaton could become a future cannabis “multi-national”; and that the legal cannabis market in North America could reach $24.5 billion by 2021. Forward-looking information is based on the opinions and estimates of Cannabis Wheaton at the date the information is made, and is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Forward looking statements involve known and unknown risks and uncertainties which may not prove to be accurate. Actual results and outcomes may differ materially from what is expressed or forecasted in these forward-looking statements. Matters that may affect the outcome of these forward looking statements include: that Cannabis may not be legalized on the same timeline as expected or at all; that markets may not materialize as expected; that cannabis may not turn out to have as large a market as thought or be as lucrative as thought as a result of competition or other factors; that Cannabis Wheaton may not be as able to diversify or scale up as thought because of potential lack of capital, lack of facilities, regulatory compliance requirements in Canada or outside of Canada or lack of suitable employees or contacts; that Cannabis Wheaton may be less flexible than anticipated; that partners of Cannabis Wheaton may not be granted licenses or additional capacity under existing licenses for them to grow for the cannabis market; that foreign governments may not allow Cannabis Wheaton to operate in their countries; that actual operating performance of the facilities affiliated with Cannabis Wheaton do not meet expectations; that competition quickly develops; that Cannabis Wheaton can retain key employees and contacts; and other risks affecting the Company in particular and the cannabis industry generally. The forward-looking statements in this document are made as of the date hereof and the Company disclaims any intent or obligation to update such forward-looking statements except as required by applicable securities laws.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Safehaven.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively, “we” or the “Company”) has been paid by the profiled company or a third party to disseminate this communication. In this case the Company has been paid by Cannabis Wheaton ninety thousand US dollars for this article and certain banner ads. This compensation is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. Gains mentioned in our newsletter and on our website may be based on end-of- day or intraday data. If we own any shares we will list the information relevant to the stock and number of shares here. We have been compensated by Cannabis Wheaton to conduct investor awareness advertising and marketing for [TSX-V:CBW and OTC: CBWTF]. Safehaven.com receives financial compensation to promote public companies. This compensation is a major conflict of interest in our ability to be unbiased. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the company. The third party, profiled company, or their affiliates may liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non- compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor awareness efforts. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price is likely to occur. Our emails may contain forward looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our communications and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, The Company often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications.

DISCLOSURE. The Company does not make any guarantee or warranty about what is advertised above. The Company is not affiliated with, any specific security. While the Company will not engage in front-running or trading against its own recommendations, The Company and its managers and employees reserve the right to hold possession in certain securities featured in its communications. Such positions will be disclosed AND we will not purchase or sell the security for at least two (2) market days after publication.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing The Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LEGAL ADVISORY. Investing in companies associated with the cannabis industry may be illegal in the jurisdiction where a reader resides. Before investing in any public company involved in the cannabis industry, potential investors should check with their legal advisor as to whether an investment will breach local law.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR- OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

All trades, patterns, charts, systems, etc., discussed in this message and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author and do not necessarily reflect those of the publisher. No system or methodology has ever been developed that can guarantee profits or ensure freedom from losses. No representation or implication is being made that using the methodology or system will generate profits or ensure freedom from losses. The testimonials and examples used herein are exceptional results, which do not apply to the average member, and are not intended to represent or guarantee that anyone will achieve the same or similar results.

AFFILIATES. Some or all of the content provided in this communication may be provided by an affiliate of The Company. Content provided by an affiliate may not be reviewed by the editorial staff member. Our affiliates may have their own disclosure policies that may differ from The Company’s policy.