For all the talk of an emerging “cashless” society, in much of the world cash is still king.

In Mexico, it’s estimated that 65 percent of the adult population is still without a traditional bank account – and 80 percent of all financial transactions are conducted in cash.

Yet an upstart company is working to change that.

QPAGOS (OTCMKTS:QPAG) has developed a way to offer digital payment services to as many as 2 billion “unbanked” consumers worldwide.

By installing self-serve payment kiosks in easily accessible locations, QPAGOS helps people without bank accounts pay bills electronically, transfer money to relatives and friends, and access digital services once cut off to them.

It’s a brand-new industry in many places – and business is exploding.

QPAGOS reported a 58 percent increase in revenue in the first quarter of 2018 – and is now expanding to an initial target market estimated at 400 million people.

Not surprisingly, QPAGOS’s stock has also soared in recent months, up more than 100 percent in value since late January 2018.

Plus, there are reasons to believe that QPAGOS’s recent revenue growth will persist – and that QPAGOS’s stock could continue to rise in value in the months ahead.

Advanced technology: The key to QPAGOS’s (OTCMKTS:QPAG) growth lies in its simple yet sophisticated self-service kiosks and secure digital payment technologies. The digital banking kiosks are like ATM machines on steroids, allowing “unbanked” consumers who normally use cash to pay bills electronically and transmit payments to remote locations.

In addition to the kiosks, the company also provides payment solutions via mobile phones.

That’s important because, according to estimates from the World Bank, half of the world’s 2 billion unbanked consumers have cell phones – and thus could potentially access QPAGOS’s “Monedero” electronic wallet app.

The app lets users without bank accounts pay for products and services with their phones, and the same technology gives small businesses the ability to accept payments in remote locations without expensive merchant card terminals.

Strategic partnerships: To achieve its ambitious goals, QPAGOS (OTCMKTS:QPAG) is working with some of the world’s largest companies, including AT&T, XBox, Dish, Apple, Virgin Mobile, Nextel and 150 others.

These companies are able to use QPAGOS’s digital banking platforms to gain access to millions of cash-paying customers who might not normally avail themselves of digital services. Consumers, for their part, can use QPAGOS kiosks to pay in cash for services such as cell phones, utility bills and even digital movies.

Huge revenue potential: The fees that digital banking generates are legendary. Although the individual charges can be relatively small, the large number of transactions creates a revenue stream that is a virtual tsunami of cash. Since it started in 2014, QPAGOS (OTCMKTS:QPAG) has seen its revenuesoarfrom $1.1 million in 2015 to $3.9 million at the end of last year.

Plus, in addition to the traditional fees that QPAGOS collects – payment processing fees, service provider commissions, advertising fees and kiosks sales and rentals – QPAGOS is also now targeting the enormous “remittances” market in North America.

Each year, foreign workers in North America transmit an estimated $60 billion to relatives back in their home countries, often using expensive and inconvenient storefront locations, such as 7-11 or Western Union, to do so. With its easy-to-use self-serve kiosks, QPAGOS hopes to siphon off a large portion of this $60 billion cash payment stream.

Virtually unlimited market: At the moment, QPAGOS (OTCMKTS:QPAG) has consolidated its position in emerging market countries in Latin America where an estimated 80 percent of the adult population still uses cash alone to pay its bills. For QPAGOS, this represents a market of 320 million unbanked consumers in countries such as Brazil, Chile, Columbia, Peru and Mexico.

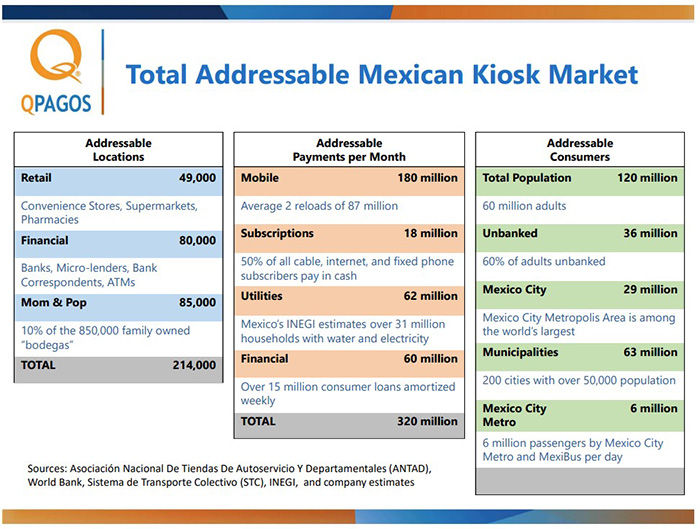

In Mexico alone, QPAGOS has already placed 700 kiosks and is targeting there an untapped market of 36 million unbanked consumers with the potential of 320 million payments per month at 214,000 possible locations, such as supermarkets, pharmacies and mom and pop stores.

And beyond the emerging markets in Latin America, QPAGOS also aims to expand into the U.S. and beyond.

Its initial goal is to establish 1,000 kiosks in the U.S., primarily in California, and then to expand quickly to 10,000 kiosks. If the company can assist foreign workers with just 1 percent of their $60 billion electronic transactions, that represents payments of some $600 million.

Plus, the U.S. is just the beginning. As noted earlier, the World Bank estimates there are currently 2 billion adults around the world without access to formal financial services. QPAGOS could potentially service –billions of electronic payments per month. It could easily end up being the PayPal of the unbanked world.

