There’s a revolution coming. A green revolution.

Next year, Canada will become the first major industrialized nation to fully de-criminalize cannabis, legalizing it for recreational use.

California, the world’s biggest single market for cannabis products, will also be passing legalization legislation, though the United States is likely to keep its federal pot laws unchanged.

This is huge news. The market for cannabis in Canada could be as large as $8 billion. The U.S. market could reach $25 billion by 2020, and even this figure could be an understatement if recreational use takes off—demand could drive investment as high as $50 billion by 2026.

These are impressive numbers, but one number that is often forgotten about is existing supply: in Canada, current production can meet only 5 percent of overall demand for a medical marijuana community of roughly 200,000 people. When legalization happens, the market could be in desperate need of new investment.

That means big opportunities for companies ready to get in on the action. Cannabis is still a very young industry, with few established firms and a lot of room for new growth. There’s also room for innovation, the application of new technology and new methods that tie producers to distributors and investors to firms in need of a shot in the arm.

It’s a major bull market, a “Green Gold Rush,” and it’s coming sooner than you think.

Here are five companies poised to meet the demands of the new green revolution:

#1 Scotts Miracle-Gro (NYSE:SMG)

To meet rapidly-rising demand, the cannabis industry is going to need strong support from “pick and shovel” companies like Scotts Miracle-Gro (SMG). The company markets tons of useful products, ranging from grass seeds to pest deterrents, weed killers and other chemicals.

SMG is also building a strong line of hydroponic growing equipment, perfect for cannabis cultivation.

Hydroponics is the art of growing plants without soil. A subsidiary of SMG, Hawthorne Gardening Company, has a special division that focuses on hydroponics—for now, it makes up 10 percent of their total sales.

Year-on-year, the hydroponics market has grown 20 percent, as methods become more sophisticated and technology grows more available.

SMG is well-positioned to supply the tools, the know-how and the methods for cannabis growers to rapidly increase output. With a market cap of $5.52 billion, SMG benefits from strong name recognition, experience and customer loyalty.

You can be sure this firm will profit from the green revolution.

#2 Cannabis Wheaton (TSX-V:CBW; OTC: CBWTF)

What Silver Wheaton does for mining, or Netflix for videos, Cannabis Wheaton will do for pot: the company is poised to become the first “streaming cannabis” firm out there.

The metrics driving Cannabis Wheaton’s business model include the vast gulf between supply and demand that is about to hit the cannabis sector, particularly in Canada where full legalization for recreational use is about to send demand through the roof.

Cannabis Wheaton intends to connect distributors and producers through its unique “streaming cannabis” platform, allowing firms access to capital and markets so they can grow their business, while Cannabis Wheaton collects royalties in money or pot, the latter of which it can distribute through its own licensed producer.

The model removes the risks of putting all your eggs in one basket, since Cannabis Wheaton invests in multiple producers and distributors: if one firm fails, or a crop goes bad, Cannabis Wheaton can shift its attentions elsewhere.

The company has strong political support and is better positioned than any other firm to meet the demands of a growing cannabis sector.

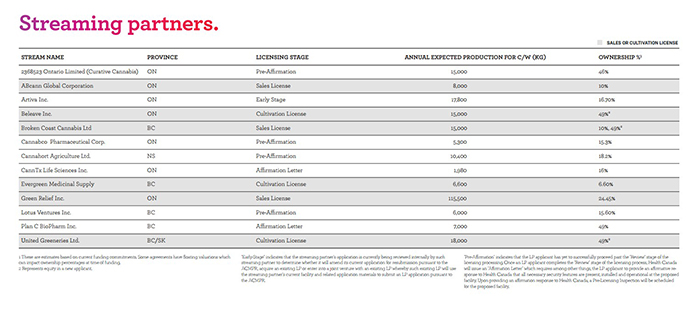

Cannabis Wheaton already has 15 partners with 17 production facilities totaling a potential 1.4 million effective square feet of growing space. In return for providing the capital to help producers build or expand their cannabis cultivation facilities and access to the Cannabis Wheaton platform, , the company gets a minority equity interest and a royalty paid in pot.

Right now, the company has focused on capturing as much of the medical marijuana community as it can before recreational legalization next year. Cannabis Wheaton has partnered with 39 clinics, with access to 30,000 registered medical marijuana patients.

Through partnering with potential distributors and producers, Cannabis Wheaton can reduce its exposure to risk and capitalize on growing demand quickly. Furthermore, through its streaming services, Cannabis Wheaton can radically increase the capacity of pot growers to meet demand, thereby growing the market.

Through partnering with potential distributors and producers, Cannabis Wheaton can reduce its exposure to risk and capitalize on growing demand quickly. Furthermore, through its streaming services, Cannabis Wheaton can radically increase the capacity of pot growers to meet demand, thereby growing the market.

