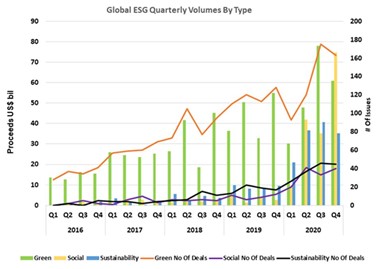

Trillions of dollars poured into ESG funds last year, but many analysts are expecting this year to pick up right where 2020 left off.

Forbes stated, “ESG Investing Came of Age in 2020. Millennials Will Continue to Drive it in 2021.”

And according to Morgan Stanley Capital International’s head of research, we’re likely to see investors shifting more and more capital into ESG this year…

Because despite worldwide lockdowns, climate change continues to be a major concern that everyone from Big Tech to Big Oil are now taking seriously.

That’s why smart money is piling in, to the tune of trillions of dollars.

BlackRock, the largest asset manager in the world, plans to have $1.2 trillion in ESG assets within the next 10 years.

And it’s estimated that 1/3 of all assets under management in the U.S. are already sustainably invested...

That’s $17.1 trillion invested in the companies taking steps to put people and planet first.

But that doesn’t mean they’re sacrificing profits in the process.

The ESG boom has produced some of the biggest gains in the market during an incredibly difficult year.

Enphase Energy jumped 472% in 2020...

Digital Turbine soared 682%…

And Tesla became one of the biggest companies on the market with incredible 622% gains.

But one Canadian company saw this mega-trend coming years ago. And they used 2020 as the launchpad they needed to grow many times bigger.

Facedrive (TSXV:FD,OTC:FDVRF), the eco-friendly ridesharing company locked in a number of major contracts, including with government agencies, A-list celebrities, and global tech titans.

Even when lockdowns slowed down the ridesharing industry, they grew their business by acquiring companies in the food delivery space…

Adding thousands of restaurant partners and tens of thousands of new customers....

And they did all of this during the last year.

That’s why Facedrive’s shares have surged upwards a massive 591% in the last year.

Now, many analystsare convinced 2021 could be a banner year for the ESG mega-trend sweeping across the globe.

2020 Set the Stage for a Climate Change Revolution

While the pandemic has devastated economies around the world, there’s been one silver lining.

With the COVID restrictions put in place by governments worldwide, carbon emissions plunged during a record drop in 2020.

But with those numbers likely to rebound in 2021 after restrictions ease, researchers are urging governments to make clean energy a top priority.

That’s a major part of why electric vehicles have been gaining steam all across the industry over the last year.

Nearly all the major automakers are rolling out their own EV models.

But the poster child for electric vehicles has been Tesla, the $793 billion juggernaut that continues to prove its doubters wrong throughout 2020.

The ESG boom has helped Tesla become the biggest company in the U.S. behind Big Tech.

And made them over 5 times larger than GM, Ford, and Fiat Chrysler combined.

And Facedrive is jumped into another aspect of EV, bringing electric vehicles to the notoriously pollution-heavy ridesharing industry.

With Facedrive (TSXV:FD,OTC:FDVRF), users can hail a ride from an electric, hybrid, or gas-powered vehicle, all without paying an extra premium for the option.

Once the riders get to their destination, the in-app algorithm kicks in, calculating how much CO2 was created during the journey.

Then it sets aside a portion of the fare to plant trees, offsetting the carbon footprint from the ride.

In other words, you ride, they plant a tree.

Through next-gen technology and partnerships, they’re giving their customers the option to make a more eco-friendly choice if they choose.

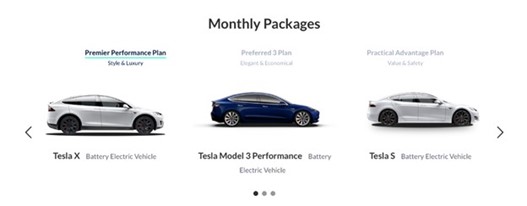

And recently, they acquired the electric vehicle service company, Steer, from the largest clean energy producer in the United States.

Steer’s subscription model for EV cars is aimed at flipping the traditional car ownership model on its head.

And that fits right in line with Facedrive, which is already proving to be a fierce competitor to Uber in certain ridesharing markets.

But the race to address the issue of climate change is just one factor in the ESG boom.

Getting Creative for Social Change

The social component of sustainable investing (the “S” in ESG) also took a front-seat in 2020 for a number of reasons.

During a year with nationwide protests and a major health crisis, companies started putting a major focus on what they can do to support the health and wellbeing of their customers and others.

For many, that’s meant getting creative to help support those industries being slammed with strained supply chains.

It was a shift we have seen from major companies since World War II.

1) Ford produced respirators and medical equipment on their assembly lines.

2) Nordstrom’s and their alteration teams made it their mission to sew nearly 1 million masks.

3) And liquor producers like Bacardi even shifted to producing hand sanitizer at their distilleries after shelves went empty last year.

Facedrive branched out and got creative to do their part during the pandemic too.

They partnered up with the University of Waterloo and MT>Ventures to create TraceSCAN, a wearable technology used to help slow or stop the spread of the virus.

Through Bluetooth technology, it offers much-needed contact tracing technology for those without cell phones.

That includes a wide range of people: children, senior citizens, low-income individuals, and employees not able to use phones on the job.

And Facedrive (TSXV:FD,OTC:FDVRF) has signed major partnerships and agreements with both the government of Ontario and Canada’s largest airline, Air Canada, to use this breakthrough technology.

While we’ve seen trillions of dollars pouring into the ESG boom already, this major shift may just be getting started. Experts expect this will only get bigger in the coming years.

But with so many companies getting on board, many investors are becoming overwhelmed trying to find the best opportunities.

The Biggest Names in ESG Set for a Shakeup?

