It’s no longer a technological maybe. Vanadium is here, and the lithium sector should be concerned.

Forget everything you think know about the looming $13-billion energy storage market by 2025. You can even forget everything you know about renewable energy, and the batteries behind the electric vehicle revolution.

Right now, the future is about Element 23, and it may be bigger than anything the energy industry has seen—ever.

It’s the key ingredient to flow batteries that run on “liquid electricity”. It’s the evolution in the revolution.

They won’t replace the small battery lithium market…

Instead, they’ll do all of the things lithium can’t do in the large battery market. We’re talking about giant new batteries the size of a shipping container that is expected to form the new backbone of the world’s electric power grid—residential, commercial and industrial.

Element 23 is vanadium …

Its price has more than doubled in the past year and supply is getting tighter by the day.

And one little-known explorer in Colorado has just unearthed a potential huge vanadium reserve.

United Battery Metals (CSE:UBM, OTC: UBMCF) is potentially poised to be the only U.S. source of this most precious of rare earth metals.

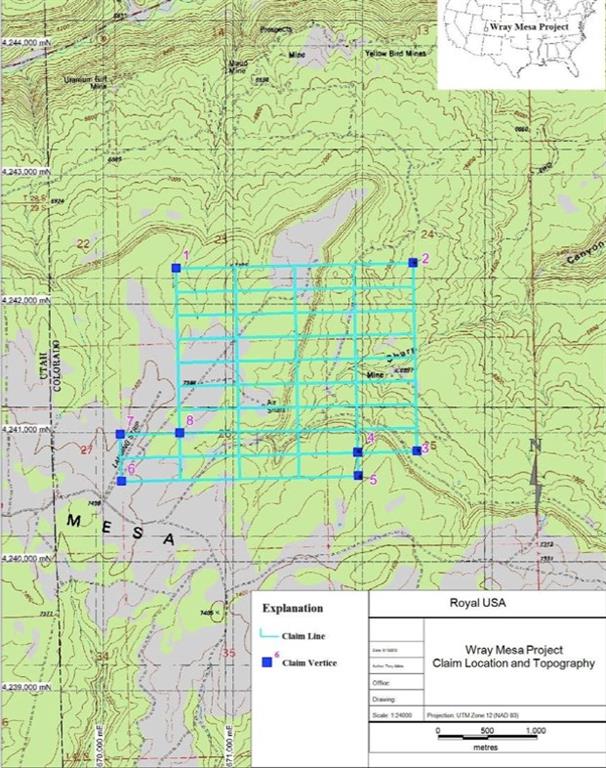

Welcome to the Wray Mesa Project in Montrose County, Colorado, where UBMCF is sitting on a massive estimated reserve of 2.7 million pounds of vanadium (along with over 500,000 tons of uranium as a bonus). (Source 43-101 report authored by Anthony Adkins in 2013.)

That may mean an American source of the rare earth metal powering the “liquid electricity” breakthrough. It makes the electric vehicle push look like child’s play. It doesn’t get any more strategic than this.

Here are 5 reasons to keep a close eye on United Battery Metals (CSE:UBM, OTC: UBMCF) as the next battery revolution begins:

#1 Billionaire Miners, World Leaders Swarming on Vanadium

It’s impossible to talk about vanadium without talking about Robert Friedland.

The legendary mining billionaire and recipient of the 2017 Northern Miner’s Lifetime Achievement Award knows vanadium is revolutionary, evolutionary and very likely a game changer in energy.

He talks of the coming revolution in vanadium redox flow batteries. He talks about the necessity of producing ultra-pure vanadium electrolyte for batteries “on a massive scale”.

“The beauty of the vanadium redox battery is that you can charge and discharge it at the same time, something that can’t be done with a lithium battery. With a vanadium redox flow battery, you can put solar power and wind power into the battery, and you can put excess grid power into the battery at night, and at the same time you can have a stable output into the grid.”

For Friedland, vanadium changes … everything. And he has put his money where his mouth is. Friedland is a chairman at Beijing-based Pu Neng, which was recently awarded a contract to build the largest vanadium flow battery in China.

Vanadium also enjoys massive political support. In fact, Vanadium is the single thing that Obama and Trump can agree on.

After all, Vanadium isn’t just any rare earth element, it’s an element of strategic interest and national security significance. (Think: one-upping China on energy and technology. Think: defense.)

Obama said “vanadium redox fuel cells” was “one of the coolest things I’ve ever said out loud”.