Limited competition: What makes QPAGOS (OTCMKTS:QPAG) a potentially exciting opportunity for investors is the relative lack of competition in the unbanked market. While those with access to regular bank accounts can avail themselves of a wide variety of electronic payment systems, such as Venmo, Apple Pay and PayPal, the unbanked have limited choices.

QPAGOS stands virtually alone in aiming to introduce the 2 billion unbanked consumers around the world to the entire digital electronic “ecosystem” – one that includes cell phone “wallets,” cellular advertising, point of sale payments, bill paying and more. In Mexico, there is currently no comparable technology and QPAGOS has a virtual monopoly on the electronic payment market among the unbanked.

Experienced management team: In addition, QPAGOS’s (OTCMKTS:QPAG) management team has unique experience in both the Latin American market as well as in the financial services, IT, telecom, and digital payment industries. The broad international resources available to the management team give QPAGOS a foundation for rapid expansion across multiple markets.

The CEO, Gaston Pereira, is a seasoned financial executive whose experience includes serving as CEO of IUSATEL Chile, MARCATEL Mexico and as vice president and country manager for Citibank. Chief of Operations Andrey Novikov served as vice president for business development at a large Russian electronic payments company, Qiwi. And the Independent director James Fuller served as Chairman of the Board of the Pacific Research Institute, Senior Vice President of the New York Stock Exchange (NYSE) and past president of both the Bull and Bear Group and Morgan Fuller Capital Group.

Undiscovered windfall: Right now, QPAGOS (OTCMKTS:QPAG) is a relatively small, brand-new company. Yet already its stock has shot up 114 percent just in the past few months as word of its unique position in the self-serve payment market spreads.

At the moment QPAGOS is generating annual revenue of approximately $4 million with just 700 of its self-serve, touch-screen kiosks operational. If it adds an additional 3,000 kiosks per year, it’s possible that QPAGOS could hit $35 million in sales in just 24 months.

Best of all for investors, QPAGOS is currently flying below Wall Street’s radar. Yet that could change overnight – especially as QPAGOS strikes new deals with such giant e-commerce companies as Virgin Mobile, Movistar, Telcel and others.

It’s possible that QPAGOS (OTCMKTS:QPAG) might eventually be seen as the “PayPal of the emerging market.”

Other companies to watch as financial technology takes off:

Kuuhubb Inc. (TSXV: KUU) is a company active in the development and acquisition of lifestyle and mobile video game applications. Its strategy is to create sustainable shareholder value through its groundbreaking AI and big data applications suggest that its stock is currently undervalued, but it’s not likely this opportunity will last for much longer.

Though it’s focus is on mobile video games, Kuuhubb’s innovative technology makes it a likely target of acquisition and could be a key player in the mobile industry.

Mogo Finance Technology Inc. (TSX:MOGO) offers a new take on the growing FinTech sector. The company provides loan management, in depth tracking of financial transactions, and easy-to-manage mortgages. CNBC has even labeled the company as “the Uber of finance.”

As the company continues to grow and innovate, offering new services to customers in the process, investors are definitely watching this fintech giant closely.

Intrinsyc Technologies (TSX:ITC) Intrinsyc is a product development company that provides hardware, software, and service solutions for embedded and wireless products. This Canadian company saw a few hiccups last year, but their impressive Internet of Things division is poised to take the world by storm.

With its high-profile partnerships and groundbreaking technology applications, Intrinsyc is on the path to success, and smart investors are paying close attention.

Apivio Systems (TSXV:APV) Apivio Systems Inc is a Canadian technology company which designs, develops and manufactures communications equipment and software. As the world becomes more connected, VoIP phones for commercial and residential markets will grow in demand, and as a necessary component in the fintech revolution, Apivio is looking to capitalize on this exploding market.

In the years to come, smart investors will be following Apivio as the mobile technology movement gains speed.

Peeks Social (TSXV:PEEK) is a Canadian company which is primarily focused on the development of social media and social commerce products. The Peeks Social app has reached over 30 million people and is growing quickly. As one of the 15th highest grossing social apps on Google platform, Peeks is adding value for both its customer and its investors.

Through strong leadership and a forward-thinking management team, the company has made waves in Canada’s mobile world. The company’s CEO, Mark Itwaru, worked with AT&T Canada for years as an engineer and designer before beginning his work with Peeks.

Peeks Social is set to continue its rise in Canada’s mobile application world, and as it continues to grow, investors are sure to profit.

IMPORTANT NOTICE AND DISCLAIMER

PAID ADVERTISEMENT. This communication is a paid advertisement. Safehaven.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by one or more of the profiled companies or a third party to disseminate these types of communications. In this case, the Publisher has been compensated by a third party shareholder to conduct investor awareness advertising and marketing for QPAGOS. The third party shareholder paid the Publisher sixty six thousand six hundred and sixty six US dollars per article to produce and disseminate six articles and certain banner ads over an approximately six-month period. This compensation should be viewed as a major conflict with our ability to be unbiased. Readers should beware that the third party shareholder, other third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur.

This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and does not contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP. The owner of Safehaven.com owns shares and/or stock options of the featured companies and therefore has an additional incentive to see the featured companies’ stock perform well. The owner of Safehaven.com will not notify the market when it decides to buy or sell shares of this issuer in the market. The owner of Safehaven.com will be buying and selling shares of the featured company for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

FORWARD LOOKING STATEMENTS. This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Factors that could cause actual results to differ include, but are not limited to, changing governmental laws and policies, the success of the companies’ technology, the size and growth of the market for the companies’ products and services, the companies’ ability to fund their capital requirements in the near term and long term, pricing pressures, etc.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.