A new technology is here that has the potential to reshape lithium production in the same way fracking reshaped oil.

In fact, as reported by USA Today, Musk offered $325 million for the International Battery Metals’ CEO’s previous company and lithium extraction technology.

But a major New York Global Investment Bank valued this company at 7X this number... $2.5 billion.

The gap was too wide, and a deal was never completed. Now, the CEO is taking the knowledge he gained over to International Battery Metals.

And today, after making drastic and patentable improvements to create a technology, they are the only company with “fracking tech for lithium”.

The world should get this breaking story now.

The global battery market is set to hit $120 billion in less than two years, and there could be a massive investor opportunity here in lithium—but this isn’t a mining play, it’s a tech play.

In the swarm of new entrants to the lithium playing field, International Battery Metals (CSE:IBAT; OTC: RHHNF) stands out—front and center—because it’s sitting on a proprietary advanced technology that could push lithium into the production stage rapidly. It has signed a share exchange agreement with Selective Absorption Lithium (SAL). SAL is a technology company, owned by Burba and his partners, that has developed unique extraction technology that is directly applicable to oilfield brine applications. In the Share Exchange agreement, IBAT will acquire SAL and all of its lithium extraction process intellectual property. SAL will become a U.S. subsidiary of IBAT.

Where traditional solar evaporation technology takes up to 24 months to extract lithium from brine, IBAT’s incoming CEO Burba says he can do it in 24 hours. That would put IBAT on the front line of new lithium coming online to meet the battery demand. And that demand is supplying our energy transition for everything from mainstreamed electric vehicles (EVs) to massive energy storage solutions and the consumer electronics market that grows in leaps and bounds.

The lithium game isn’t about exploration, it’s about innovation—and IBAT’s proprietary third-generation technology acquired from SAL was co-invented by the same game-changing inventor—Burba— that came up with a similar tech for FMC Corp. (NYSE:FMC), one of the world’s four top lithium producers.

Lithium is currently produced through a grueling 24-month solar evaporation process that entails slowly extracting all other elements from the brine until only lithium remains.

IBAT’s technology is designed to remove evaporation ponds from the equation. As inventor-CEO John Burba puts it: “Our tech has such a high specificity for lithium that it can directly take the lithium out.”

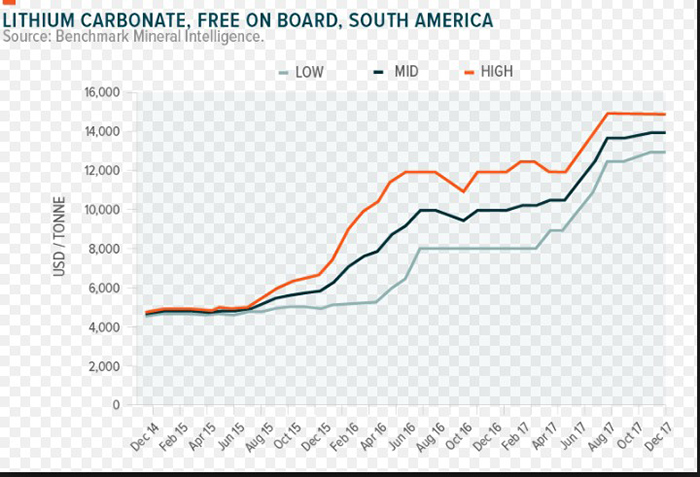

With its eye on the lithium prize, IBAT is going for fast production and commercial scalability, at a time when lithium prices per metric ton are fantastic:

Disruptive technology changes everything, and if the deal with NAL completes and IBAT’s tech breaks through successfully, it could potentially do for lithium what fracking did to unlock shale for the U.S. oil and gas industry.

Here are 4 reasons to keep a close eye on International Battery Metals (CSE:IBAT; OTC: RHHNF)

#1 Big Lithium Doesn’t Hibernate in Evaporating Ponds

The technology IBAT has an agreement to acquire, and on acquisition is considering for licensing to third party lithium producers could be a significant key to unlocking significant lithium brine resources—by making it faster and cheaper to produce.