First developed by NASA for aerospace applications, vanadium redox fuel cell batteries now have a much bigger—and broader—future. There’s been an explosion in manufacturing, and the market isn’t prepared for it.

And late last year, Trump signed an executive order to develop a federal strategy to ensure “secure and reliable supplies” of critical minerals, including vanadium because the U.S. is reliant 100 percent on imports of these minerals.

So, a potential discovery of the rarest and most critical metal of all in Colorado won’t just be on the radar of legendary billionaire investors. It will be on the Pentagon’s radar.

#2 Vanadium Is The Missing Link That’s Just Been Found Right At Home

Batteries for phones, laptops, even EVs … that’s small-time. The big-time is this: batteries that can store energy and power entire cities and everything in between.

But even the smaller-time applications of vanadium will rock investor worlds. Vanadium redox batteries (“VRB”) like Cellcube will be used in car-charging stations worldwide. Cellcube’s batteries are already installed in 130 places across 24 countries—and counting and United Battery Metals (CSE:UBM, OTC: UBMCF) is hoping to capitalize on growing demand.

There are the Tesla batteries acting as backup for a wind farm in Australia. There’s PG&E building the world’s biggest battery in California to store electricity for its grid. And there’s the $3 billion project to turn the Hoover Dam into one big battery.

And it doesn’t hurt that the State of California has just announced that all homes and mid-rises must have solar panel batteries. That means every single house and building will need power-storing batteries, and VRB is probably the best solution.

And when the rest of the states start to follow suit, VRB demand should be explosive.

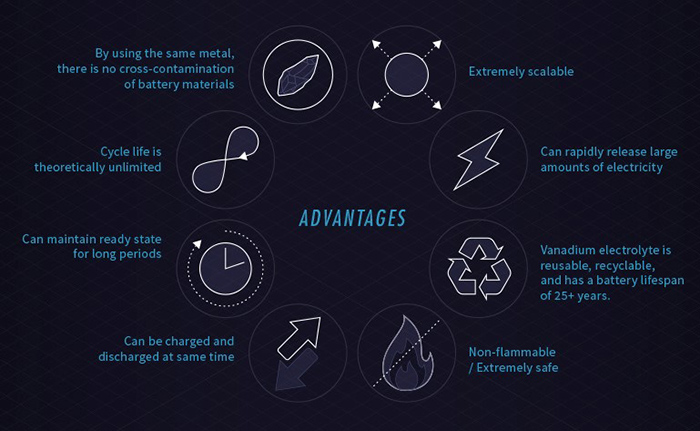

When it comes to energy storage, bigger is better—no contest. It’s possible because vanadium flow batteries store their energy in tanks. The fluid (electrolyte) that transfers charges inside a battery flows from one tank through the system and back again, making a closed circuit. They can charge and discharge simultaneously.

We’re talking tanks that can be as big as you want them: an aquarium, a shipping container or even an Olympic swimming pool—as big as your imagination can take you.

For renewable energy it is a game-changer. VRBs will forever change the storage capacity of wind and solar energy, making them more reliable and cheaper.

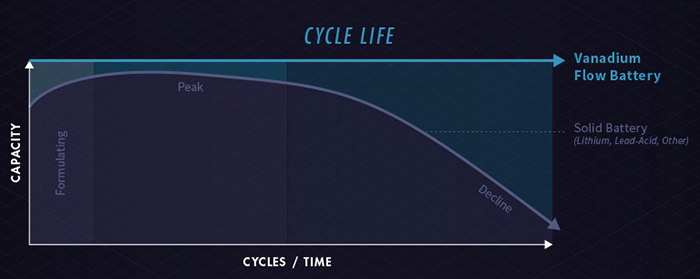

Vanadium is superior to lithium in so many ways.

- Its longevity is infinite

- It’s not explosive, flammable or toxic (no corrosive salts that come with lithium)

- Not only can it be scaled up cheaply, but it’s actually cheaper to scale it up, making it the antithesis of lithium

This last point, and the real kicker is this: Vanadium batteries are already providing complete energy storage systems for $500 per kilowatt hour. In less than a year, that should be down to $300. By 2020, we should be looking at $150/kilowatt hour. Cost-reduction comes fast and years before a lithium-ion battery Gigafactory can get that down.

It’s tough to scale up a lithium-ion system. If you double the size, you double the cost. Not so with vanadium: All you have to do is make the tank bigger, and the bigger the scale the lower the cost.

That’s what has investor mouths watering the most …

It’s also what makes the prospect of the Colorado vanadium discovery so tantalizing.

