Blockchain could be about to revolutionize the energy industry. Jerry Bailey, former President of Exxon operations in the Arabian Gulf explains,

“The Blockchain holds the promise of unlocking billions of dollars in profits for the Energy Industry by reducing the friction inherent in the business processes we need to control.

Few people outside of the energy industry understand the complexity of the transactions involved in getting crude oil from the ground to your car.

There is no such thing as a “simple transaction” in oil & gas. Even the smallest producers are managing...

- Land lease agreements

- Royalty agreements

- Taxes

- Revenue shares

- Profit shares

- Shipping

- And many more.

Bailey, one of the leading tech minds in oil & gas today, sees the blockchain as the obvious solution to reducing the friction, fees, and costs in the complex ecosystem.

The resulting profits could be in the billions.

BP, Shell, Statoil and major commodity trading houses all seems to agree. They are all getting involved in blockchain solutions for the energy industry.

Today, Bailey is President & Director of Petroteq (TSX:PQE.V; OTCQX:PQEFF) a technology company that develops and monetizes tech in the oil & gas industry.

Petroteq is at the heart of blockchain use cases in oil & gas. They are aiming to create an oil & gas consortium to deliver a blockchain-based solution to manage transactions across the industry.

PetroBLOQ is the solution it is working to develop through First Bitcoin Capital Corp, (OTC: BITCIF).

The major problem PetroBLOQ tackles is the difficulties oil and gas companies encounter when putting together supply chains in constantly changing geopolitical conditions and shifting regulations.

Services to streamline such efforts cost a lot, and costs can multiply at times when prices are low. That really takes a bite out of profits. PetroBLOQ is being developed to allow companies retain to save many of those costs.

Geoffrey Cann, a Director at Deloitte specializing in the oil and gas industry, recently cited PetroBLOQ as a serious contender for becoming the blockchain solution in the energy arena.

Why? Because with PetroBLOQ deals normally taking weeks to complete can be done in hours, or even minutes.

Even better, it’s more secure than the current processes. And cuts out expensive middle-men.

PetroBLOQ is an example of Petroteq’s (TSX:PQE.V; OTCQX:PQEFF) unique tech-first approach to the oil & gas market.

But it’s not the only one.

Nothing epitomizes Petroteq’s (TSX:PQE.V; OTCQX:PQEFF) tech-based approach to oil & gas more than their revolutionary oil sands process.

Bailey’s team could potentially unlock billions of barrels of oil in Utah, Colorado and Wyoming alone – for just $22/barrel!

Bailey’s team is not chasing after profits in traditional upstream, midstream or downstream sectors.

Instead the company focuses on developing bold new technological strategies for unlocking energy resources.

Like its breakthrough oil sands extraction process.

The U.S. Department of Energy reports the U.S. has the third most abundant oil sands in the world.

Just three states together could hold between 1.2 trillion to 1.8 trillion barrels of untapped oil.

So far, little has been done to develop this resource, mostly because up until now oil sands exploitation has been dirty and expensive. The tar sands of Canada, for instance, were so dirty and costly, most majors had to divest from the fields altogether after the last oil price crash.

But Petroteq’s (TSX:PQE.V; OTCQX:PQEFF) new tech is on track to change that. Petroteq bought the rights to exploit a huge oil sands deposit of an estimated 87 million boe in eastern Utah.

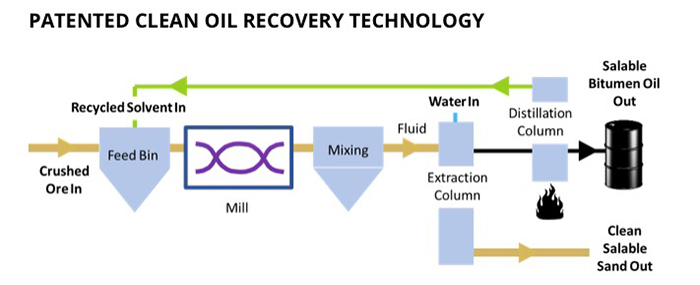

Their unique Liquid Extraction System unlocks oil sands deposits without producing a lot of excess waste. It’s a clean process.

Their first project in 2015 produced 10,000 barrels of oil – roughly 1 barrel per ton of sand.

Petroteq’s potential massive licensing opportunity.

The potential for mass application of Petroteq’s (TSX:PQE.V; OTCQX:PQEFF) new technology is vast. Canada alone has 100 billion boe of oil sands, and worldwide reserves are estimated at 500 billion boe.

Utah, Colorado and Wyoming together potentially hold about 1.2 trillion boe in oil sands and shale, worth a combined $72 trillion at current market prices.

Canada has $6 trillion worth of oil sands that could eventually benefit from safe, inexpensive exploitation through Petroteq’s new methods, although Canada’s oil sands are considered wet and the Petroteq technology works best on dry oil sands.

Petroteq’s cheap, environmentally friendly process could make it a top solution for tapping these vast oil sands resources.

The company is led by an experienced, proven, and connected management team.

The management at Petroteq (TSX:PQE.V; OTCQX:PQEFF) is a cut above the rest: they know the energy sector and the world of blockchain intimately.

CEO and Chairman Alexsander Blyumkin has invested millions in the business, including an interest-free loan for the production facility at Temple Mountain in Utah.