Production capacity is now at a critical juncture. It takes a minimum of 4 years for an average Lithium brine mine to come online--and another 3-4 years to reach full capacity.

The ambitious targets for EV deployment and energy storage applications require massive Lithium mining capacity to be built much sooner than current technologies allow.

That's the chief reason why companies are aggressively pursuing new resources such as oil field brines, jadarite and hectorite clay. Lithium brine deposits are estimated to contain 66 percent of the world's 14 million metric tonnes (MT) of Lithium. That's Lithium worth $84 billion at current prices.

Unfortunately, recovery of Lithium from brine deposits is a painfully slow process. Traditional solar evaporation technology is an extremely time-intensive process, with a lengthy production cycle that can exceed 18 months. This means that thousands of acres of evaporation ponds are tied up during this process. Expansion requires the construction of thousands more acres and years of construction and start up. To meet the developing demand, we cannot wait almost a decade for a new resource to come on stream. IBAT’s new technology is on track to dramatically reduce that time.

Oilfield brines solve some of these problems due to their high Lithium concentrations. But, there's a kicker here as well-- oil field brines contain very high concentrations of dissolved ions (>100,000 mg/L), making commercial recovery of Lithium exceedingly expensive.

The technology IBAT is acquiring from NAL is based on a process that has been extracting lithium continuously in Argentina for almost 20 years.

Instead of going the traditional route of trying to isolate Lithium by removing all of those complex ions, the IBAT tech removes the Lithium directly.

According to incoming IBAT CEO John Burba, the mastermind of this technology, the process takes the lithium out on a continuous basis. As the brine goes by, it collects lithium and lets the other impurities continue on and go straight back into the ground. The end-product is a diluted stream of lithium chloride and water that comes out as the brine goes by. This solution has few impurities which are easily removed before lithium carbonate production.

The whole extraction process requires only a few hours, and it operates continuously—so it would mean the end of 18-24-month residence times. This is a net positive for several reasons. First, the environmental foot print of IBAT’s technology will be tiny, compared with that of solar evaporation facilities that contain thousands of acres of evaporation ponds and salt stacks. Additionally, new evaporation ponds systems require years to build and more years to bring up to steady state operation. IBAT’S new third generation extraction tech can be put in place in a fraction and be operational in a fraction of that amount of time.

Once operational, this technology could be highly disruptive, offering the fastest-to-production Lithium brine extraction solution out there. Faster means more efficient and cost effective.

While all the new entrants are struggling with costs, IBAT’s technology could put it on cost par with the Big 3 lithium producers—the lowest-cost producers right now. That includes Albemarle Corp. (NYSE:ALB), Sociedad Quimica y Minera de Chile (NYSE:SQM) and FMC.

#2 Inventor/CEO + Technical and Commercial Dream Team

Inventor John Burba—a veteran in lithium extraction—is the incoming IBAT (CSE:IBAT; OTC: RHHNF) Chairman and CEO, and he’s one of the most important pioneers in extraction technologies. He is considered a genius in this space.

IBAT’s new to-be-acquired technology is actually based on a tech that John Burba co-invented and sold in the 1990s when he was a leading technology figure at giant FMC.

Before Burba came along, everyone thought that lithium could be produced from only a limited number of brines.

That’s where Burba’s genius came into play … FMC has been using an early version of that same tech for nearly 20 years, and it’s responsible for making the purest primary lithium carbonate in the world. It’s even earned its own lithium label: “FMC-grade” carbonate.

Burba, who became the CEO of lithium extraction company Simbol Materials in 2013, which was the company Tesla bid on, has made dramatic advancements upon the old technology he co-developed for FMC.

This inventor/CEO has already revolutionized lithium processing once. Now he’s determined to do it again, this time leading a company and a dream team that packs a professional punch.

#3 IBAT Hits the Brine, Running

Entering the lithium business just this year, IBAT (CSE:IBAT; OTC: RHHNF) has hit the ground running and they have reason to be confident in the commercial viability of their to-be-acquired advanced technology. Who wouldn’t be with the genius in this space who helped design FMC’s super-efficient lithium extraction process?