#3 A Game-Changing Colorado Property

The worldwide battle for vanadium is about to ramp up. The world’s largest battery is being constructed right now in China, while the U.S. has zero production of this strategic mineral.

Mining.com calls Vanadium, "the metal we can't do without and don't produce".

That may be about to change.

We already know there’s an indicated resource of 500,000 pounds of uranium and an estimated resource of 2.7mm pounds of vanadium at United Battery Metals (CSE:UBM, OTC: UBMCF) Wray Mesa Project in Colorado. We know that because it was extensively explored by the public and private sectors since. It was explored in the 1940s for nuclear bombs, and then in the 70s and 80s for nuclear power. (Source 2013 43-101 report by Anthony Adkins)

But this isn’t the 40s, or even the 80s. Now we have new tech that are hoped to revise these numbers upward significantly.

The mineral resource base estimate here was made using a 739-drill hole database showing an indicated resource of approximately 500,000 pounds of uranium and an estimated resource of some 2.7 million pounds of vanadium.

Even better: It’s easy to mine because it’s in exposed sandstone—right there for the ‘scraping up’.

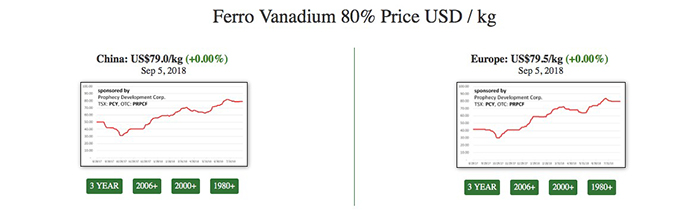

With current ferro vanadium prices at $79 per kilogram, 2.7 million pounds (1,227,000 Kg) would be a $96M gross take for a company that has a market cap of roughly $20 million. Ferro vanadium is an alloy made from vanadium and iron. Current unprocessed vanadium prices are about $18.50 per pound.

And even then, we’re not even considering new exploration.

Nor does United Battery Metals (CSE:UBM, OTC: UBMCF) have all its eggs in a single rare earth’s basket: This was originally a uranium resource, and this is a double win because vanadium can also be used in nuclear energy.

And it’s not just about batteries. It’s about steel, too. Today, 43 percent of cars incorporate vanadium... but by 2025, 85 percent are project to because it doubles steel strength and lowers weight.

#4 Vanadium Prices Under Severe Pressure

It’s never been more important, as China’s environmental crackdown is curbing supplies of vanadium (also a steel-making element) and trade war rumblings will make rare earths even rarer.

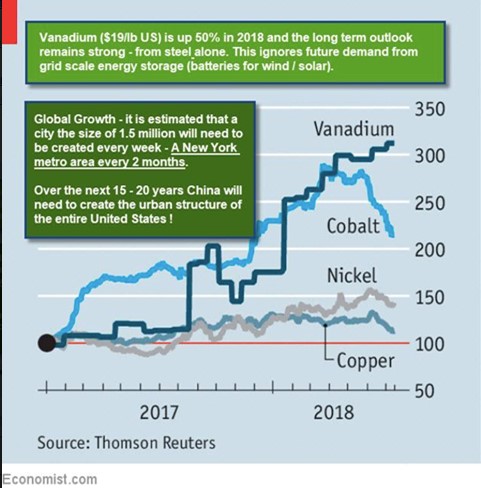

Vanadium prices soared more than 130 percent in the past year, outperforming other battery metals like cobalt, lithium and nickel. That’s because VRBs are closing in on the cost of lithium-ion batteries, and are expected to become cheaper real soon.

By January of this year, prices of ferro-vanadium (VAN-FERRO-LON) had hit a nine-year high of $59/kg. They’ve gained $20 since then.