CTO Dr. Vladimir Podlipskiy is a 23-veteran of chemistry, manufacturing and R&D. He’s an expert on extraction, and has pioneered the company’s innovative solution for oil sands production. He’s already secured patents for a variety of different methods.

President Dr. R. Gerald Bailey, the former Exxon president of operations in the Arabian Gulf, is dedicated to environmental protection: he firmly believes in Petroteq’s mission to extract oil sands in a clean and affordable way.

This tiny company is situated to capitalize on two technologies capable of producing big changes in the industry.

Petroteq’s licensing program for their unique oil sands extraction process could help produce a lot of oil from oil sands that were thought to be too expensive and too dirty to unlock.

Combine that with their looking to develop cutting edge blockchain solution and we could be looking at the early stages of one of the great tech companies in energy today.

Now is the time for investors to review Petroteq (TSX:PQE.V; OTCQX:PQEFF) in detail to determine if it’s a company they want to add to their portfolio.

Other top picks transforming the energy sector:

Imperial Oil (TSX:IMO): Imperial oil could be one of the best contrarian bets in the oil markets for 2018, having missed its third quarter profit estimates and currently dealing with the resultant stock decline. It still has some of the lowest cost producing oil sands in Canada and that is going to pay off as oil prices continue to rise and new tech breakthroughs bring breakeven prices even lower.

As infrastructure becomes a target for hackers, oil companies are scrambling to secure their networks and find solutions to prevent losses in their supply line, and Imperial is certainly aware of this.

The management is well known for being conservative, but that certainly shouldn’t put investors off in a time when recovery is the buzzword of the day and consistency is sure to be rewarded.

Crescent Point Energy Corp. (TSX:CPG): CPG is particularly attractive for the dividend that investors can expect back, but it is also now worth looking at for returning value in the coming months.

The recent fall in stock price provides investors with a great entry point for a company with a positive outlook in a market that is set to grow. The collapse in price over the last year appears to have stopped, with some great growth in late October and early November. This oil and gas company provides exposure in both the Canadian and U.S. markets.

MEG Energy Corp (TSX:MEG): is a Canada-based oil producer which operates primarily in Northern Alberta’s oil sands. The forward-thinking company uses steam-assisted gravity drainage to retrieve oil from the deep wells which it drills. The excess heat and electricity produced from this process is then sold to Alberta’s power grid.

The company’s large proven resources and their cutting-edge technology make MEG a promising company for investors looking to get in to the promising oil sands in Alberta.

Tourmaline Oil Corp (TSX:TOU) is another Canadian resource producer focusing on exploration, production, development and acquisition within Western Canadian Sedimentary Basin. The company is in possession of an extensive undeveloped land position with long-term growth opportunities and a large multi-year drilling inventory.

Tourmaline’s strong leadership make the company a promising pick for investors looking to take advantage of the tremendous Canadian oil opportunities which are due for a strong rebound as oil prices inch higher.

Encana Corporation (TSX:ECA): Calgary-based Encana saw October oil production recover to more than 325,000 oil-equivalent barrels per day after matching analyst expectations at just 284,000 boe/d in the third quarter.

The oil market looks to be recovering and now appears to be the perfect time to get in on the rebound with companies like Encana that are seeing a tangible improvement in performance. There is very much a future in oil stocks and plenty of value to be found amongst the survivors in Canada.

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This news release contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this release include that PETROTEQ will be able to produce oil as currently scheduled, at the rates of production announced and at the targeted low prices from its Utah property; that PETROTEQ will successfully develop a blockchain supply chain solution for the oil industry; that it will have customers and contracts for its supply chain technology; that oil will be as much in demand in future as currently expected; that PETROTEQ’s technology is protected by patents and that it doesn’t infringe on intellectual property rights of others; that PETROTEQ will find licensees for its technology and that it can patent its technology in many countries; that PETROTEQ’s technology will work as well as expected; that blockchain technology will help PETROTEQ create a supply chain management system which can handle all transactions; and that PETROTEQ will be able to carry out its business plans. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that the Company’s patents and other technology protection are not valid, patents may not be granted in countries where PETROTEQ wants to license its technology; production of oil may not be cost effective as expected, technology development costs may be much higher than expected, there may be construction delays and cost overruns at the production plants, PETROTEQ may not raise sufficient funds to carry out its plans, changing costs for extraction and processing; technological results based on current data that may change with more detailed information or testing; blockchain technology may not be developed to be as useful as expected and PETROTEQ may not achieve its business plans; competitors may offer better technology; and despite the current expected viability of its projects, that the oil cannot be economically produced with its technology. Currently, PETROTEQ has no revenues.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) has been paid by the profiled company to disseminate this communication. In this case the Company has been paid by PETROTEQ seventy thousand US dollars for this article and certain banner ads. This compensation is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. We have been compensated by PETROTEQ to conduct investor awareness advertising and marketing for TSXV:PQE and OTCQX:PQEFF. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the company. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases.

The information in our communications and on our website has not been independently verified and is not guaranteed to be correct.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares of this featured company and therefore has an additional incentive to see the featured company’s stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing The Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. Investing is inherently risky. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits similar to those discussed.