Oilfield brines are a potentially staggering resource. But it will require highly efficient technology that returns undesirable brine components back into the ground. IBAT’S new technology promises to do just that. So, again, this is like a potential shale revolution—but for lithium.

Lithium has been found extensively in North American oilfield brines, and IBAT has targeted several so far. IBAT plans to set up a pilot extraction facility in early 2018, and then secure licenses for high-grade lithium brines.

#4 Lithium Demand is a Producer’s Dream

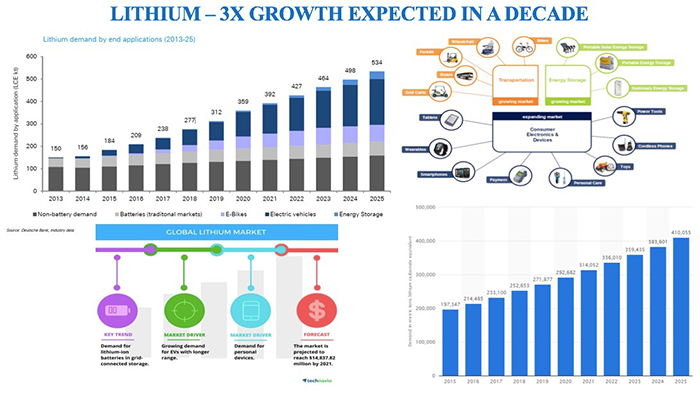

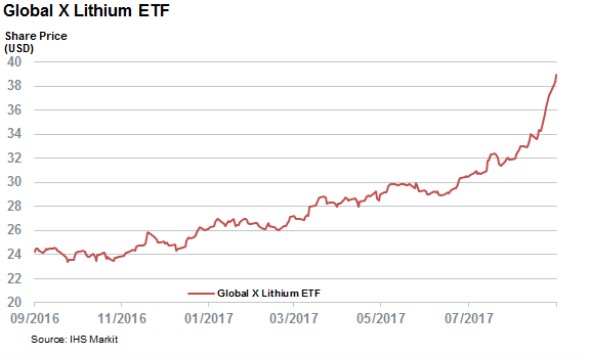

With global battery demand forecast to rise 7.7 percent to $120 billion already in 2019, and with the lithium market alone set to reach $1.7 billion, this is a market that won’t wait for evaporating ponds.

The global Li-ion market is expected to exceed $46 billion by 2022, growing at nearly 11 percent CAGR. What the world needs right now is plentiful supply of high-grade Lithium to power the unfolding EV revolution.

There’s more upside risk here because of battery demand than there is downside risk, according to Bloomberg New Energy Finance’s Andrew Grant.

Lithium prices have made prodigious runs to all-time highs.

Tesla’s (NASDAQ:TSLA) 70kWh Model S battery pack contains 63Kg of lithium, equivalent to the amount of lithium in 10,000 cellphones, and the EV posterchild has already accumulated more than 400K Model 3 pre-orders on its books.

Tesla, too, will use up the entire world's current supply of battery-grade lithium when it hits a production clip of 500K Model 3s in its giant Nevada Gigafactory sometime in 2018. When it opens up four more gigafactories, well …

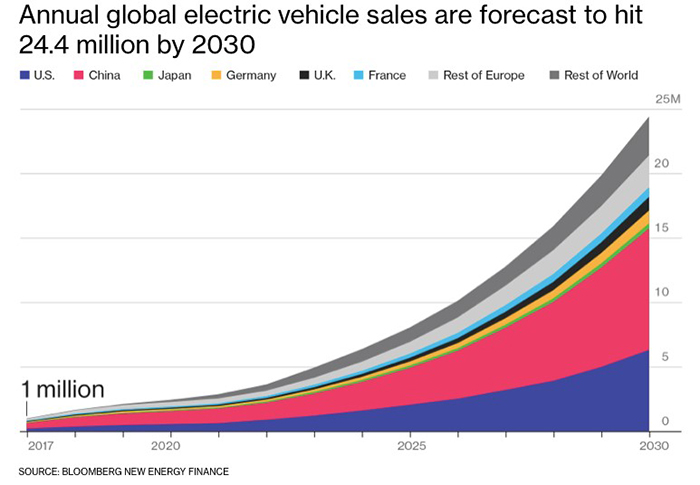

Meanwhile, the plug-in EV market is already growing at 10x faster than its gasoline-powered counterpart. Bloomberg Finance has forecast there will be more than 100 million EVs on our roads by 2040.