When you take a deep dive into the top ESG funds on the market, you may be shocked to see whose names you find on the list.

In these eco-friendly and socially responsible funds, the biggest holdings often aren’t the ones promoting solar energy or building electric cars.

Instead, they’re riddled with Big Tech stocks like Facebook, Google, and Microsoft.

And while they’re doing their part through one-off initiatives or putting out corporate statements about climate change...

Many of these companies aren’t exactly known for their green programs or “socially responsible” moves.

Plus, when predicting the biggest winners for 2021, it’s hard to place bets on Big Tech companies that may spend the next several years dealing with antitrust suits.

That’s why many are looking at the pure ESG plays, the ones who put environmental and social issues at the core of their business models.

That includes companies like Facedrive, who’s become known for their “people and planet first” philosophy.

After growing their business by tens of thousands of customers last year throughout Canada, they’ve taken strategic steps to move into the U.S. markets and beyond.

They’ve done this through partnerships with A-list celebs like Will Smith and Jada Pinkett Smith… superstar athletes like Super Bowl-winning quarterback Russell Wilson… and trillion-dollar companies like Amazon.

Now, with Big Tech companies riddled with uncertainty, that leaves plenty of room for up-and-comers like Facedrive to take their place in the ESG boom set to surge throughout 2021.

Here are just a few other companies hopping on the ESG trend:

BlackRock (NYSE:BLK)

BlackRock needs no introduction. It is the world’s largest global investment management corporation, with over $7.4 trillion in assets under management. With clients in over 100 different countries, it is the de facto leader in its field.

In 2017, BlackRock underwent a major shift in its investment strategy, prioritizing stocks with high ESG ratings. BlackRock’s focus on technology and sustainability has fueled the new trend in the marketplace, pushing even more investors to consciously consider where they put their money.

Shopify Inc (TSX:SHOP)

Shopify is a Canadian e-commerce company. More than 1,000,000 businesses rely on Shopify’s real-time e-commerce, including Tesla, Budweiser and Red Bull, among many others. Shopify makes purchasing goods and services easy for anyone – and in a time where convenience is king, Shopify surely has staying power.

In addition to its revolutionary approach on e-commerce, Shopify is also delving into blockchain technology, making it a promising pick for investors in sustainability.

Shaw Communications Inc (TSX:SJR.B)

Shaw owns a ton of infrastructure throughout Canada and its cloud services and open-source projects look to address some of the biggest issues that its customers might face before the customers even face them. Shaw’s dominance in Canada’s telecom sector means that if any internet-based services want to operate, they’ll likely be utilizing the company’s infrastructure. After all, without telecoms, these TaaS companies would not be able to operate.

BCE Inc. (TSX:BCE)

Like Shaw, BCE is a Canadian telecom giant. Founded in 1980, the company, formerly The Bell Telephone Company of Canada, is composed of three primary subsidiaries. Bell Wireless, Bell Wireline and Bell Media. However throughout its push into the position of one of Canada’s top telco groups, it has bought and sold a number of different firms.

BCE is also at the forefront of the Internet of Things movement in Canada. Its Machine to Machine solutions are being used by numerous businesses, including TaaS providers throughout North America and its new LTE-M network is sure to rapidly increase the adoption of these solutions.

Polaris Infrastructure (TSX:PIF)

Polaris is a Toronto-based renewable energy giant with a global footprint. The company’s biggest projects are in Latin America. It’s Nicaragua geothermal project, for example, is already producing over 77 MW of renewable electricity. And in Peru, its El Carmen and 8 de Augusto power plants, is set to produce a combined 17MW of electricity in the near future.

Westport Fuel Systems (TSX:WPRT)

Westport is a renewable energy provider for the transportation industry. it provides systems for less impactful fuels, such as natural gas. In North America alone, there are over 225,000 natural gas vehicles. But that shies in comparison to the global 22.5 million natural gas vehicles globally, which means the company still has a ton of room to grow!

While renewable providers clearly take the lead, Canada’s tech and telecom giants won’t be left out!

By. Pauline Yule

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This publication contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this publication include that the demand for ride sharing services will grow; that Steer can help change car ownership in favor of subscription services; that Tracescan could help the travel and tourism industry deal with COVID and will sign new agreements for use of its alert wearables; that new tech deals will be signed by Facedrive and deals signed already will increase company revenues; that Facedrive will be able to expand to the US and globally; that Facedrive’s merchandise business and sports prediction app will prove popular and successful; that Facedrive will be able to fund its capital requirements in the near term and long term; and that Facedrive will be able to carry out its business plans. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that riders are not as attracted to EV rides as expected; that competitors may offer better or cheaper alternatives to the Facedrive businesses; TraceScan may not work as expected in commercial settings and customers may not acquire or use it; changing governmental laws and policies; the company’s ability to obtain and retain necessary licensing in each geographical area in which it operates; the success of the company’s expansion activities and whether markets justify additional expansion; the ability of the company to attract drivers who have electric vehicles and hybrid cars; the ability of Facedrive to attract providers of good and services for merchandise partnerships on terms acceptable to both parties, and on profitable terms for Facedrive; and that the products co-branded by Facedrive may not be as merchantable as expected. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

This communication is not a recommendation to buy or sell securities. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) owns a considerable number of shares of FaceDrive (TSX:FD.V) for investment, however the views reflected herein do not represent Facedrive nor has Facedrive authored or sponsored this article. This share position in FD.V is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the featured company. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases. The information in our communications and on our website has not been independently verified and is not guaranteed to be correct.

SHARE OWNERSHIP. The owner of Oilprice.com owns a substantial number of shares of this featured company and therefore has a substantial incentive to see the featured company’s stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherently risky. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any stock acquisition will or is likely to achieve profits.