Founder breakups are not uncommon in the tech world. Perhaps the most famous tech split of all time was that of former Apple CEO John Sculley and Apple Founder Steve Jobs—where the legendary Steve Jobs was ousted from his own company, over a dispute with the Apple Inc. (NASDAQ: AAPL) in 1985.

Today another very public tech split is underway, between the co-founders of the state-of-the-art fintech payment app company Glance Technologies (OTC: GLNNF) (CSE: GET).

Playing the part of John Sculley is current President and CEO Desmond Griffin, who back in February fired co-founder Penny Green. Not going down easily, Green simultaneously charged back as Glance's top shareholder and as CEO of The Yield Growth Group with a Steve Jobs aura to seize back the company she had a significant hand in building.

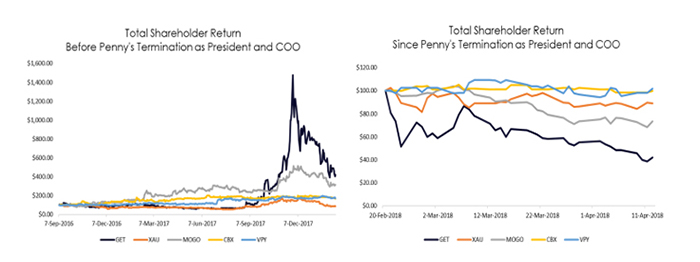

However, unlike Apple's now infamous loss of Jobs in 1985, the internet and its speed with which press releases can be circulated to the market has made splitting very public, and downright nasty. Since Griffin dismissed Green back on February 20th, through an unorthodox announcement of the dismissal, Glance's stock has mostly languished, dropping below the $1 per share mark—of which it has yet to return.

In fact, shares for the company have fallen to as low as 40% of their value since Green's departure, and now sit roughly at 60% of their February 20th price mark.

Which is why a dissident shareholder insurrection led by Green has picked up steam in the months that have followed, all leading towards a pivotal June vote that could see a handpicked team of Board replacements remove both Desmond Griffin and his wife Angela Griffin (Glance's current Chief Technology Officer) from the company's offices, and usher back Penny Green to her position as Glance's President and likely its new CEO.

The saga has a lot of moving parts, and ultimately both sides want to get the company back on track, trending in the way it was prior to the beginning of the year. As ugly as relationship has gotten since February, the attacks will likely come to a climax after the vote and peace will prevail for Glance's increasingly disgruntled shareholders.

THE TRICKY TRADING TIMELINE

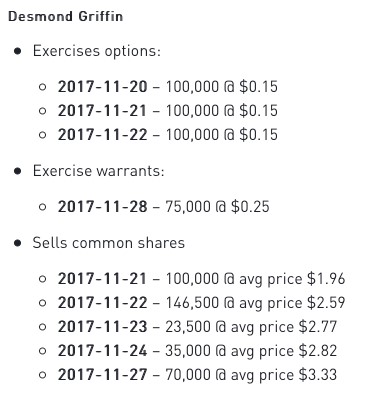

While the decline of Glance's stock since Green's dismissal has been well documented, the company's steep decline began after it hit its all-time high at $3.84 on November 27, 2017. However, as pointed out in an alarming press release by Penny Green released on May 18, 2018, the trading activities of Desmond Griffin and Glance Director Larry Timlick with their Glance stock could be cause for concern.

Highlighted in the release was evidence of the questionable timing of Griffin's trades in the week leading up to an announcement of Glance's $11 million bought deal on November 28, 2017 (the day after Glance's all-time high).

"We did something Mr. Griffin was hoping no one would do, which was to look at his trading record," said Penny Green. "The CEO of a company should not be trading against his shareholders. It appears he was exercising 'in-the-money' options and warrants then turning around and selling those shares within days while likely having inside knowledge of an impending bought deal."

The most scathing indictment in the release pointed at how Glance's CEO made several trades during the week from November 20 to November 27, 2017. Normally, insider trades aren't necessarily alarming, however Griffin's trades were feathered out over the week leading up to a major financing announcement—one that he must've been aware was on deck.

Ahead of what was the company's largest equity financing in its history, Griffin spent roughly $63,750 to exercise options and warrants at prices of $0.15 and $0.25, only to turn around and cash them out for approximately $972,330.

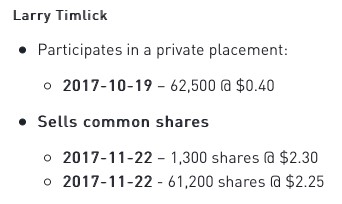

Director Larry Timlick also sold shares in the lead-up to the $11 million bought deal financing—paying $25,000 to then turn around and sell for a quick profit of $115,690.

Even CTO Angela Griffin was active ahead of the financing, selling 20,000 shares at an average price of $3.42 on November 27th. Given that Desmond and Angela are married, it's also unlikely that Desmond was unaware of these trades in his household, and adds a questionable nature to the trading activities of management ahead of the company's biggest financing in history.