#5 No Other Small-Cap Can Produce Lithium in Time

Timing is critical when we’re talking about lithium, and IBAT’s technology can extract lithium in 24 hours—not 24 months. This means more efficient operations and a much smaller environmental footprint.

While some small-cap resource companies have made similar claims, based on small scale laboratory tests, none are basing their claims on technology that has been commercially proven. The technology that IBAT is bringing to the table is a vastly improved version of the technology that Burba and his partner sold to FMC, which became the basis of FMC’s lithium production process. FMC’s lithium extraction plant has continuously operated with this technology for 20 years.

Lithium shortage fears first emerged about two years ago, causing a tripling in lithium prices in only 10 months. Suddenly it occurred to everyone that the electric vehicle boom had crept up on them stealthily. Then EVs started hitting the mainstream market, and the race to build battery gigafactories to support them was on in full force. Today, the fear is that much greater.

We simply don’t have enough lithium mining operations online to feed this revolution. EV production is set to increase more than thirtyfold by 2030, according to Bloomberg.

Again, this playing field is crowded with small-caps trying to get in on the fantastically tight supply set-up. But they won’t make it because they don’t have the right technology.

Many will spend a ton of money that they don’t have, and then some will crash and burn because they can’t get the lithium out of the brine fast enough to corner any decent market share.

Production capacity is now at a critical juncture. It usually takes a minimum of 4 years for an average Lithium brine mine to come online--and another 3-4 years to reach full capacity.

It’s the key to unlocking what could be over $80 billion in lithium brine resources—resources that major EV players like Tesla—and now every other auto maker in the world—and tech giants like Apple, on its way to becoming the first-ever trillion-dollar company, are coveting.

The Bottom Line? This is Burba’s Brine

This is an improved technology that we’ve already seen put to work in an older, less advanced version, for giant FMC—which is today one of the world’s four major producers who have monopolized lithium.

With the same inventor behind the advanced version of this technology to take over at the helm of IBAT, confidence runs high that we’ll see a positive evaluation process for licensing.

Before the explosive entrance of the lithium-ion battery, getting lithium out of the brine wasn’t so urgent. Now, as EVs become mainstream, all the talk is of massive energy storage solutions and consumer electronics sees no end to demand in site—the brine is the new battlefield. And IBAT (CSE:IBAT; OTC: RHHNF) is poised to deliver the most decisive weapon.

Other companies to watch in the mining space:

Teck Resources (TSX:TECK.B): Zinc hasn’t been Teck’s best friend of late, but that looks set to change in the medium term, as supply continue to dwindle and as we hear news that the world’s top producer of the metal—Glencore—isn’t planning to bring shuttered mines back online. Supply will remain tight.

Keep in mind this, though: Teck’s Q1 earnings and revenue fell short of expectations because of weaknesses at its zinc unit, sending it shares down about 6% in late April. In particular, there’s been a 23% drop in production at its Red Dog mine due to lower grades of zinc.

Endeavor Silver (TSX:EDR) operates three silver-gold mines in Mexico, but it’s also got three attractive development projects. Production has dropped, and all-in sustaining costs have risen, leading to a negative cash flow. But the company has significantly reduced its debt, so it’s future is anything but bleak.

By 2018, with development in the pipeline, this stock might be prohibitively expensive again because there is plenty of near-term growth potential here. It’s also got further upside with zinc and should get a boost in this coming bull market. Catalysts include positive reserve estimates for its fifth mine, the Terronera silver/gold project in Mexico’s Jalisco state.