A series of recent catalysts illustrate the company’s strategy. Cannabis Wheaton purchased a $15 million share in ABcann Global Corporation, which forms part of a larger investment into ABcann that when complete will allow ABcann to increase its growing acreage by 50,000 square feet. Another $15 million purchase of ABcann shares is scheduled for next year, with half of the production revenues of such 50,000 square foot expansion going to CBW.

In anticipation of next year’s legalization, Cannabis Wheaton has formed partnerships with a convenience store chain and an independent pharmacy chain, putting it in a position to potentially supply pot directly to distributors well-suited to meet recreational demand.

In November, it acquired RockGarden, a licensed producer. This gives Cannabis Wheaton the ability to retain the cannabis it gets from its streaming deals and furthers the company’s streaming platform strategy by providing additional resources and regulatory tools to help accelerate its current and future streaming partners.

More pot will be coming in thanks to the company’s novel debt financing arrangement with Beleave which the company has nameda “Debt Obligation repayable in Product Equivalent”, or DOPE Note, whereby Cannabis Wheaton will provide up to $10 millon in debt financing and be repaid solely in pot.

So, with its unique business model and its superb position, Cannabis Wheaton should be taking the Canadian pot world by storm. This is definitely one to watch.

#3 Pfizer (NYSE:PFE)

This huge drug maker is offering big dividends to investors and looks set to grow in the next few quarters, a welcome change following a rough patch.

Pfizer’s two divisions, innovative health and essential health, generated $52.8 billion in revenue last year. The company’s net income is $7.2 billion, and operating cash flow nearly $16 billion.

It goes without saying that Pfizer, one of the largest companies in pharmaceuticals, has some big money behind it. Yet its standard products face declining sales. New products are looking a lot more promising, and growth from innovative cancer and auto-immune drugs will fuel future growth.

Debt-to-equity ratio wasn’t great, but that’s mostly due to Pfizer’s buying spree: it’s recently acquired Anacor Pharmaceuticals, Hospira and Medivation.

That’s put it in the red, but the revenues generated from these new acquisitions should put Pfizer back on top.

What is sure to get investors’ attention is a new company, Allergan (NYSE: AGN), which has a brilliant new drug on the market: Restatis, a dry-eye disease drug, for which Allergan has exclusive marketing rights. The rumors now point to a forthcoming acquisition of Allergan by Pfizer, a deal which could further strengthen the company’s bottom line.

Pfizer tried to take on Allergan last year but dropped the merger in the face of federal objections. Now, the deal looks like it might be back on the table.

A merger between Pfizer and Allergan could be a further shot in the arm for the pharma firm.

#4 Canopy Growth Corp. (TSX:WEED)

With a market cap of CAD$1.6 billion and a reputation as Canada’s first “cannabis unicorn,” Canopy Growth Corp. looks set to lengthen its bull run.

The company is a diversified cannabis firm, with a number of brands, curated strains and half a million square feet of indoor and greenhouse production space. It has partnerships with the leading names in cannabis, including Tweed, Spectrum Cannabis and Bedrocan.

Canopy is getting set to meet the challenges of Canada’s legalization next year. Shares in the firm jumped in March 2017 when the Canadian government signaled it was about to start pushing its bill for full legalization in 2018.

In the last year, Canopy’s stock has grown by a jaw-dropping 386 percent, pushing it past $1 billion market cap into “unicorn” territory.

It’s just announced new licensed facilities with expanded growing potential. It’s going to be the first company to be brought on to the S&P/TSX Composite Index.

In December, Canopy won a retail supply agreement for Newfoundland and Labrador. The deal also has Canopy setting up a new production facility to supply 12,000 kg per year, bringing 145 jobs to the area.

Canopy’s success has attracted the attention of investors like Constellation Brands, the company that owns the Corona beer brand. The firm plans to buy a 9.9 percent stake in Canopy, and Constellation’s CEO has predicted that full legalization in the US is sure to follow the new law in Canada.

With such strong support, Canopy is sure to grow further in 2018 and beyond.

#5 Sanofi (NYSE:NYS)

Some firms in big pharma are playing the long game when it comes to cannabis—letting the small caps spend money on development and clinical trials, then swooping in to acquire them once they strike gold.

The legalization in Canada will create big opportunities, with demand set to exceed supply by an enormous margin. That means that companies with lots of money to burn will be well-positioned to enter the market, buying up smaller firms and entering the cannabis trade without taking on too much risk.

French pharma firm Sanofi is one such company. With a market cap of $123.99 billion market cap, this titan has no need to gamble on short-term investments, and can afford to wait out the changing cannabis market and dive in once the waters look safe for swimming.

Since its IPO in July 2022, Sanofi’s performance has been 8.41 percent. It’s biggest growth has come from the drug Dupixent, an anti-eczema drug which is expected to reach US sales of $4.3 billion by 2022. After winning FDA approval in March 2017, Dupixent is set to take the US market by storm.

Another drug, dupilumab for treating severe asthma, should also prove a winner for Sanofi, which recently released data for the first round of clinical trials. The drug, which is essentially the same as Dupixent but directed at different ailments, will enter a billion-dollar market and challenge rival GlaxoSmithKline.

