Cannabinoid infused foods and beverages are coming to the federally legal cannabis market in Canada.

Amendments to Bill C-45 announced in October 2017 will allow cannabinoid infused edibles and beverages to be federally legal in Canada for the first time. This historic news provided a huge boost to a booming sector and major players like; Aurora Cannabis (TSX: ACB) (OTC: ACBFF), Canopy Growth Inc. (TSX: WEED) (OTC: TWMJF) and Liberty Health Sciences (CSE: LHS) (OTC: LHSIF).

Legalization of edibles in Canada came on the heels of a game-changing deal involving Canopy Growth and beverage giant Constellation Brands—owners of iconic beers brands Corona and Modelo—who purchased a 9.9% equity stake of Canopy, paving the way and validating the infused products category. It marks the first time a blue chip has crossed over into the now global cannabis market - and as many expected - it came from big alcohol.

Most analysts see the deal as a defensive move, as the global cannabis industry poses the largest threat to big alcohol’s monopoly on legal recreational products. The trend is a global one. Young people are drinking alcohol less frequently that their elders.

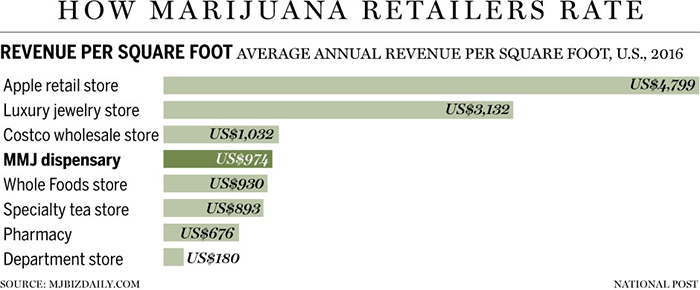

Big pharma and tobacco are also set to crossover, as M&A within the global cannabis market makes the first big splash. US consumer attitudes are also favoring the legal cannabis retail market. MJBIZ Daily reported that the average annual revenue per square foot in 2016 for Medicinal Marijuana dispensaries ranked #4 at US$974 per square foot, behind #1 ranked Apple retail at US$4,799.

Strides in the capital markets have already been made by only a few Canadian listed companies. Isodiol International Inc (CSE: ISOL), already at a $350 million market capitalization Nutritional High (CSE:EAT), Phivida Holdings Inc (CSE:VIDA) and Tinley Beverage Company Inc (CSE:TNY) are among the ones to watch in the space. In recent news, Isodiol acquired Canadian National Pharma Group Inc. (CN Pharma), a pharmaceutical manufacturing company, to develop, process and manufacture its products in Canada.

Through another recent agreement. The Tinley Beverage Company Inc. (CSE: TNY) of Toronto announced that its hemp extract drinks are now available in stores in Southern California, including several of the state’s leading premium grocery chains. By February, Tinley was trading at a $88 million market cap. Nutritional High, a maker of infused hemp oil edibles that is establishing operations in Washington and Oregon, (CSE: EAT) has also seen double digit growth on these developments, trading above a $50 million valuation.

Vancouver-based Phivida (VIDA:CSE) recently launched its IPO and has seen the market receive them very well, attracting and the brain trust behind the wildly successful Red Bull Canada brand with the addition of former Red Bull President, James Bailey. Originally on the board of Phivida, Jim has assumed the roll of CEO bringing decades of experience in the beverage and CPG industry. Bailey has brought his former CMO Michael Cornwell to the company as well creating a powerhouse food and beverage team of executives to replicate their success in this industry.

Notably the company’s chair of its advisory is John D. Silverman, former CEO of Seagram's International Division and former EVP and COO, Grupo Empresarial Bavaria and strategic advisor for John Labatt’s.

Phivida launched on the Canadian Securities Exchange as “VIDA” and has seen it’s stock trade as high as $2.20, settling this week with some recent market activity.

In major announcement Phivida is now partnering with a leading LP here in Canada with their partnership with WeedMD (WMD:TSXV) to build the first ever federally legal cannabis consumer products and cannabinoid infused beverage manufacturing facility in the history of the industry.

This blockbuster news comes just a week after Phivida announced the appointment of its new CEO, on James Bailey the former President of Red Bull Canada and former senior executive at Adidas, Merrell and Salomon. Jim joins Phivida to lead the new senior executive which include recent hire Mike Cornwell, former Marketing Director at Red Bull Canada and CMO of Samsung NZ and Microsoft NZ. An impressive team.

The company has an assertive global expansion plan to dominate the world wide CBD sector. Phivida is competing for a leadership share in; five channels, four segments, and in four key states in the US market as well as an aggressive growth strategy for Canada. Already it has agreements with licensed partners in California, Oregon and Washington, a global online agreement with Namaste initially targeting the EU (specifically the UK and Germany) and Australia, and one in the Asia-Pacific with Japan-based Asayake.

Phivida is well cashed up with more than $10 million in the treasury –after an earlier than expected warrant conversion at $0.75 that immediately doubled its cash position and cleaned up its share structure–are ready to make further inroads in the market.

Clearly, the cannabis infused-beverage industry is already making huge strides into the mainstream, as shown with a mature edibles market in legalized states. There is a huge potential for infused beers, wines and other beverages through groups like Constellation, or health and wellness based - “functional” cannabinoid infused beverages, like CBD iced teas, juices and shakes from Phivida. And the given the early successes, the equities market are ripe for eating it all up.

Legal Disclaimer/Disclosure: Nothing in this publication should be considered as investment advice. Always consult a licensed financial advisor before making any investment decision. A fee was paid for the creation and distribution of this content and is neither an offer nor recommendation to buy or sell any security. The author(s) or 3rd parties may own shares in the mentioned securities, and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this content as the basis for any investment decision. While all information is believed to be reliable, it is not guaranteed by us to be accurate. Baystreet.ca has been compensated six thousand dollars for its efforts in distributing the Phivida Holdings Inc. article. Individuals should verify all information contained in this article with their own independent research and consultation with a registered investment advisor. Always be extremely careful investing in securities which carry a high degree of risk; you may likely lose some or all of your investment.