Source: Vanadium Price

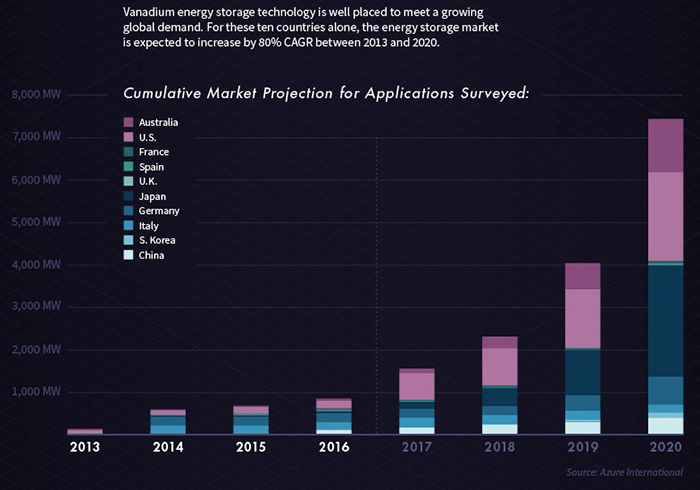

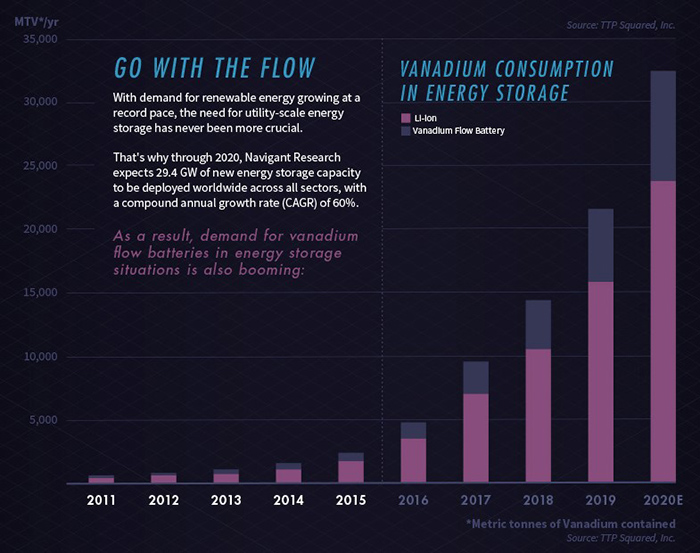

And energy storage demand is soaring wildly to put major upward pressure on prices:

#5 A Super-Charged Team for a Super-Charged Electric Evolution

We don’t just need a ton of batteries anymore—we need utility scale, and lithium won’t cut it. It will be vanadium. It’s catching up to lithium quickly, and because of cheaper scaling, it will soon overtake it as the far superior element:

Lithium batteries’ “parasitic load factor” and scalability may hamper future growth, but vanadium is poised to dominate the utility energy sector very soon.

The Chinese definitely understand this reality.

We’ve all heard of Tesla’s battery Gigafactory in Nevada, endlessly. But it’s nothing compared to the vanadium redux-flow battery factory belonging to Rongke Power in China. It covers an area bigger than 20 soccer fields. That’s because in China, vanadium is already becoming the alternative to lithium.

Having a primary supply of vanadium electrolyte is key to winning this game, and United Battery Metals (CSE:UBM, OTC: UBMCF) has already staked out America’s key strategic patch in Colorado.

And it’s got the dream team to bring it to the finish line.

- UBMCF’s President and CEO, Matt Rhoades, is a renowned geologist and the former State Geologist for New Mexico. He knows Colorado’s vanadium potential and has a string of exploration and development projects behind him across North and South America.

- Advisor Eric Saderholm is the former exploration manager for giant Newmont in the Western U.S., and former VP of U.S. Gold who has added millions of ounces of gold to reserve bases from Nevada and Washington and as far away as Peru.

- Director Anthony Kovschak has a major line-up of rare earth exploration projects from New Mexico and the U.S. to Turkey, Peru and Niger.

- Director John Read is a geologist with over 33 years of precious metals experience, consulting for everyone from Newmont to Kinross Gold.

We’re just at the beginning of this battle for vanadium. Today, nearly all of the world’s vanadium comes from South Africa, China and Russia. The U.S. has been missing out on this revolution, but with its first vanadium resource identified, and the trade war with China heating up, the timing could not be better for UBM.

In United Battery Metals (CSE:UBM, OTC: UBMCF), there is a team of experienced rare earth geologists sitting on the only American vanadium that we know about.

There’s no ETF for vanadium, and vanadium doesn’t trade like a commodity on COMEX or LME. Investors who want to get in on the future of vanadium need to look at producers and those companies that have vanadium resources.

Now that the Chinese are pushing vanadium religiously, the U.S. needs to catch up. A $10-million market cap company sitting on an estimated resource of 2.7 million pounds of vanadium will help it do that.

Other companies poised to transform the energy and mining industries:

Cameco Corporation (TSX:CCO ) Cameco is one of the largest global producers and sellers of uranium and nuclear fuel. Its operating uranium properties include the McArthur River/Key Lake, Cigar Lake, and Rabbit Lake properties located in Saskatchewan, Canada; the Inkai property situated in Kazakhstan; the Smith Ranch-Highland property located in Wyoming, the United States; and the Crow Butte property situated in Nebraska.