Magna International (TSX:MG) is based in Aurora, Ontario. The global automotive supplier is gutsy and innovative--and definitely tuned to the obvious future--clean transportation. A great catalyst is its development of a combo electric/hydrogen vehicle--a fuel cell range-extended EV (FCREEV). It’s not going to produce them (for now, at least) but plans to use the model to show off its engineering and design prowess and produce elements of the electric drivetrain and contract manufacturing.

The company’s auto parts are distributed to heavyweights such as General Motors, Ford, Tesla, BMW, Toyota, Volkswagen and Chrysler. These huge deals provide a safe and steady profit stream for the company. It’s insightful, forward-thinking and smart value/low cost for shareholders.

Pretium Resources (TSX:PVG): This impressive Canadian company is engaged in the acquisition, exploration and development of precious metal resource properties in the Americas.. Additionally, construction and engineering activities at its top location continue to advance, and commercial production is targeted for this year.

The company’s modest market cap and stock price make it an appealing buy for investors. Pretium has an impressive portfolio and if you can catch the stock while the price is right, there could be huge opportunity for upside.

Orocobre (TSX:ORL): This company has had some serious problems and its stocks have seen major extremes. Right now it’s really low and has earned the title of one of the most-shorted stocks in this space because of production delays and even a gross spreadsheet error. But the company still must be viewed as the first brine concentrate lithium project in 20 years, and a new catalyst may end up being the ability to self-fund the expansion of its Olaroz lithium hydroxide plant in Japan.

Right now, Orocobre is on a rampage. The TSX traded stock has risen 25% in three months, with no signs of slowing. The company has just announced big news and could be a potential target for takeover.

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This news release contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this release include that IBAT will complete its announced transaction with North American Lithium and acquire NAL’s technology and IP; the Lithium extraction process will be cost effective and can work much more quickly that other extraction technologies; that the process can be commercialized for large scale production; that the NAL team which knows the NAL technology will join IBAT; that the NAL technology can be licensed worldwide; that IBAT plans to set up a pilot extraction facility in early 2018, and then secure additional licenses for other high-grade lithium brines by this summer; that by 2020, IBAT anticipates becoming a supplier of various battery metals; that IBAT plans to secure 3 tin properties in 2018; and that it plans to acquire high value tin and tantilum properties. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that the Company and NAL may not agree on the final agreement terms, aspects or all of the process development may not be successful, the process may not be cost effective, the Company may not raise sufficient funds to carry out its plans, changing costs for mining and processing; increased capital costs; the timing and content of upcoming work programs; geological interpretations and technological results based on current data that may change with more detailed information or testing; potential process methods and mineral recoveries assumption based on limited test work and by comparison to what are considered analogous deposits that with further test work may not be comparable; high value mineral properties may not be available for IBAT to acquire, or IBAT may not be able to afford them; competitors may offer better technology than NAL’s lithium extraction technology; the availability of labour, equipment and markets for the products produced; IBAT may not be able to finance its business plans; and despite the current expected viability of the project, that the minerals cannot be economically extracted with the NAL technology, or that the required permits to build and operate the envisaged mines cannot be obtained. The forward-looking information contained herein is given as of the date hereof and the Company assumes no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) has been paid by the profiled company or a third party to disseminate this communication. In this case the Company has been paid by International Battery Metals. In this case the Company has been paid by International Battery Metals one hundred and ninety thousand US dollars for this article and certain banner ads. This compensation is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. Gains mentioned in our newsletter and on our website may be based on end-of- day or intraday data. If we own any shares we will list the information relevant to the stock and number of shares here. We have been compensated by International Battery Metals to conduct investor awareness advertising and marketing for [CSE:IBAT and OTC:RHHNF]. Oilprice.com receives financial compensation to promote public companies. This compensation is a major conflict of interest in our ability to be unbiased. We have not investigated the background of the company. The third party, profiled company, or their affiliates may liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. You should verify the information, and again are encouraged to never invest based on the information contained in our written communications.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing The Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.