So, with two new drugs about to come on the market and a mountain of cash at its disposal, Sanofi is a firm that will be well-positioned to meet new demand.

And like other big pharma companies, it will be tempted to throw its hat into the cannabis ring.

Other companies to watch:

Cronos Group Inc (TSXV:MJN) is another Toronto-based cannabis company with a lot of ambition. The company has prioritized its production acquisitions in order to provide geographically diverse products. Loaded with values, this company is comprised of passionate and focused employees. One of the primary objectives of Cronos Group is to destigmatize the medical use of marijuana and bring medicine to those who need it. Cronos Group has made it their priority to lead as an example for the industry, and provide the best care possible to the community.

Supreme Pharmaceuticals Inc (TSXV:FIRE): Supreme Pharmaceuticals Inc is engaged in production and sale of medical marijuana. The company is a cultivator and distributor of sun-grown cannabis through its wholly-owned subsidiary 7ACRES. The Company is focused on the wholesale sector of the medical cannabis market in Canada and operates an approximately 342,000 square foot greenhouse facility located in Kincardine, Ontario.

Supreme had its license term extended for an additional two years and license now permits the company to store up to $150 million of cannabis products at any given time. The company is expected to produce 10,000 grams of cannabis in 2017 with an estimated value of $35 million.

MedReleaf Corp (TSX:LEAF): As a licensed producer of cannabis-based pharmaceutical products, MedReleaf Corp has a head start on the coming boom in Canada. Early July has seen a bounce in the stock price, and investors may look to ride it upward from here. Med Releaf could become Canada’s second biggest medical marijuana company after Canopy Growth Cooperation as many analysts expect the ‘legal weed’ industry to grow 25% on an annual basis over the next 10 years.

MedReleaf has seen its share price fall since June, but has steadied out in recent months and could be poised for gains as the expected legalization of recreational marijuana materializes.

Aphria Inc (TSX:APH): Aphria Inc is engaged in the production and selling of medicinal marijuana, and while the stock has trended downward since April, the constant profits here suggest there is a lot of upside. The recent pro-marijuana legislation from the Canadian government is sure to boost companies with the reputation of Aphria Inc. Aphria’s $137 million expansion project is well underway to ramp up output to 70,000 kg. If Aphria successfully ramps up production, we believe its share price could go much.

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

FORWARD-LOOKING STATEMENT. Statements in this communication which are not purely historical are forward-looking statements and include statements regarding beliefs, plans, intent, predictions or other statements of future tense. Forward looking statements in this article include that new cannabis legalizing legislation will create an $8-billion-dollar industry; that there will likely be a supply shortage; that this industry will be $25 billion annually in the US; that Cannabis Wheaton’s business model reduces risk for investors; the ability to generate revenue or take production through the streaming agreements. Forward-looking information is based on the opinions and estimates of Cannabis Wheaton at the date the information is made, and is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Forward looking statements involve known and unknown risks and uncertainties which may not prove to be accurate. Actual results and outcomes may differ materially from what is expressed or forecasted in these forward-looking statements. Matters that may affect the outcome of these forward looking statements include that markets may not materialize as expected; marijuana may not turn out to have as large a market as thought or be as lucrative as thought as a result of competition or other factors; Cannabis Wheaton may not be able to diversify or scale up as thought because of potential lack of capital, lack of facilities, regulatory compliance requirements in Canada or outside of Canada or lack of suitable employees or contacts; partners of Cannabis Wheaton may not be granted licenses or additional capacity under existing licenses for them to grow for the cannabis market; and other risks affecting Cannabis Wheaton in particular and the cannabis industry generally. The forward-looking statements in this document are made as of the date hereof and the Company disclaims any intent or obligation to update such forward-looking statements except as required by applicable securities laws.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Safehaven.com, and their owners, managers, employees, and assigns (collectively “the Company”) has been paid by the profiled company or a third party to disseminate this communication. In this case the Company has been paid by Cannabis Wheaton ninety thousand US dollars for this article and certain banner ads. This compensation is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. Gains mentioned in our newsletter and on our website may be based on end-of- day or intraday data. If we own any shares we will list the information relevant to the stock and number of shares here. We have been compensated by Cannabis Wheaton Income Corp. to conduct public awareness advertising and marketing for [TSX:CBW.V]. Safehaven.com receives financial compensation to promote public companies. This compensation is a major conflict of interest in our ability to be unbiased. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the company. The third party, profiled company, or their affiliates may liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non- compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated public awareness efforts. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of public awareness marketing, which often end as soon as the public awareness marketing ceases. The public awareness marketing may be as brief as one day, after which a large decrease in volume and share price is likely to occur. Our emails may contain forward looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our communications and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, The Company often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing The Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LEGAL ADVISORY. Investing in companies associated with the cannabis industry may be illegal in the jurisdiction where a reader resides. Before investing in any public company involved in the cannabis industry, potential investors should check with their legal advisor as to whether an investment will breach local law.