While many analysts see low uranium prices as a problem for miners, the OPEC -ike move from world uranium leader Kazakhstan to bump prices has benefited Cameco and its peers significantly.

First Vanadium Corp (TSXV:FVAN) is a full-blown mining company based in North America. The company engages in the exploration for copper, zinc, silver, gold, and of course, vanadium.

With vanadium finally getting the attention that it deserves, First Vanadium is in an excellent position as one of the only other companies looking to begin production in North America.

Recently, First Vanadium reported its Phase 2 drill results for its massive Nevada-based vanadium project, exceeding initial expectations. CEO Paul Cowley noted, "The higher grades in a second twinned hole are very promising indicators for our project."

Teck Resources (TSX:TECK.B): Teck Resources is a diversified miner with years of experience producing a variety of metals, including two vital ingredients in the EV revolution, copper and zinc.

In late August, Teck suffered a slight production hiccup as wildfires wreaked havoc on the British Colombia province. After a brief outage, however, the company’s lead smelting operations are back up and running.

Currently, Teck is looking to begin its ambitious $4.8 billion upgrade of the Quebrada Blanca copper mine in northern Chile, though the company has yet to set an exact start date.

Magna International (TSX:MG) is based in Aurora, Ontario. The global automotive supplier is gutsy and innovative--and definitely tuned to the obvious future--clean transportation. A great catalyst is its development of a combo electric/hydrogen vehicle--a fuel cell range-extended EV (FCREEV). It’s not going to produce them (for now, at least) but plans to use the model to show off its engineering and design prowess and produce elements of the electric drivetrain and contract manufacturing.

Though Magna has some ambitious plans in the pipeline, the ongoing tariff war has put a dent in its stock prices. While the tariffs have weighed on the auto industry as a whole, Magna was hit particularly hard. Despite this, outlook remains positive thanks to its ambitious plans to provide thermoplastic liftgates for the growing SUV/compact SUV market.

Pretium Resources (TSX:PVG): This impressive Canadian company is engaged in the acquisition, exploration and development of precious metal resource properties in the Americas.. Additionally, construction and engineering activities at its top location continue to advance, and commercial production is targeted for this year.

Pretium Resources’ efforts are clearly paying off, with another strong quarterly report surpassing analysts’ estimates. Though the strong earnings report inspired some investor confidence, Pretium also came under fire in the final week of August, with a research firm claiming the company had artificially inflated its figures.

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This article contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this article include that prices for vanadium will retain value in future as currently expected; that UBM can fulfill all its obligations to maintain its property; that UBM’s property can achieve drilling and mining success for vanadium, and potentially sell 2.7M pounds of vanadium; that the vanadium extraction process being developed will be cost effective; that the vanadium battery process can be commercialized for large scale production; that high grades found in samples are indicative of a high grade deposit; that high-grade vanadium is in sufficient quantities to make drilling economic; that batteries and EVs will start using large amounts of vanadium; that vanadium system costs will be reduced quickly and dramatically; and that UBM will be able to carry out its business plans. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that the Company may not be able to finance its intended drilling programs, aspects or all of the property’s development may not be successful, mining of the vanadium may not be cost effective; even if mining is successful, UBM’s property may not yield 2.7M pounds of vanadium; UBM may not raise sufficient funds to carry out its plans, changing costs for mining and processing; increased capital costs; the timing and content of upcoming work programs; geological interpretations and technological results based on current data that may change with more detailed information or testing; potential mineral recoveries assumptions based on limited test work with further test work may not be viable; competitors may offer cheaper vanadium; more production of vanadium could reduce its price, or the price may drop for other reasons; technological advances to reduce vanadium system costs may not occur as expected; alternatives could be found for vanadium in battery technology; the availability of labour, equipment and markets for the products produced; and despite the current expected viability of its projects, that the minerals cannot be economically mined on its properties, or that the required permits to build and operate the envisaged mines cannot be obtained. The forward-looking information contained herein is given as of the date hereof and the Company assumes no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) has been paid by the profiled company or a third party to disseminate this communication. In this case the Company has been paid by UBM fifty nine thousand two hundred and eighty six US dollars for this article and certain banner ads. This compensation is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. We have been compensated by UBM to conduct investor awareness advertising and marketing for CSE: UBM; OTC:UBMCF. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the company. The third party, profiled company, or their affiliates may liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our communications and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct.

SHARE OWNERSHIP. The owner of Oilprice.com may be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing The Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

RISK OF INVESTING. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.