In fact, it makes the boast made by the Griffins in their letter announcing the firing of Green all the more dubious, as they stated: "We are a husband-and-wife team. That gives us, and all shareholders, a valuable edge."

Amidst the back and forth of the PR war being waged between the Griffins and Ms. Green, the issue regarding Glance's top execs cashing in on options ahead of the biggest financing in company history was left unexplained. Instead, attention was directed towards attacks of a more personal nature.

GETTING PERSONAL

Tucked in among the closing paragraphs of the Griffins' letter to shareholders regarding Green's dismissal, was a disclosure of their family ties—Penny and Angela are sisters, making Green and Griffin in-laws.

Notably absent from the announcement was a cause. Other than the declarative statement that they could no longer work with Penny, there wasn't a material implication made showing Penny's alleged shortcomings.

Instead, the shareholders were left guessing what happened, all while witnessing their shares dive in value. During her tenure, Ms. Green was instrumental in many of the company's marketing and financial milestones—as evidenced by the shares rising shortly after adding top fintech influencer Spiros Margolis to the advisory board, and his remaining loyalty as a candidate on Green's GREEN ballot of Board replacements.

A TALE OF TWO BALLOTS

Shareholders of Glance at this year's AGM will be greeted with two ballots from which to choose from. At their basest descriptions, the BLUE ballot stays the course with the current board, while the GREEN ballot would be a complete overhaul, replacing management and the board in one fell swoop.

BLUE BALLOT – TEAM GRIFFIN

Kirk Herrington, BASc – Chairman

Software exec with over 30 years of experience, and co-founder of Connect2Classes education discovery platform. Former CTO of Pivotal Corporation.

Larry Timlick

Seller of innovative technology for over 25 years. Former VP of Cisco Systems, Western Canada. Experience as board member of Elevation Capital Corp, CounterPath Corporation, and Para Reserouces Inc.

James Topham, FCPA, FCA

Fellow Chartered Professional Accountant, and audit partner in KPMG's Technology Group for 20 years. Also been a board member at Norsat International, UrtheCast Inc., Epic Fusion Corp (Chair) and DDS Wireless International.

GREEN BALLOT – TEAM GREEN

William Davis III

Managing director at LDJ Capital. Former CIO and Chief Cybersecurity Officer at Europe's largest mobile payment firm Daopay. Former president of Gate Impact, a broker dealer in the fintech business of secondary trading of clean energy companies on a proprietary ATS/exchange.

Jonathan Fry

Chairman of LifesDNA, a search engine using blockchain and AI tech in the lifestyle and healthcare sectors. CEO of TeamBlockChain, a UK-based int'l influencer network assisting organizations' transition to blockchain economy. Former CEO of Premier Asset Management PLC, which had over £1 billion under management during Mr. Fry's tenure.

Monique Imbeault

CEO of General Financial Corporation. Former Chair of the board and member of Audit Committee of Organigram Holdings Inc, and of Imvescor Restaurant Group, one of Canada's largest restaurant chains. Former counsel with law firm McInnes Cooper specializing in corporate and commercial law.

Spiros Margaris

Founder of Margaris Advisory. Recently was recognized by Onalytica with the triple crown, ranked #1 worldwide as the top influencer in FinTech, Blockchain, and Artificial Intelligence. Senior advisor to numerous fintech companies, and previous partner and member of the Investment Committee of the hedge fund advisory firm Crossbow Partners AG.

Penny Green

President and CEO of The Yield Growth Group, and CEO of Bacchus Law Corporation, a boutique securities law firm. Co-founder, director and former President and COO of Glance, and the largest shareholder. Ms. Green oversaw the raise of over $30 million from the capital markets, and sourced, negotiated, and closed the $4 million in revenue licensing deals at Glance, generating the majority of Glance's revenues.

BATTLE OF THE BALLOTS

The vote to decide the future of Glance Technologies (OTC: GLNNF) (CSE: GET) is scheduled for the company's AGM on June 12, 2018. It's still to be seen whether Glance's shareholders are unhappy enough to hit the reset button on the entire board, now that they've lost 40% of their value since Penny Green was terminated (and lost 85% since the aforementioned financing that was preceded by heavy insider selling).

The key allegation being made by Green's side of this dispute is that the current CEO and board have bred a culture of inaction inside Glance. A lack of new revenue streams, and a seemingly slowed rate of new catalyst events has so far taken its toll on the company's fortunes. The major point being made by the Green campaign is that Glance was the top performer among its peers in the fintech sector prior to Ms. Green's termination; and now it is among the worst after her termination as President and COO.

The numbers point towards the legitimacy of her strong claim. Glance's shares dropped by more than 19% the day after Ms. Green's termination was announced, and overall the price just hasn't recovered.

What happens to Glance after June 12th is up to the shareholders—of which Penny Green is the largest single shareholder. Things certainly will be interesting when those votes are counted, whether change is coming or not.

Disclaimer: Nothing in this article should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid article and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this article is not provided to any individual with a view toward their individual circumstances. Baystreet.ca has been paid a fee of five thousand dollars by The Yield Growth Group. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.